August 22, 2023

Key Takeaways

- Health care costs continued to rise, with a 6% increase in trend in 2023 after plan changes were made and a higher-than-average 6% increase projected for 2024. Pharmacy-specific trend following plan design changes increased to about 9% in 2023 and is expected to increase by the same amount in 2024.

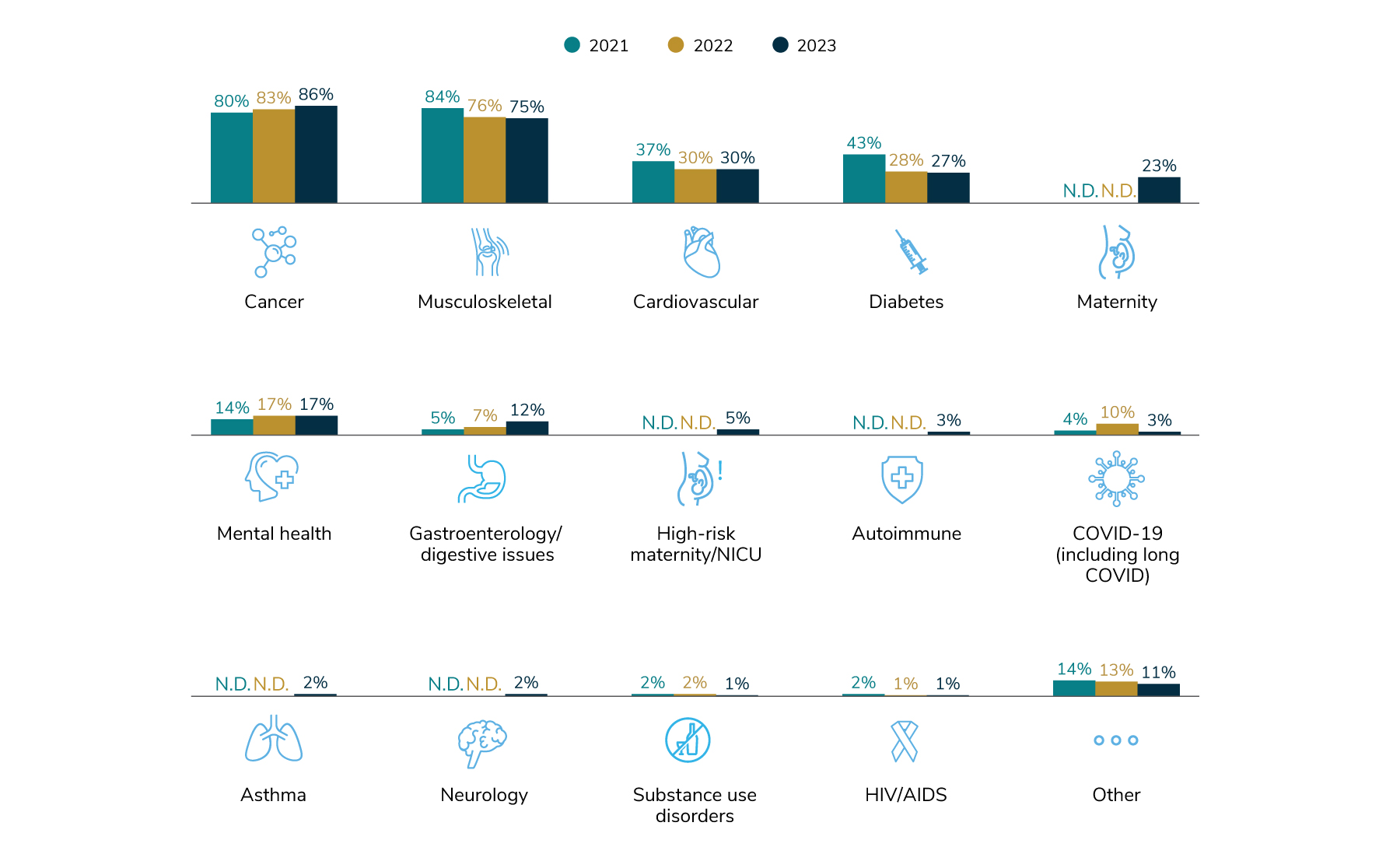

- For the second year in a row, cancer was the top cost driver, followed by musculoskeletal conditions, heart disease and diabetes.

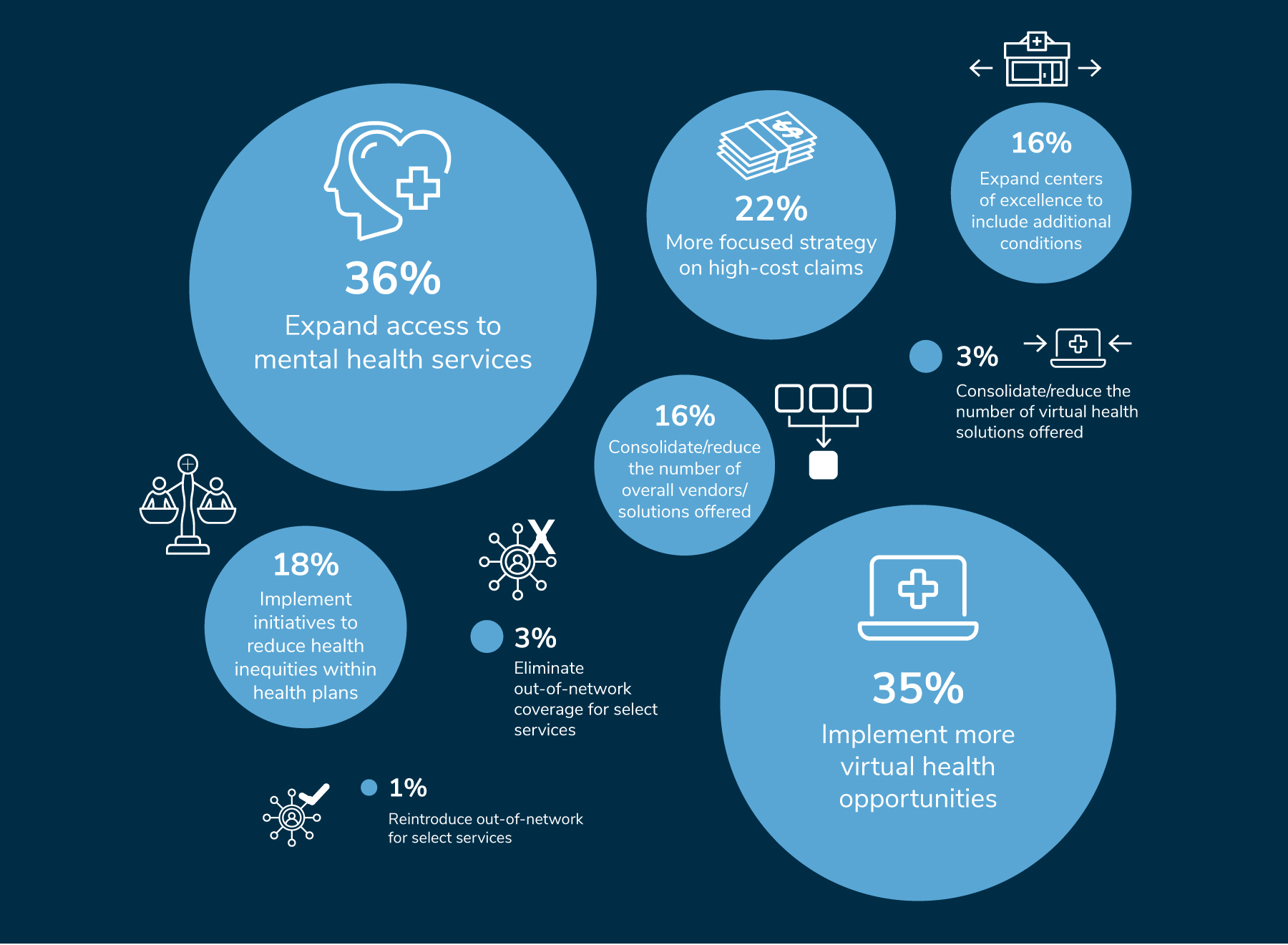

- Priorities for 2024 include increasing access to mental health services (36%), followed closely by implementing more virtual health opportunities (35%). Sixteen percent of employers also said that they want to consolidate or reduce the number of vendors/solutions.

Health Care and Pharmacy Trends

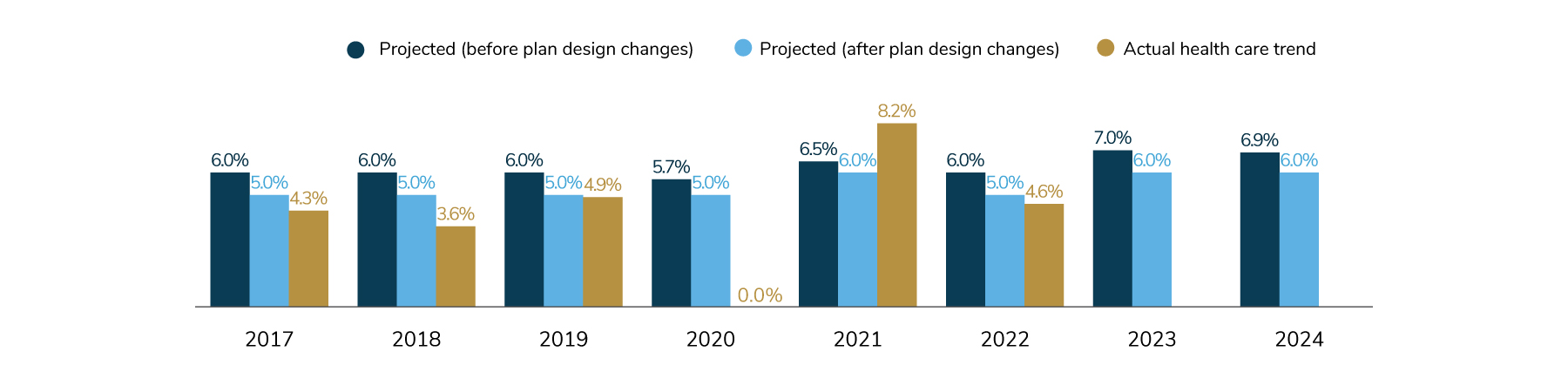

Health care cost trend continues to be volatile. After an abnormally high trend increase (8.2%) in 2021, largely due to pandemic-related uncertainty and unpredictability, the rate of increase in 2022 dropped to 4.6%, narrowly below the 5% increase that was projected and is consistent with pre-pandemic levels. For 2023, employers expect cost trend to increase by 6% after plan design changes, with the same 6% increase again for 2024. (Figure 4.1). These cost projections are higher than prior year forecasts, representing concern about costs overall.

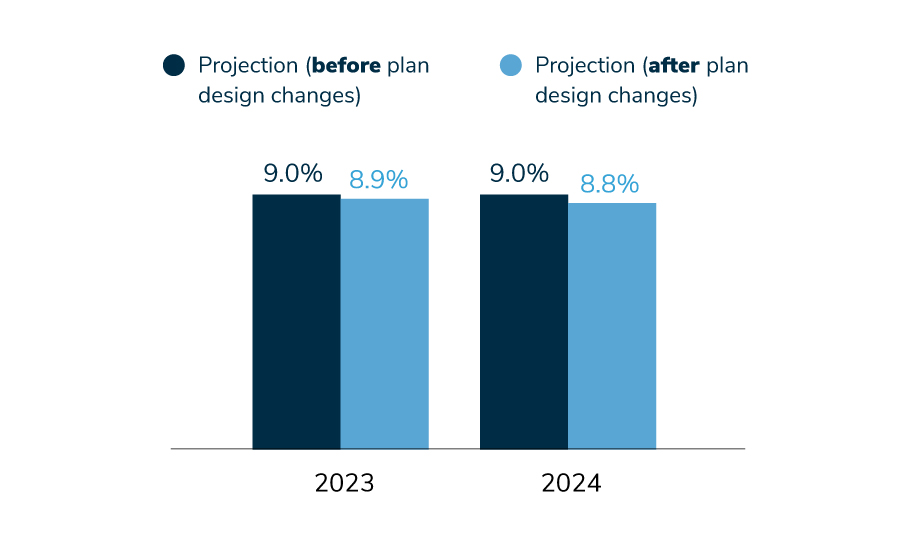

Pharmacy trend contributes to the uptick in overall expected trend for 2023 and 2024. With numerous high-cost therapies and gene/cell therapies now available, the cost of offering pharmacy benefits continues to rise. Blockbuster drugs like GLP-1s (e.g., Mounjaro, Wegovy), originally developed for diabetes but increasingly used as a weight-loss product, sometimes as an off-label indication (e.g., Ozempic), also may have an impact on pharmacy costs. For both 2023 and 2024, these costs are expected to increase by about 9% after plan design changes are made (Figure 4.2). Given the minor impact plan design changes will make in pharmacy trend (0.2% decline), it appears that employers intend to tackle pharmacy costs at the macro level as outlined in Figure 3.8 – not necessarily through adjustments in plan design.

Employers Bear the Brunt of Health Care Cost Increases

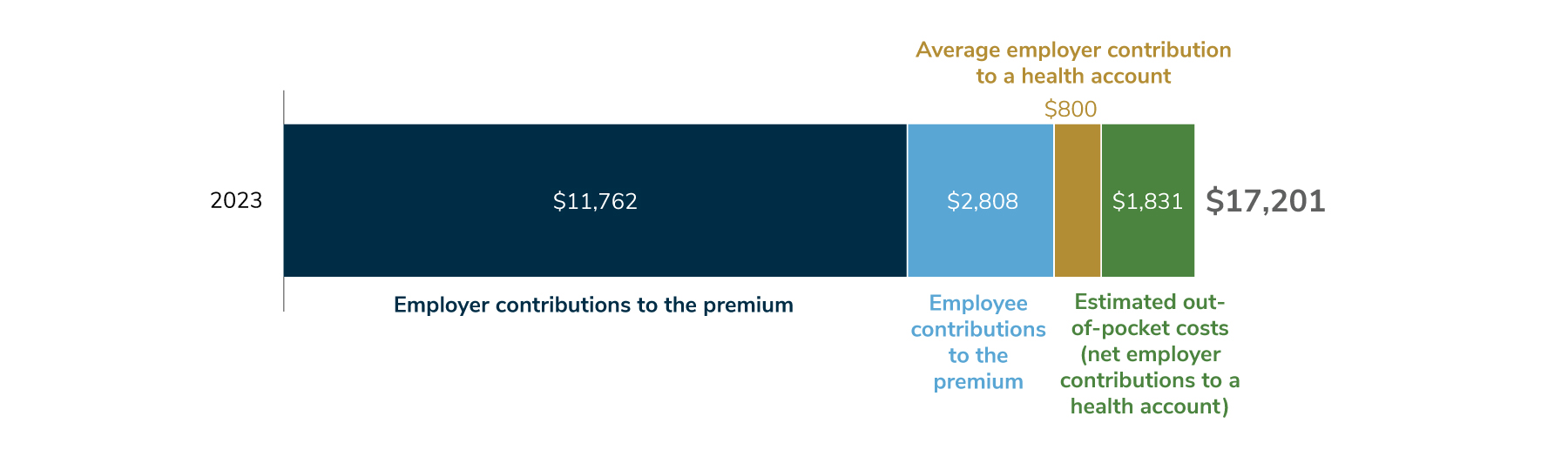

As health care costs continue to rise, employers are taking on more of the cost, shielding employees as much as they can. As shown in Figure 4.3, in 2023, it’s estimated that employers contributed an average of $12,562 (premium and health account contribution) compared to the $4,639 employees spent (portion of the premium and estimated out-of-pocket costs).

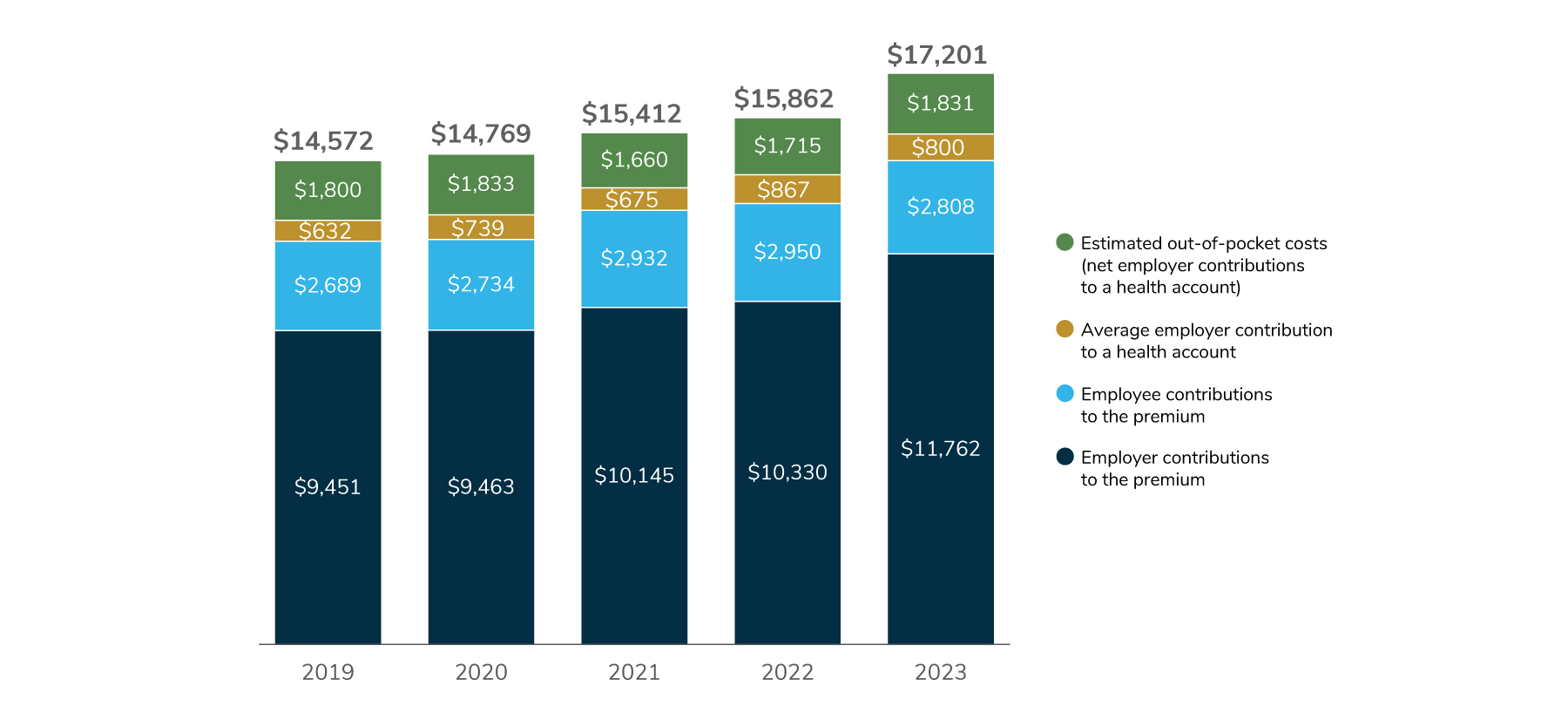

A comparison between cost sharing in 2022 and 2023 further illustrates this strategy. In 2022, the per capita health care cost (premiums + employer contributions to health accounts + employee out-of-pocket costs) was $15,862, and employers paid $10,330 of the premium while employees paid $2,950. In 2023, the per capita health care cost went up to $17,201, a $1,339 increase.

Despite the 2023 cost increase, employers paid more of the premium and employees paid less than in 2022. Employer contributions increased by $1,432, to $11,762. At the same time, employees saw their costs reduced overall. While out-of-pocket costs went up $116 from 2022 to 2023, employee contributions to premiums went down $142 (Figure 4.4).

This is the second year in a row that most employers have opted to absorb increased health care costs to keep costs more affordable for employees. However, it is unclear how much of the cost sharing employers can continue to take on and for how long they will be able to continue with this approach in the coming years.

Health Conditions Driving Cost

Increases in health care costs can often be attributed to specific conditions. Knowing which conditions are the top cost drivers is vital in determining how best to mitigate and address cost pressures whether through prevention, early detection and/or cost-effective treatments.

When employers were asked to name the top three conditions driving costs, 86% selected cancer, followed by musculoskeletal issues (75%) and cardiovascular problems (30%) (Figure 4.5). With cancer driving costs for so many employers, it is not surprising that they are looking for ways to lower costs. Options include exploring opportunities for earlier intervention, continued investment in prevention and increased scrutiny of the quality of care and outcomes.

Top Priorities for 2024

Consistent with other parts of this survey, employers’ top priority for 2024 is to increase access to mental health services (36%), followed closely by implementing more virtual health opportunities (35%). In previous years, virtual health took the top spot; as noted earlier, employers are inclined to see virtual care as less transformative than previously thought, contributing to this shift in priorities. However, employers expressed concern this year about the number of vendors/solutions, with 16% saying that they would like to consolidate or reduce that number. This finding is in alignment with an earlier result indicating that employers were assessing their partnerships to ensure that they get value from their benefits and health plans.

Other health care priorities are also part of employers’ plans for expansion. For example, 22% of employers will have a more focused strategy on high-cost claims, while 16% will add more conditions to their COE offerings. Eighteen percent will add new initiatives or dramatically change their current offerings to address health care inequities within their health plan. (Figure 4.6).

The data indicate that employers have a plethora of health care priorities for 2024, with a focus on increasing access to mental health and streamlining virtual solutions.

Additional Resources

To learn more on how to address the topics in this section, see the following Business Group member resources:

Part 4: Health Care Costs and 2024 Initiatives

-

Introduction2024 Large Employer Health Care Strategy Survey

-

Full Report2024 Large Employer Health Care Strategy Survey: Full Report

-

Executive Summary2024 Large Employer Health Care Strategy Survey: Executive Summary

-

Part 1Part 1: Employer Perspectives

-

Part 2Part 2: Health Care Delivery

-

Part 3Part 3: Health and Pharmacy Plan Design

-

Part 4Part 4: Health Care Costs and 2024 Initiatives

-

Chart Pack2024 Large Employer Health Care Strategy Survey: Chart Pack

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()