August 22, 2023

Key Takeaways

- Pharmacy costs, whether from the pharmacy or medical plan, continue to weigh heavily on the minds of employers, especially high-cost therapies, gene/cell therapies and appropriate use of blockbuster drugs like GLP-1s.

- To address costs and other factors, opportunities exist within employers’ precision medicine and biosimilar coverage.

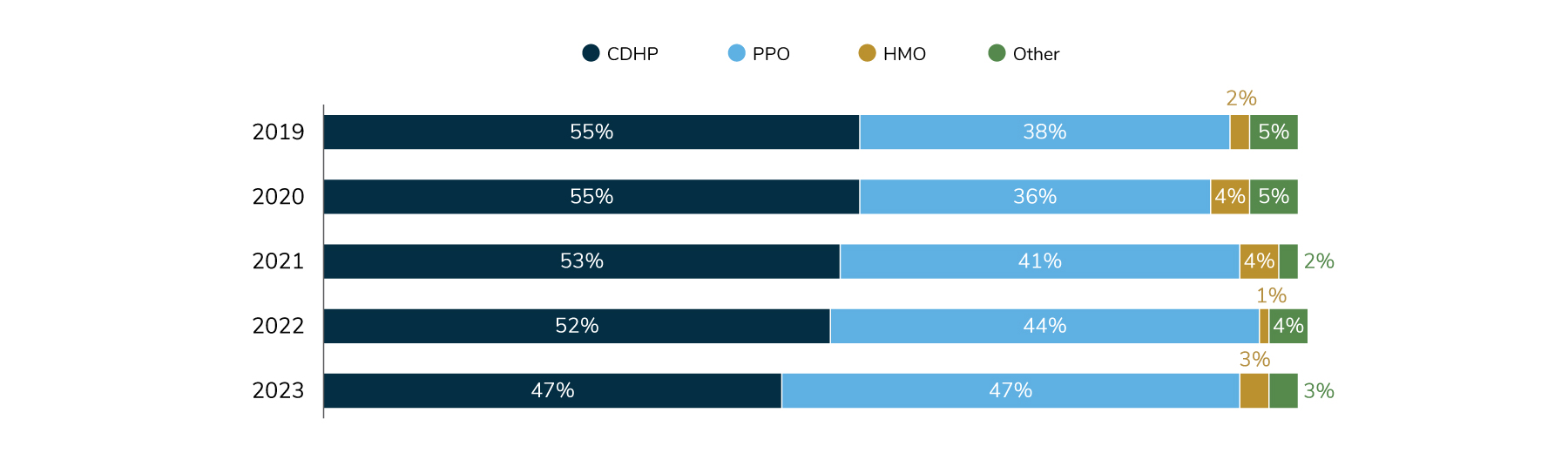

- Consumer-directed health plans (CDHPs) and preferred provider organizations (PPOs) are now tied as the plan option with the highest enrollment.

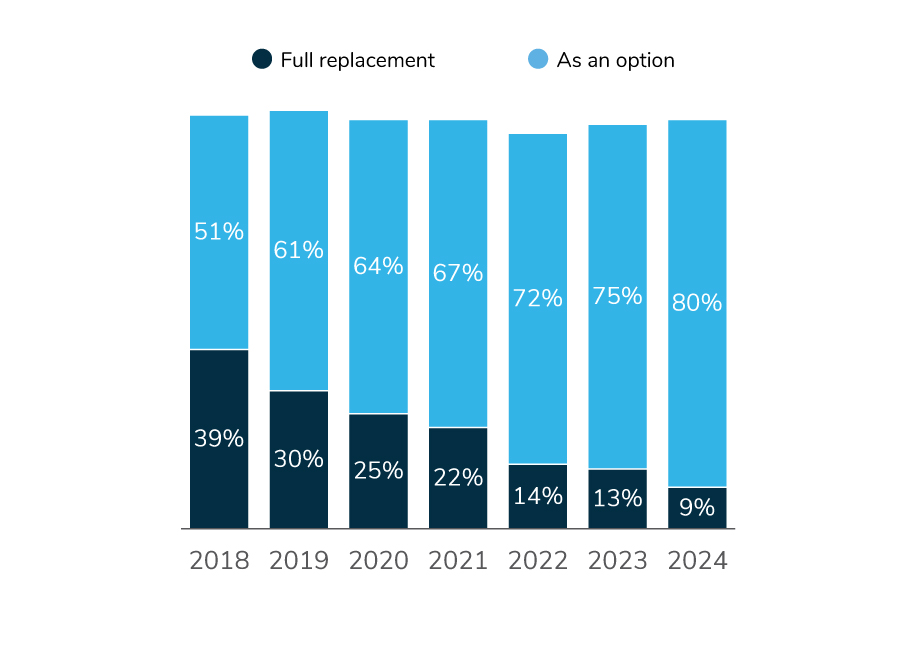

- While CDHPs are offered by 89% of those surveyed, only 9% make it their sole offering. Full replacement approaches have been on a steady decline for the past 6 years.

Employers Continue to Increase Choice of Plans

As employers strive to provide more variety in their benefit offerings and address affordability concerns, the highest enrolled plan type is also experiencing a shift. Dating back to 2016, CDHPs were the highest enrolled plan for a majority of employers; since then, employers have slowly reintroduced other plans. A confluence of factors has led to this change: affordability concerns, limited variety and flexibility in plan offerings, elimination of the excise tax, and observed shortcomings of CDHPs – like the failed promise of consumerism and declines in the use of preventive care, to name a few. In fact, 9% of employers will offer only CDHPs to employees in 2024, a 30-percentage point decline from 2018 (Figure 3.1).

This trend has also resulted in higher enrollment in other plans, mainly PPOs (Figure 3.2).

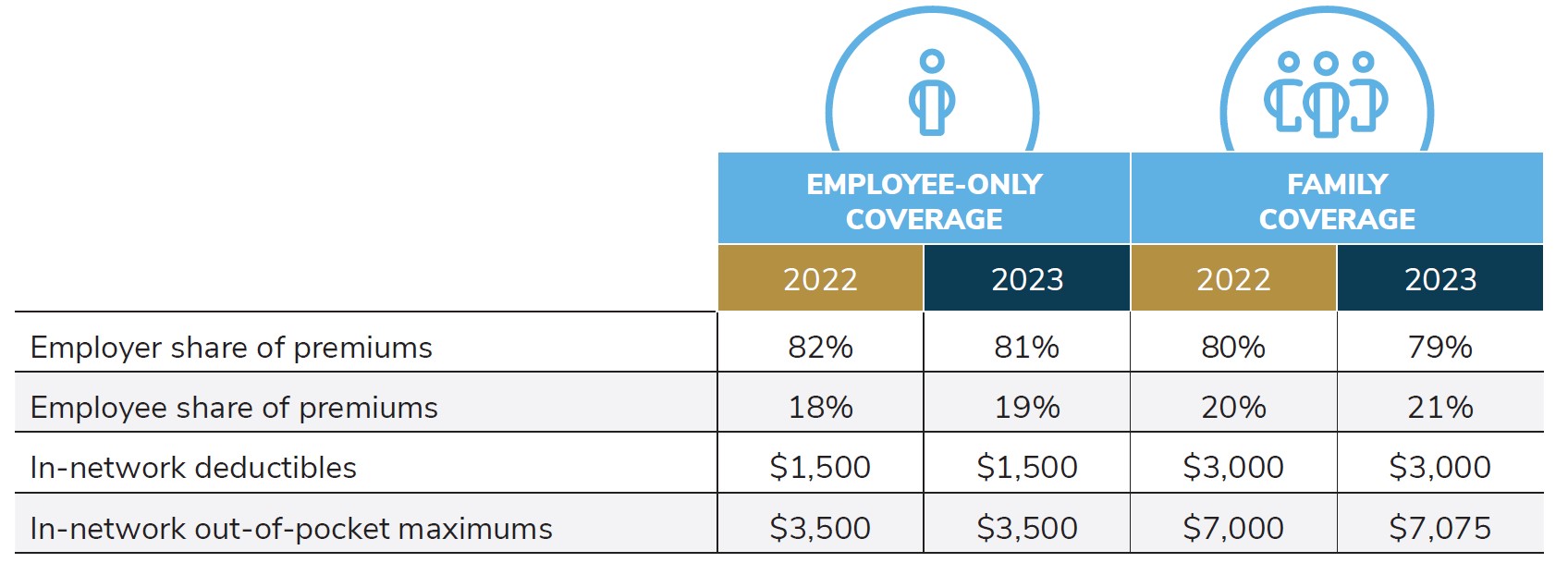

When asked for more details about 2023 cost sharing within the most popular plan, employers reported that they are paying for 81% of premiums for individuals and 79% for family plans – which has stayed steady since 2022 (Table 3.1). In-network deductibles and out-of-pocket maximums are also largely remaining steady. Overall, the data show that in recent years, employers are able to stabilize their cost sharing while adding plan choice. Nonetheless, it is unclear how long employers will be able to absorb these escalating plan costs.

The remainder of this section will focus on plan design changes employers have in mind for 2024 and beyond.

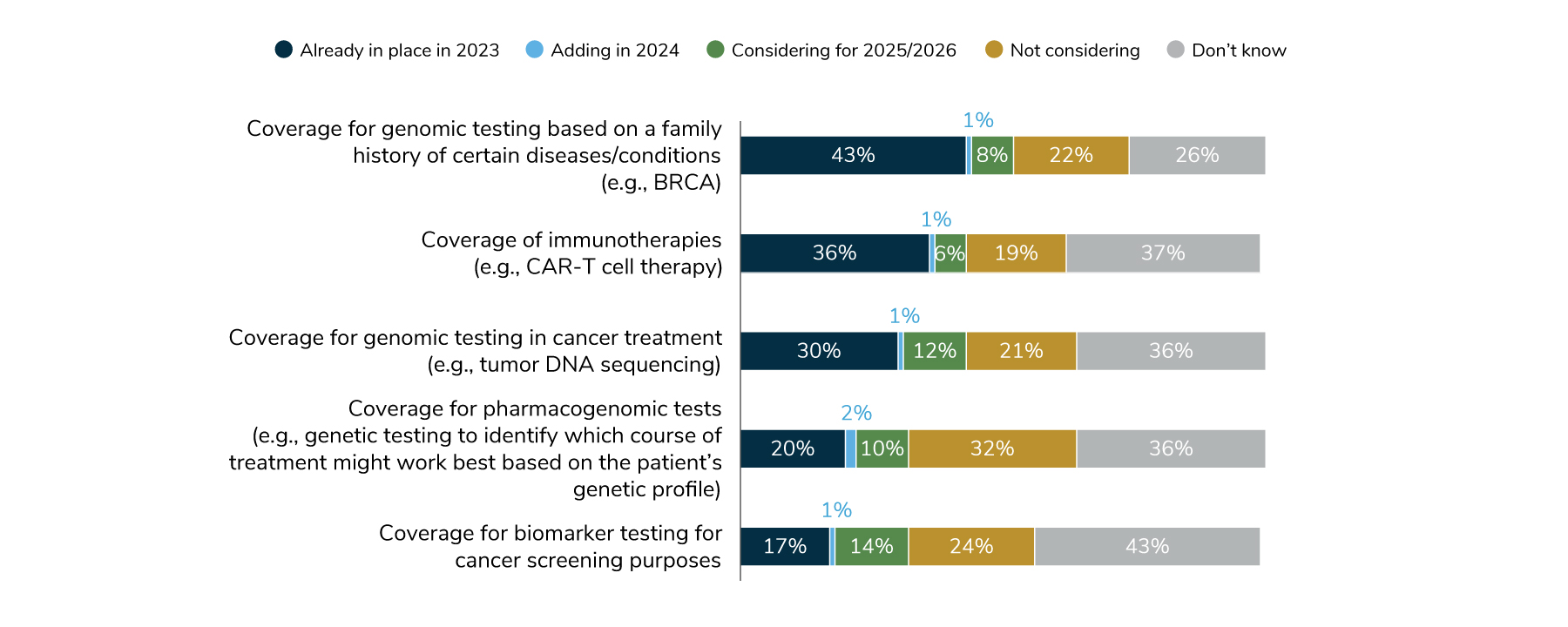

Precision Medicine Coverage Is Rising Steadily

Precision medicine—genomic and pharmacogenomic tests, biomarker testing and immunotherapies—have the potential to improve the quality of care for employees with rare and serious conditions. These therapies tend to be relatively newer to the market, and therefore, may not have universal coverage by employers. In addition, they may not be universally recommended by providers, largely because the speed of innovation in this field is outpacing the knowledge and practice capabilities of many providers.

The most common test covered—by 44% of employers in 2024—are those that determine the risk of developing certain conditions/diseases based on family history (the BRCA gene test to determine risk of certain cancers is an example). Thirty-one percent of employers will cover genomic tests to inform cancer treatment, and 18% will cover biomarker testing for cancer screening purposes (Figure 3.3). However, it’s important to recognize that at least a quarter of employers don’t know which tests are actually covered, which speaks to the need to partner with their consulting and health plan partners to explore this further. Precision medicine coverage may be an opportunity for employers looking to promote quality and personalized care within their health plans.

Employers Will Continue to Face Numerous Pharmacy Challenges in the Years Ahead

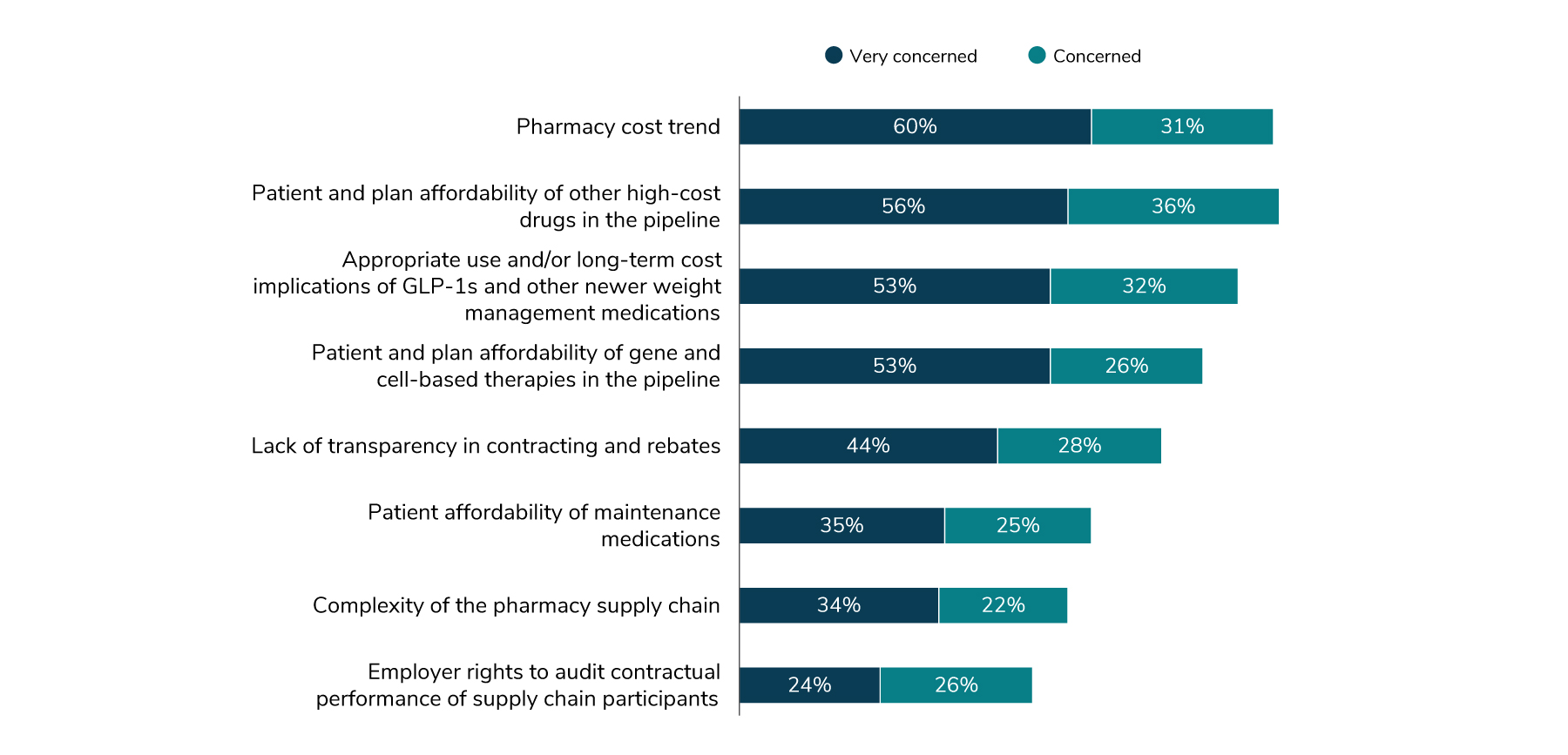

For many employers, pharmacy costs are one of the main drivers of their increases in health care costs. As increasingly sophisticated and targeted treatments come to market and existing medications see new indications, employers are seeking ways to reduce the drug costs within both pharmacy and medical benefits. The top concern of employers is patient and plan affordability of high-cost drugs in the pipeline (92% very concerned or concerned), followed closely by the overall pharmacy cost trend at 91% (Figure 3.4).

Perhaps the pharmacy issue most widely covered by the media in 2023 comes in at number three – a class of medications labeled GLP-1s that are mainly prescribed for diabetes but are also being used more recently for weight loss. Eighty-five percent of employers are concerned about the appropriate use of GLP-1s and other weight management medications and their long-term effect on cost in 2024; nearly all employers (94%) will cover these medications for the treatment of diabetes but are relatively split (49% in 2024) on whether they will be covered for weight management purposes. Much consideration is being given to these therapies, perhaps because of their relative recent entry into the weight management field. There are concerns about appropriateness, off-label usage, long-term reliance on the medication and the necessity for lifestyle and behavioral interventions used in conjunction with the medication.

A Check-in on Rebates Reveals Little Progress

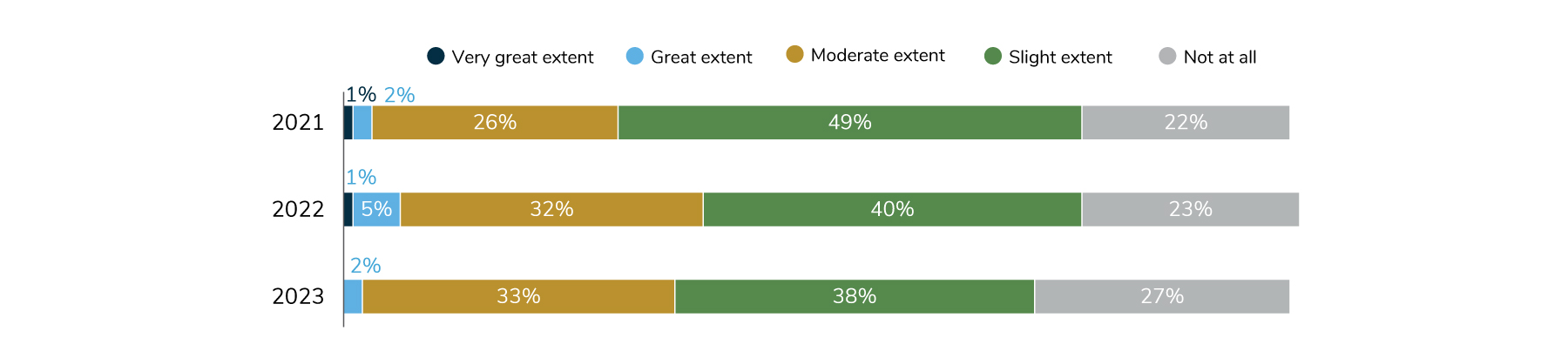

Prescription drug rebates have been a constant concern in many pharmacy supply chain conversations over the years. Many employers would like to see a rebate-driven model give way to a more transparent, net-price-based contracting approach. Despite these sentiments, employers as a whole do not feel that suitable alternatives have been established. In 2023, only 2% say that the industry has made great progress, 33% say moderate progress and the remainder say little progress (or none at all) has been achieved (Figure 3.5).

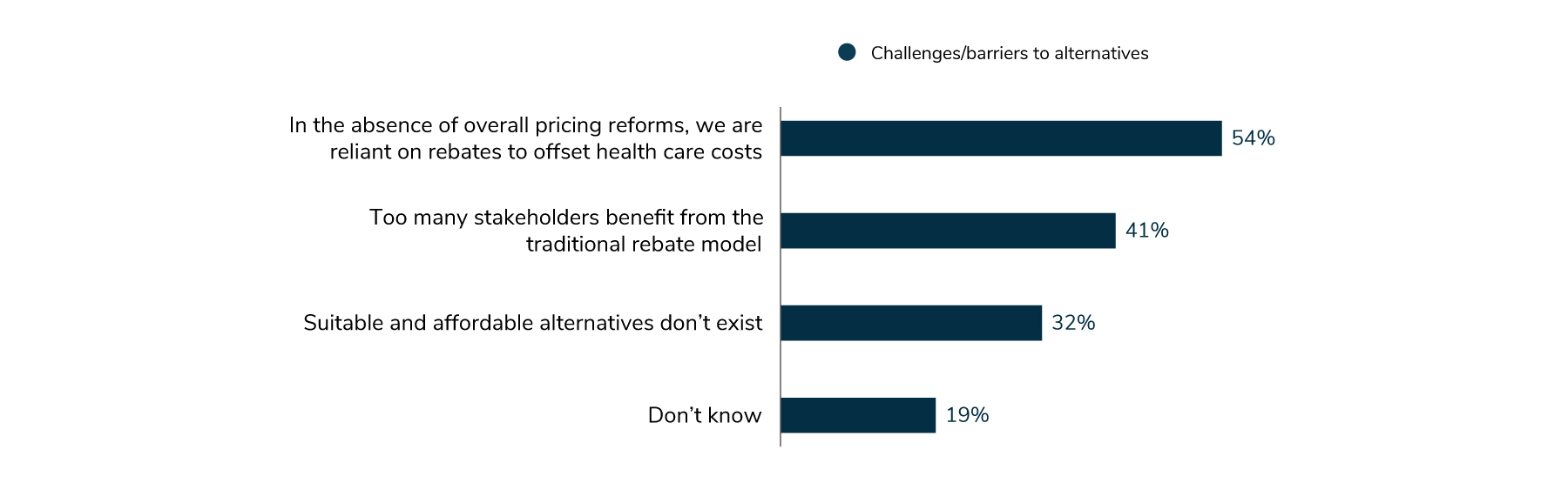

Similarly, the survey sought to understand employers’ challenges in moving away from a rebate-driven system. While employers provided a variety of reasons, the top barrier (54% of employers) was the reliance on rebates to balance health care costs for plan participants. It is important to note, however, that this is largely because no other suitable pricing reform actions have been taken. Following this barrier, some employers (41%) attested that too many stakeholders benefit from the traditional rebate model, reducing motivation to make changes among incumbent players, and that alternatives to the rebate model don’t exist (32%) (Figure 3.6). This space will be one to keep a watchful eye on given the recent legislative focus on the prescription drug industry.

Pharmacy Consumes Even More Health Care Spend, Opportunities Abound for Improvement in Utilization Management and Access

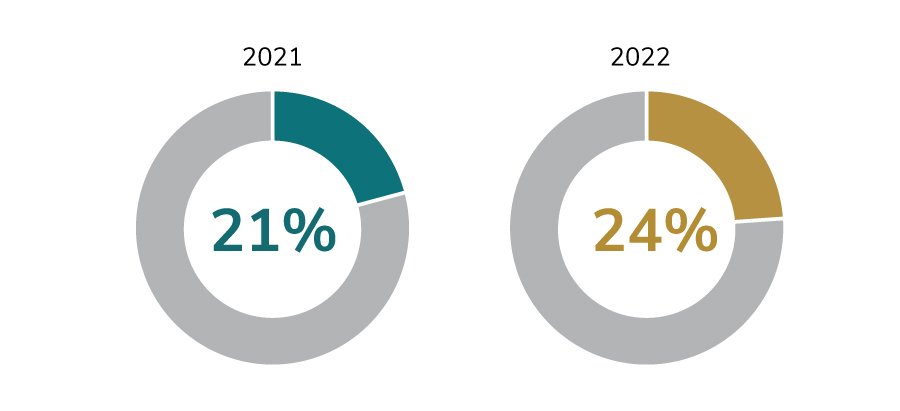

A lookback to 2022 revealed that the percentage of health care dollars spent on pharmacy is on the rise. That is, employers are spending a greater portion of their total health care budget on pharmaceutical treatments and medications. In 2021, the median percentage among surveyed employers was 21%; in 2022, the percentage spent was up three percentage points to 24%. (Figure 3.7).

A Range of Program Changes Considered to Address Pharmacy Concerns

To offset future and current cost pressures, employers are looking at widespread approaches (e.g., a new PBM), utilization management levers (e.g., prior authorization) and specific tactics to manage cost and financial volatility associated with high-cost therapies coming to market. Use of biosimilars continues to be an area of opportunity for employers. A suite of cost management approaches is described below.

1 | Pharmacy Management Strategies

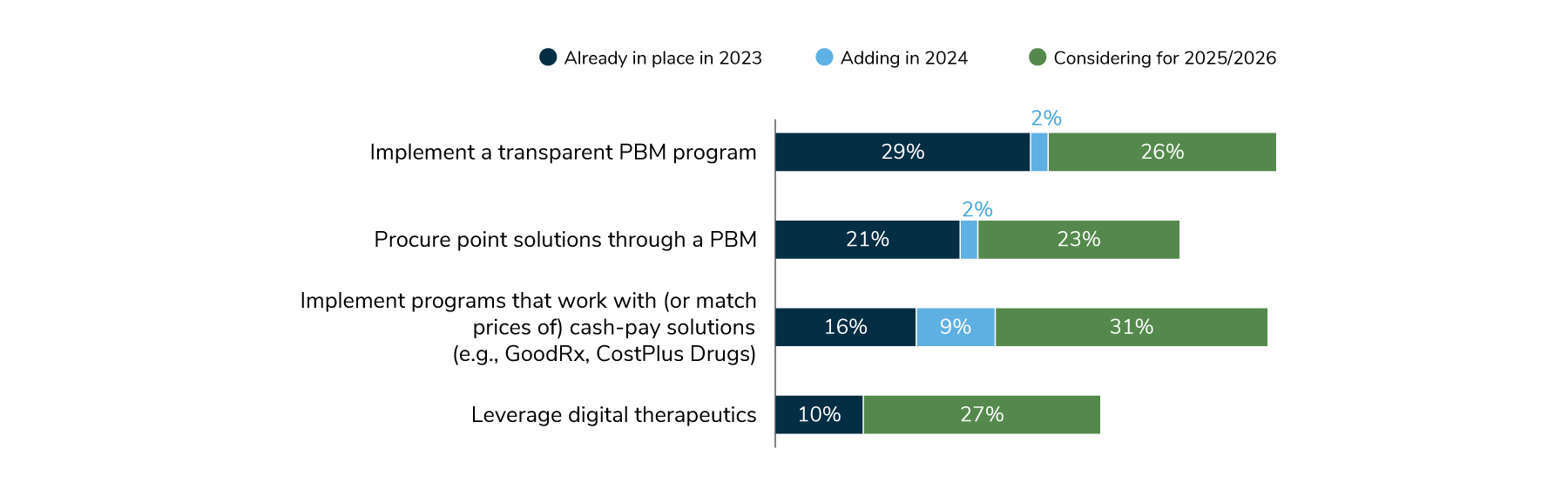

In 2024, 31% of employers will implement (or already have in place) a transparent PBM program that provides employers with greater access to information on net costs. An additional 26% are considering a transparent PBM program for 2025/2026; this could signal employers’ desire to have line of sight to how drugs are priced and provides a spotlight on misaligned incentives prominent in the pharmacy supply chain. Cash-pay solutions, while popular among consumers for their ability to find the lowest cost drugs even for those without insurance, haven’t generally been part of employer plans, with only 16% having these in place in 2023. That will change in 2024, when 25% will offer programs that will either work with or match the prices of cash-pay solutions like GoodRx and CostPlus Drugs. An additional 31% are considering doing so in 2025/2026 (Figure 3.8).

2 | Tactics to Manage Specialty Pharmacy and High-cost Therapies

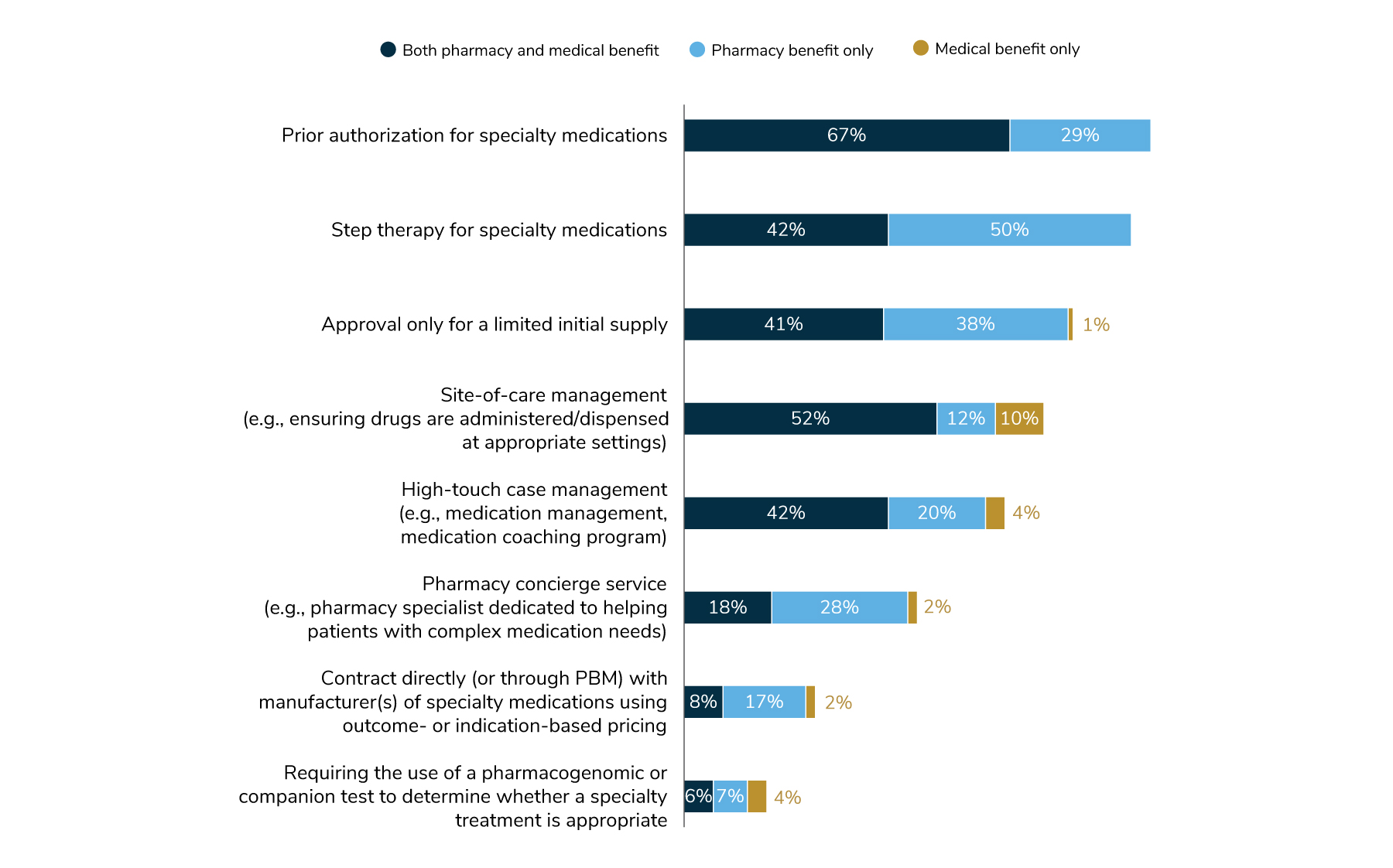

Employers can deploy a variety of methods to control specialty pharmacy costs. Prior authorization persists as the top way employers are managing specialty among drugs administered through the pharmacy and medical plans. Next, site-of-care management is leveraged across all benefits: 52% have site-ofcare management for both pharmacy and medical benefits; 12% have it for only pharmacy; and 10% have it for only medical. Another common approach is limiting the supply of medications approved for the first fill to minimize drug wastage. This approach has been adopted by 80% of employers in total (calculated when adding pharmacy coverage, medical coverage and a combination of both). In comparing 2023 practices to 2024, there are slight increases in the percent of employers that have adopted the tactics listed in Figure 3.9, but each tactic’s prominence relative to one another has stayed the same.

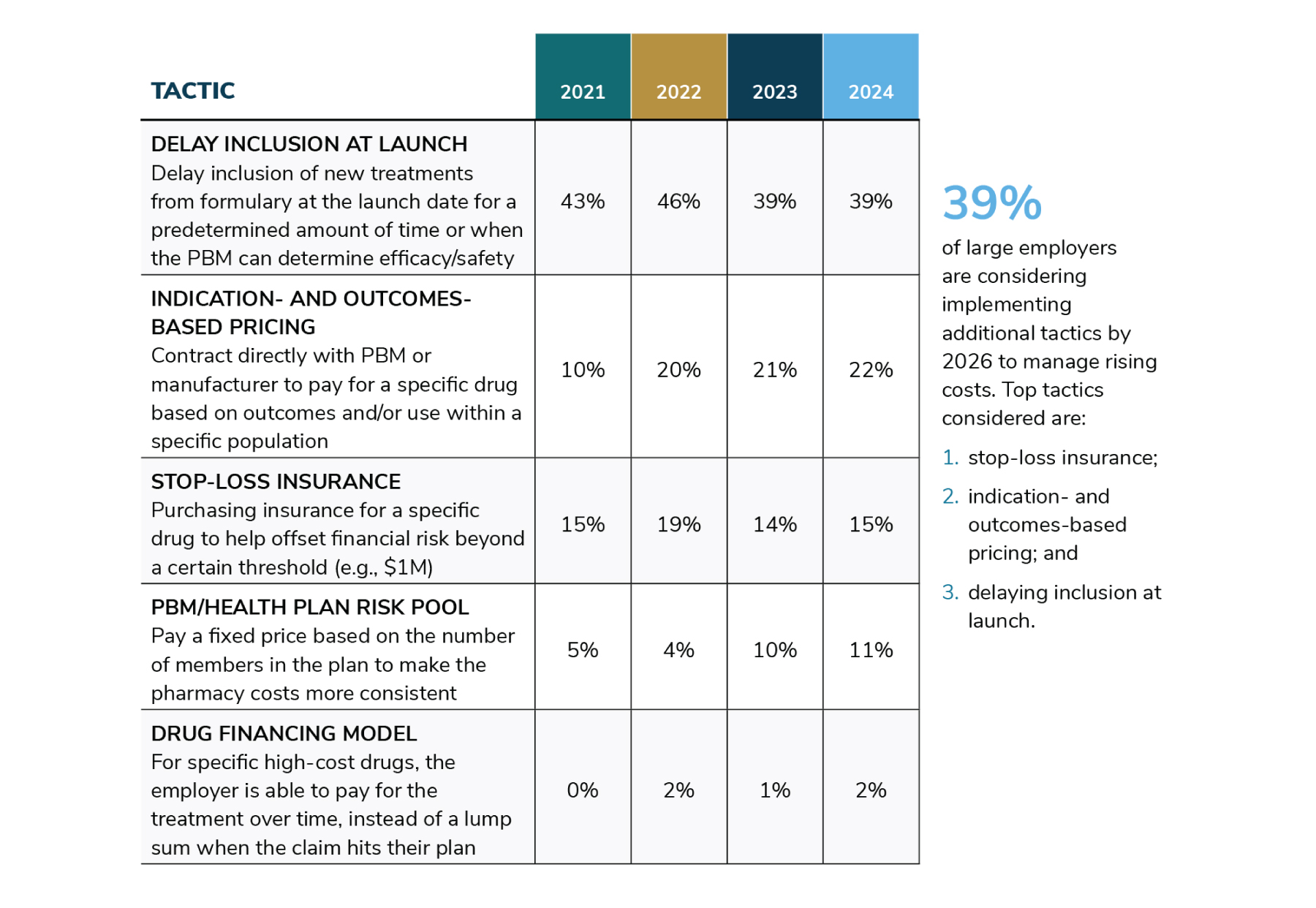

Employers have also looked for ways to specifically address high-cost therapies (e.g., those that cost $1 million or more). These approaches are sometimes unique to a specific medication. As it pertains to the percentage of employers deploying these tactics, there has been a change of course for some. Fewer employers (39%) are delaying high-price drugs at launch compared to 2022 (46%), although it’s still the most common approach for managing high-cost therapies. With additional new therapies expected on the market in the next few years, an additional 12% are considering this approach in the future. Likewise, stop-loss insurance and drug financial model adoption will see a dip in interest in 2024 but has interest for implementation in 2025-2026. Indication- and outcomes-based pricing may experience a doubling between 2022 and 2026, possibly attributed to manufacturers and PBMs heeding the call to make more value-based contract arrangements available to employer plans (Table 3.2).

3 | Biosimilar Coverage

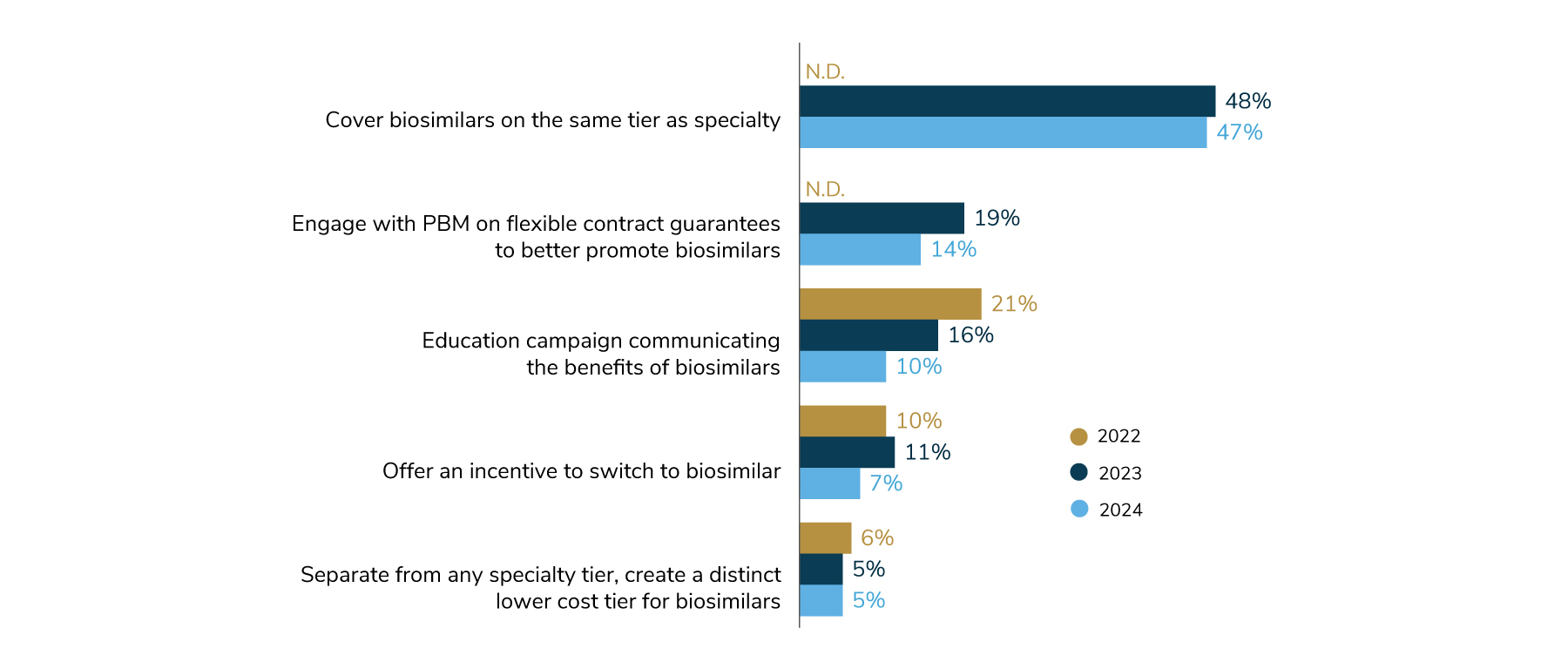

Opportunities to promote biosimilars, which may provide lower-cost alternatives to some specialty drugs, seem to have stagnated among employers. This is surprising given the number of biosimilars entering the market in 2023. In 2024, 47% of employers will cover biosimilars on the same tier as other specialty drugs, fairly similar to last year’s prevalence of 48%. Some employers are taking it a step further by making the biosimilar the more cost-effective option, but this is the exception. Only 7% offer an incentive to employees that switch to biosimilars, and 5% have created a distinct lower-cost tier for biosimilars (Figure 3.10). Interestingly, 36% of employers couldn’t pinpoint their biosimilar coverage. As more biosimilars become available and show potential for lowering costs, employers may begin to take advantage of these options. These findings represent an opportunity for employers to work closely with their consulting and PBM partners to better understand and deploy biosimilars as part of their overall pharmacy management strategy.

Plan Design Changes in 2024

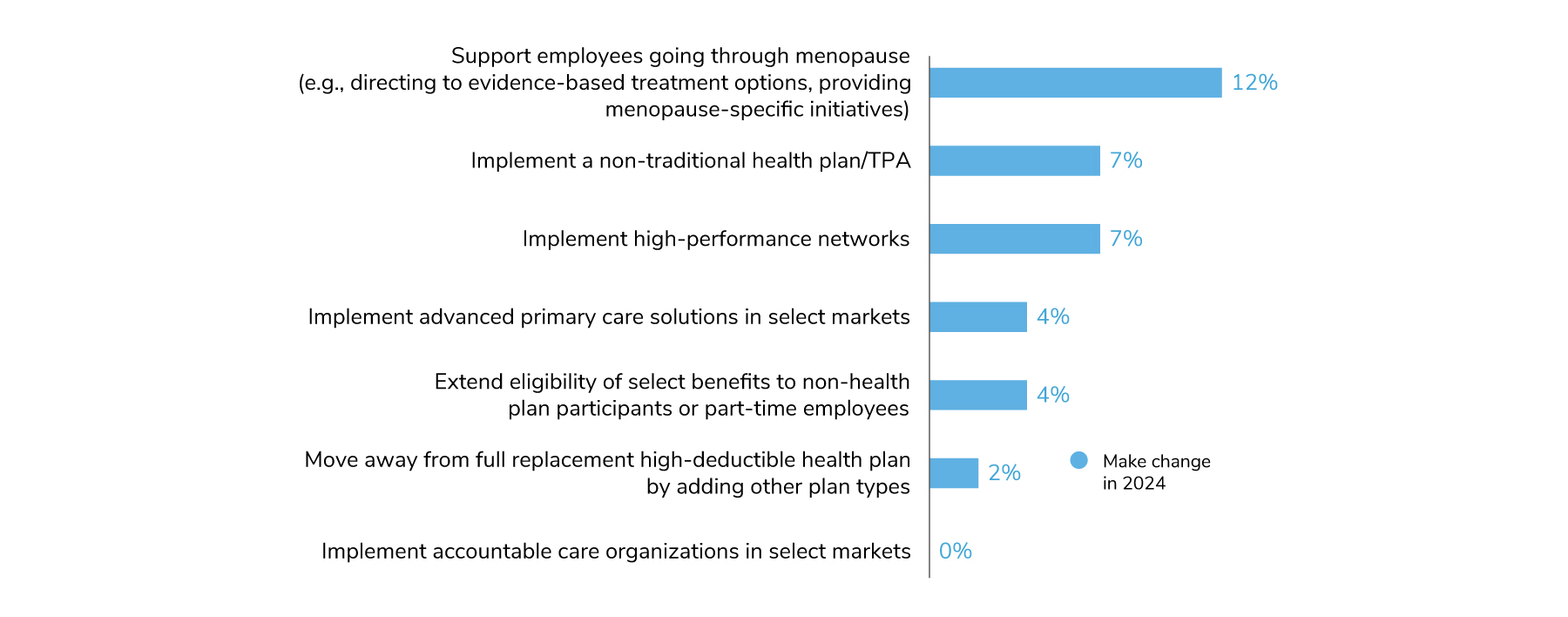

When it comes to major plan design changes, most employers indicate they do not intend to make dramatic changes to their designs in 2024, reflecting their aim to keep offerings stable (Figure 3.11). Twelve percent of employers will offer a program to support employees going through menopause, whether it’s a specific initiative/campaign or helping them navigate to providers for symptom management. In the area of value-based design, 7% will implement high-performance networks for the first time and 4% will offer advanced primary care in select markets. No employer said they would implement ACOs for the first time. Lastly, 2% of employers will move away from a full replacement CDHP strategy by adding other plan types to their lineup, which will contribute to the downward trend observed in Figure 3.1.

Additional Resources

To learn more on how to address the topics in this section, see the following Business Group member resources:

Part 3: Health and Pharmacy Plan Design

-

Introduction2024 Large Employer Health Care Strategy Survey

-

Full Report2024 Large Employer Health Care Strategy Survey: Full Report

-

Executive Summary2024 Large Employer Health Care Strategy Survey: Executive Summary

-

Part 1Part 1: Employer Perspectives

-

Part 2Part 2: Health Care Delivery

-

Part 3Part 3: Health and Pharmacy Plan Design

-

Part 4Part 4: Health Care Costs and 2024 Initiatives

-

Chart Pack2024 Large Employer Health Care Strategy Survey: Chart Pack

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()