August 22, 2023

Key Takeaways

- Employers look to influence health care delivery by advancing quality and alternative payment models such as centers of excellence (COEs), in addition to supporting advanced primary care and other ways to address value in their health plans.

- Access to mental health support and services remains one of the most pressing issues employers are facing. They continue to see increased demand post-pandemic.

- On-site clinics may have reached a plateau, although employers are adjusting what is offered on-site to be reflective of care delivery priorities.

- Employers are moderating their expectations regarding how transformative virtual health is in the overall health care delivery system. This change is due to concerns about outcomes, quality, cost, experience and integration.

Changes to Health Care Delivery in 2024: ACOs, HPNs and COEs

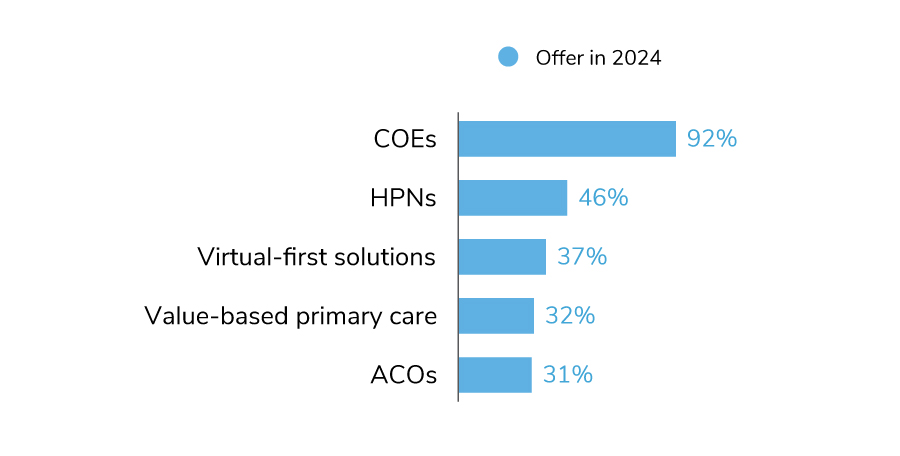

In employers’ quest to guide employees to high-quality providers, many continue to leverage different plan designs and payment structures that do just that. Between 2023 and 2024, there will be no significant change in the percentage of employers offering accountable care organizations (ACOs) and high-performance networks (HPNs). These two strategies have held steady largely due to the ability of health plans to integrate ACOs and HPNs into their own networks. In 2024, 46% will have an HPN and 31% of employers will offer an ACO.

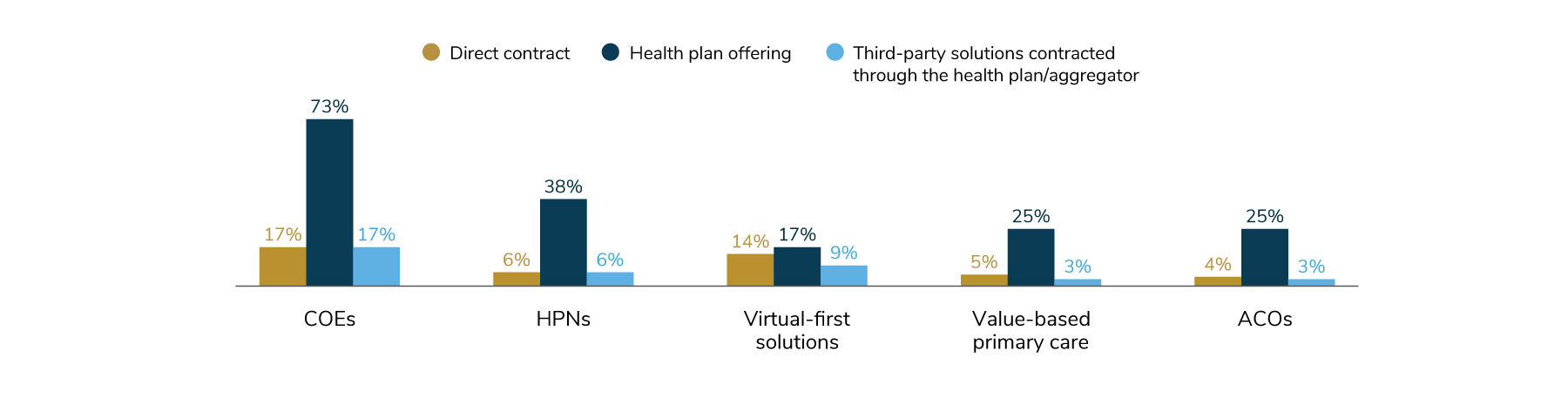

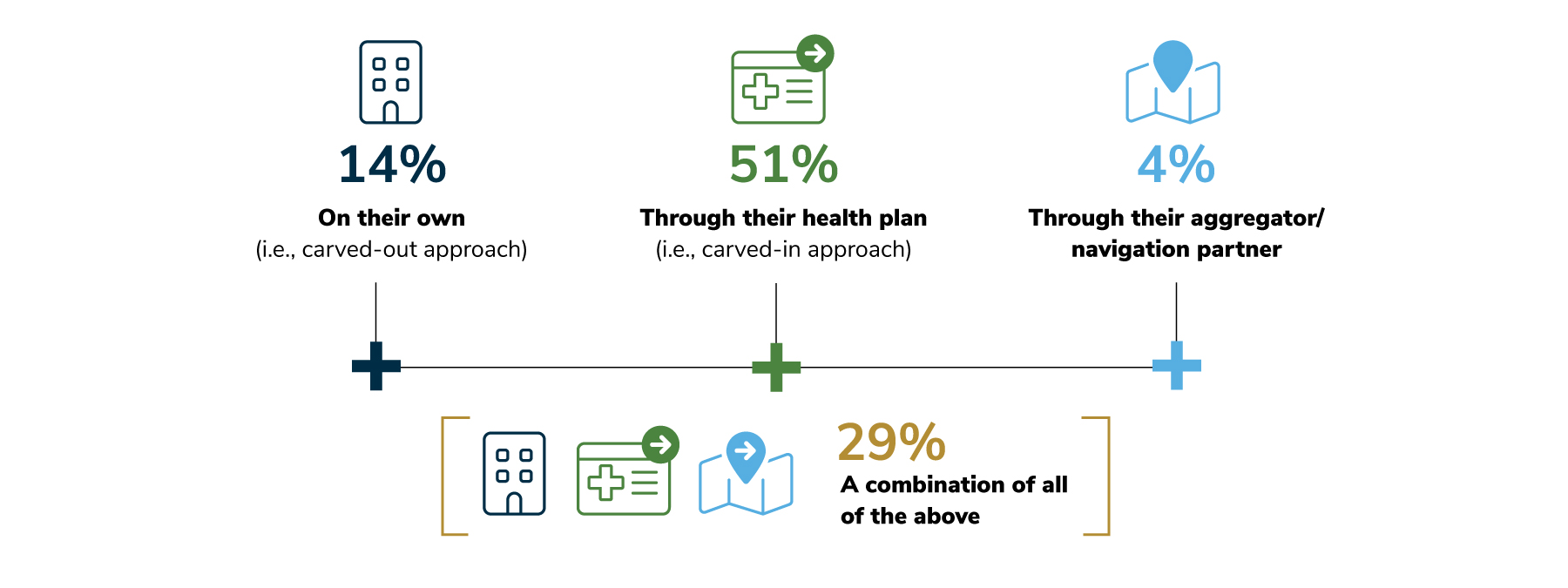

Nearly all employers (92%), however, have adopted COEs. COEs target specific conditions/procedures offered by higher quality providers. These groups of health care providers are most frequently organized by health plan networks (73%), but employers can contract with them directly or through a third party (Figure 2.2). As employers have been keenly focused on ways to address cost drivers like cancer, musculoskeletal care and cardiac procedures, COEs have been deployed in support of this strategy. This is largely due to their ability to provide high-quality, effective care, often leading to reduced total cost of care with improved outcomes. COEs will be explored in more detail later in this section.

Centers of Excellence (COEs): Centers of excellence are groups of health care providers who practice high-quality, efficient care for reasonable and predictable prices, often leading to reduced total cost of care with improved outcomes.

High-performance Networks (HPNs): High-performance networks typically include specific networks that encourage enrollees to choose network providers deemed high performing on efficiency and quality measures.

Virtual-first Solutions: Care delivery approaches that require or heavily incentivize the use of virtual care before provision of in-person care, with exceptions for examinations or treatments that necessitate in-person care.

Value-based Primary Care: Employees are “assigned” to a primary care provider (PCP), and in turn, the PCP is accountable for improving the health of a population that is assigned to them. The PCP does so by leveraging innovations and practices that optimizes population health, coordinating across other provider groups, integrating mental health and embracing virtual care delivery where appropriate.

Accountable Care Organizations (ACOs): ACOs are health care providers who come together in a delivery model that ultimately accepts responsibility for the quality and cost of care for a defined population.

Advancing Primary Care to Expand Access and Garner Value

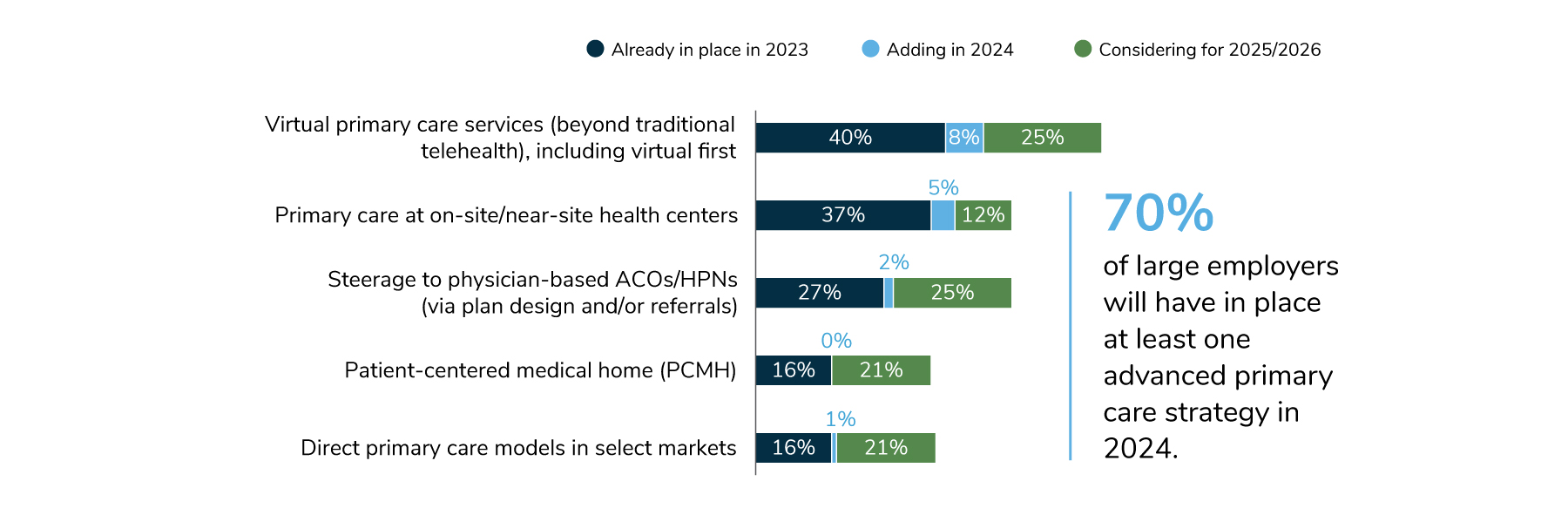

Employers are looking at a variety of strategies to positively impact employees’ access to and use of primary care. Overall, 70% of employers will leverage at least one advanced primary care strategy in 2024, up by 10 percentage points over the prior year. Virtual primary care services (including virtual first) are the main drivers of past and future growth in this area. More employers will look to virtual services as a means for expanding access to primary care. In fact, upward of 73% of employers could offer virtual primary care by 2026 (Figure 2.3).

While employers continue to expand health offerings that are delivered virtually, they are also mindful of the concerns raised in Part 1 regarding virtual health’s limitations. Therefore, they will be assessing future virtual health partners with a particularly discerning eye.

Other areas of expansion include offering primary care at the worksite (42% in 2024 to 54% in 2025/2026), along with steerage to an ACO/HPN (29% in 2024 to 54% in 2025/2026). On-site care could expand access, while ACOs/HPNs would be an impactful way to address the overall quality of primary care (Figure 2.3).

Finding Cancer Earlier Through Advanced Screenings

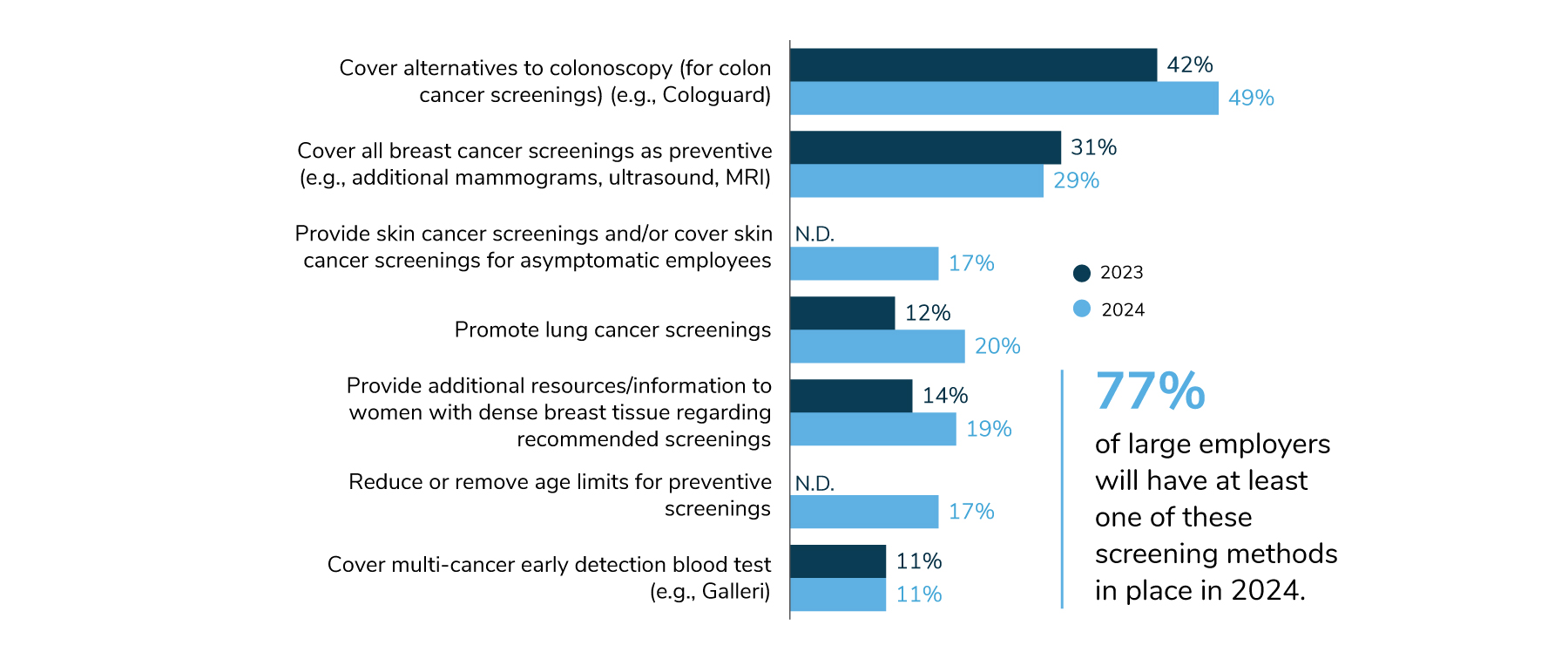

As a possible reaction to anticipating more late-stage cancers post-pandemic, employers are exploring all avenues to promote preventive screenings that detect cancers earlier. As was found last year, colon cancer screenings, outside of traditional colonoscopies, were the most common advanced screenings offered by employers. Second to this, 29% of employers will cover all types of breast cancer screenings as preventive (Figure 2.4).

Employers are enhancing their coverage of skin and lung cancer screenings (17% and 20%, respectively). In addition, 17% of employers are reducing or removing age requirements for preventive screenings altogether, removing another barrier and giving more choice to employees looking to reduce their risk of cancer. Eleven percent of employers will offer a multi-cancer blood test.

Access to Mental Health: Employers’ Priority for 2024

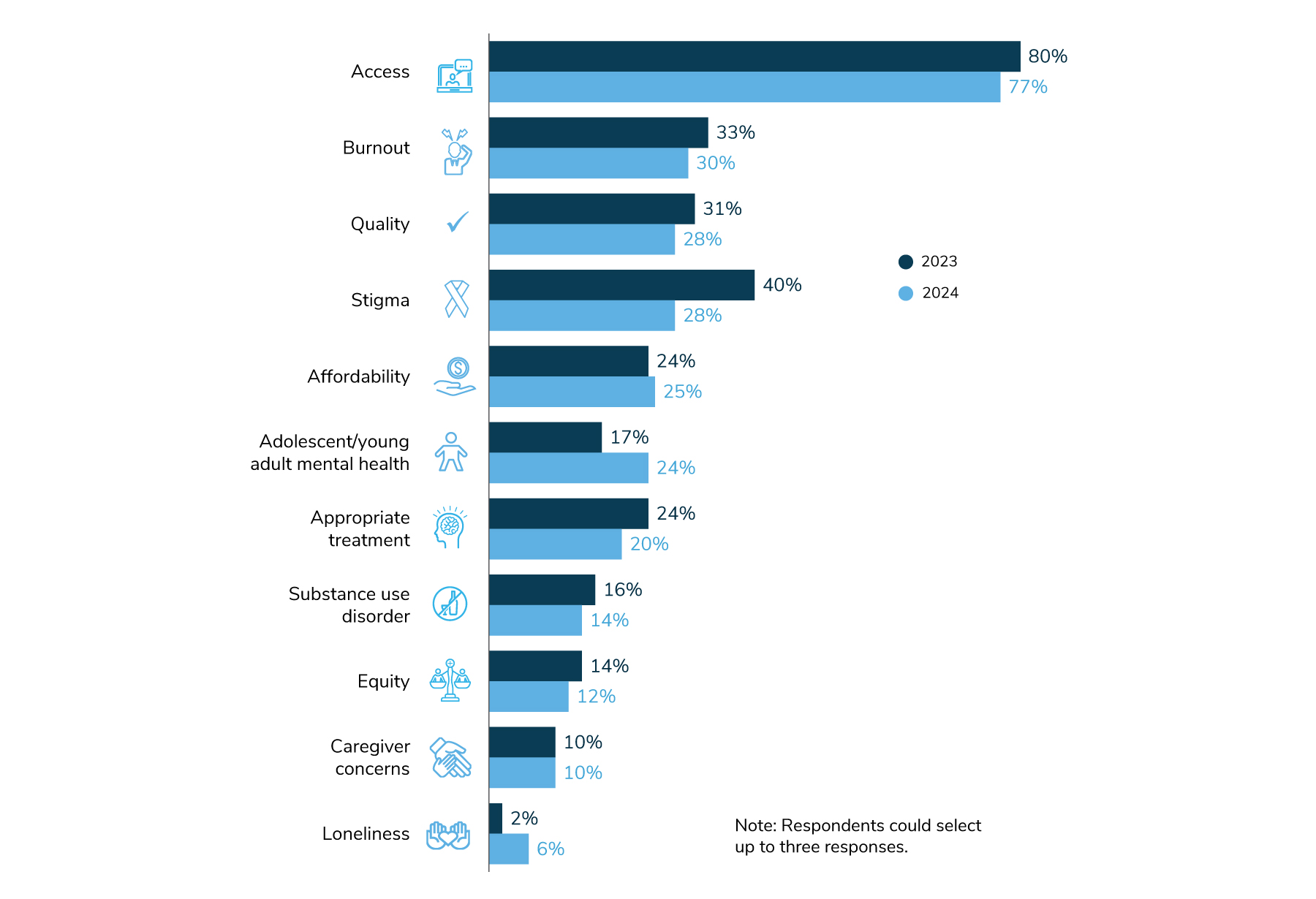

Looking forward to 2024, employers are highly focused on access to mental health services – more so than any other mental health concern. While access as a focal area declined by a few points between 2023 and 2024, it remains the clear priority. Other areas of focus include burnout, stigma, quality, affordability and a growing concern regarding adolescent/young adult mental health and appropriateness of treatment (Figure 2.5).

Many employers are addressing mental health by improving company culture. The hope is that an improved culture will lead to a more informed workplace, which will in turn dispel employee concerns about seeking support.

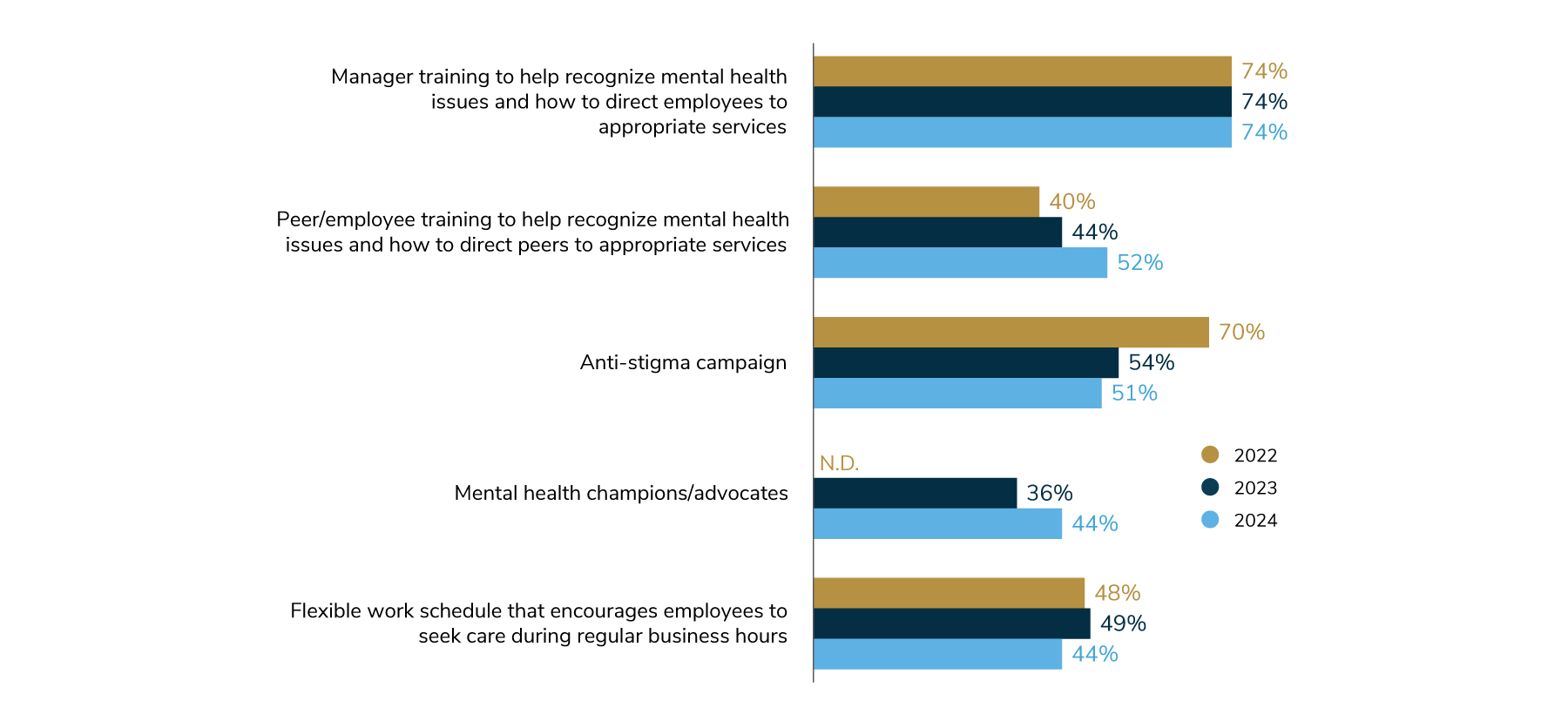

To reach this goal, employers are ramping up trainings for employees and cultivating mental health advocate networks. In 2024, 52% of employers will implement peer trainings to help employees recognize mental health issues and direct peers to appropriate resources. A similar training for managers is provided by 74% of employers, a tactic that has held steady since 2022.

In addition to trainings for employees and managers, 44% of employers are going so far as to develop a network of mental health champions/advocates, who can help spread the word about mental health resources and are a consistent resource for HR/Benefits to partner with on mental health initiatives (Figure 2.6). These approaches signal employers’ collaborative approach to addressing mental health among their employees. Interestingly, only about half of employers will host an anti-stigma campaign in 2024, a drop of 19 percentage points over 2 years (Figure 2.6). This decline is a positive sign that employers have made progress in battling stigma in the workplace, explaining why they are now focusing on employee and manager trainings.

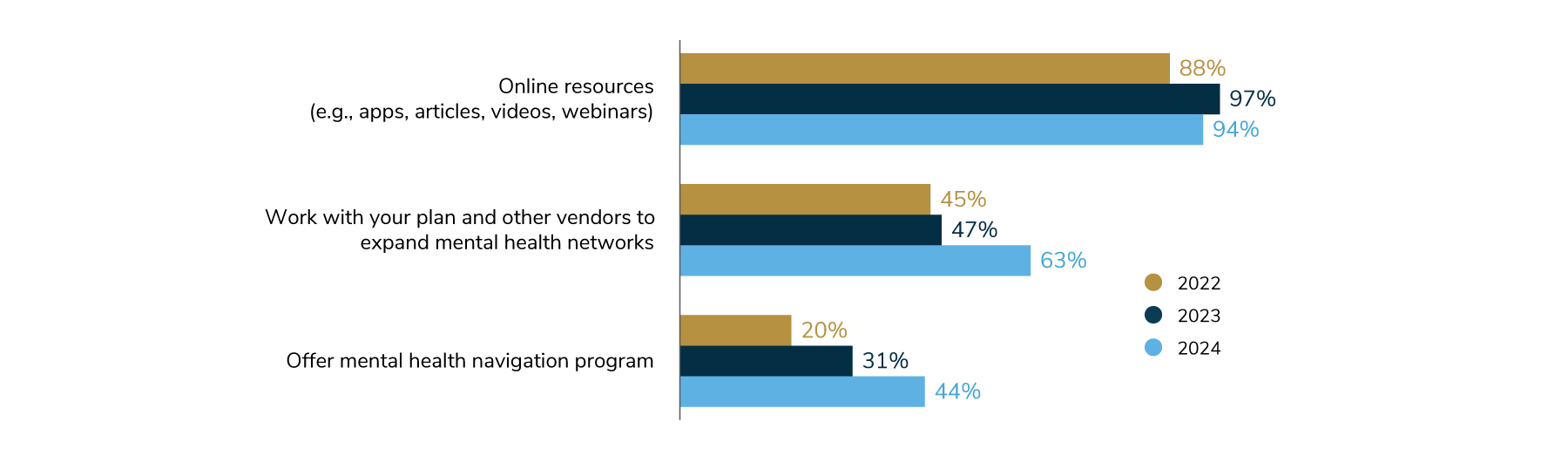

Employers are also looking for effective ways to increase access to mental health services. Their strategies include providing more options for support and lowering cost barriers to care. Nearly all employers (97%) offer some type of online resource on mental health.

Sixty-three percent of employers are working with their health plan to expand mental health networks – perhaps by adding providers to health plan networks or by curating a custom network through a telemental health vendor. Mental health navigation will double in just 2 short years, from 20% of employers offering it in 2022 to 44% in 2024 (Figure 2.7).

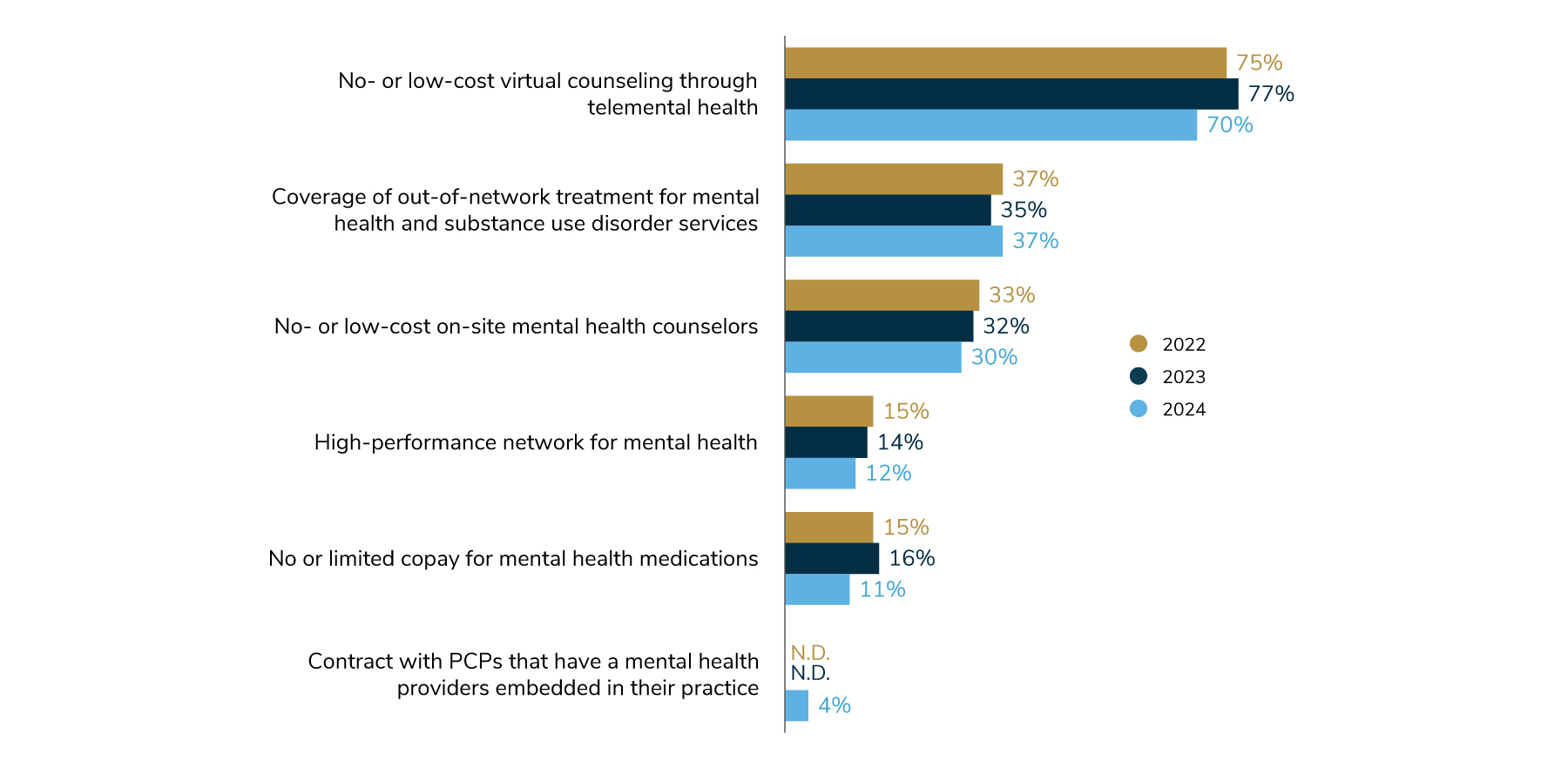

In addition to providing many avenues to mental health support, employers are also continuing to work to reduce barriers to care caused by out-of-pocket costs. The most common way is to cover virtual counseling through telemental health at a reduced cost or even eliminating any expense to the employee. Employers are largely maintaining efforts put in place over the past 2 years to reduce employee costs. They are doing so by offering no- or low-cost counseling through telemental health, covering out-of-network treatment and bringing counselors directly on-site at no- or low-cost to employees (Figure 2.8).

Virtual Health Continues to Grow; Engagement Platforms Needed for Support

As mentioned in part 1, although employers’ sentiments on virtual health as a transformative strategy may have cooled slightly, it remains a significant element in overall care delivery. This is evidenced by the finding that virtual health offerings will either be maintained at current levels or expand to other condition groups. Part of this growth may be fueled by health plans’ ability to function as a conduit in offering virtual programs that may otherwise be carved out or not offered at all – with the expectation that this addresses the integration concerns cited earlier in this report. In fact, 51% of employers offer virtual health exclusively through their health plan, while another 29% (up from 23% in 2022) offer a combination of virtual health services (Figure 2.9).

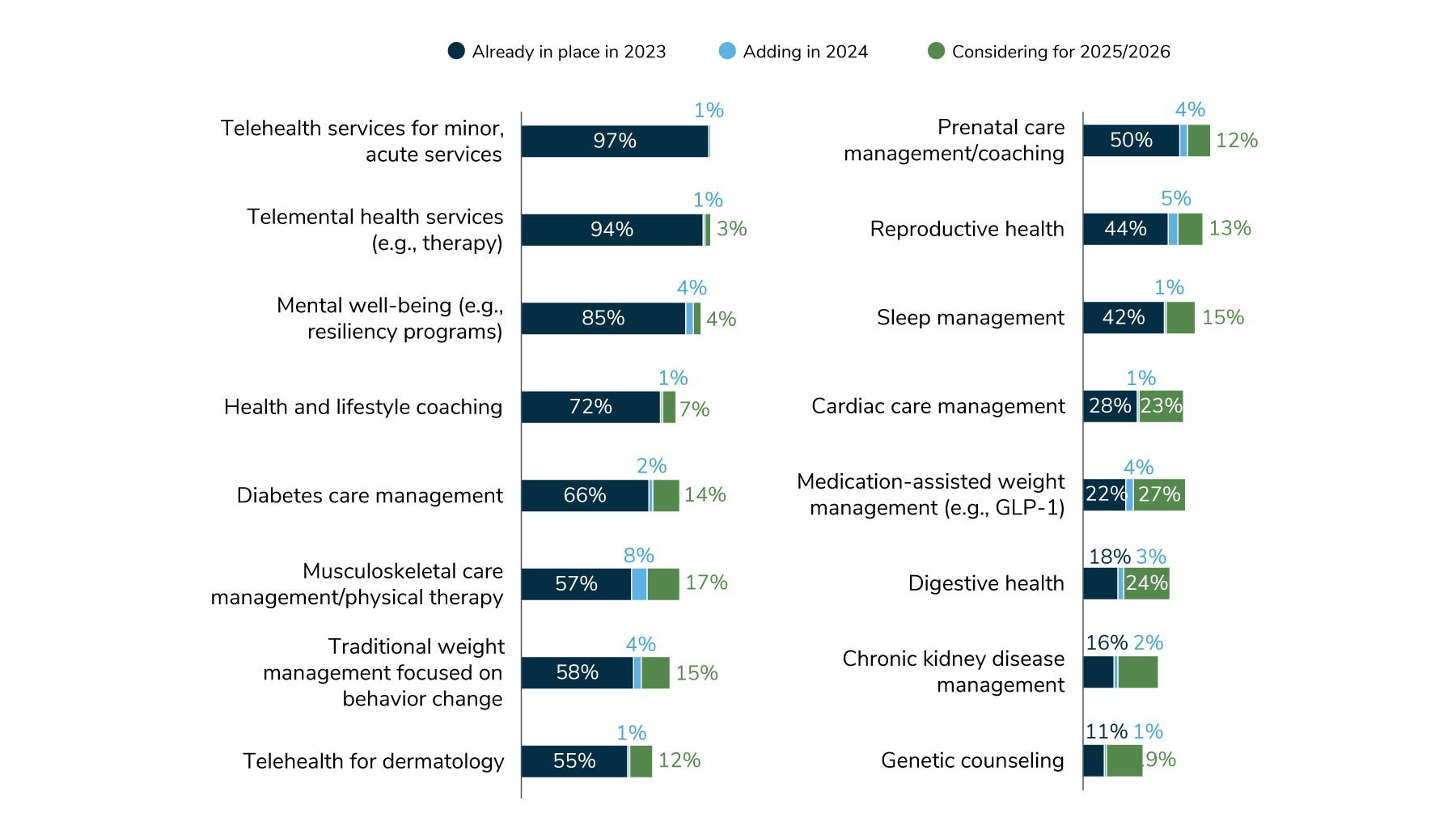

In evaluating changes in virtual health services across various conditions and distinct service categories over the next 2-4 years, it becomes clear that some will a) remain relatively flat, b) stay on course for a paced growth or c) see rapid growth. Established solution categories are among those remaining flat due to already being highly prevalent and achieving ubiquity. Those expected to experience rapid growth are largely attributed to newer solutions and/or conditions with emerging concerns (e.g., medication-assisted weight management and digestive health). Telehealth, telemental health and mental well-being (e.g., resiliency, mindfulness) will be offered by most employers by 2026. Lifestyle coaching, diabetes care management, musculoskeletal/physical therapy, weight management, dermatology, prenatal support and reproductive health will all steadily increase between 2023 and 2024 and then at the same pace through 2026 (Figure 2.10).

The remainder of virtual health offerings will see narrow growth next year; however, many employers are considering them for 2025/2026. This includes cardiac care, medication-assisted weight management, digestive health, kidney disease management and genetic counseling.

Employees now have access to a wide range of health and well-being services, including virtual health programs, making the need for navigation support and engagement platforms to guide employees to the most appropriate resource more pressing. With an array of virtual programs being offered by the majority of employers (alongside traditional health plan and EAP offerings), navigation services have become a crucial element of an employer’s engagement strategy.

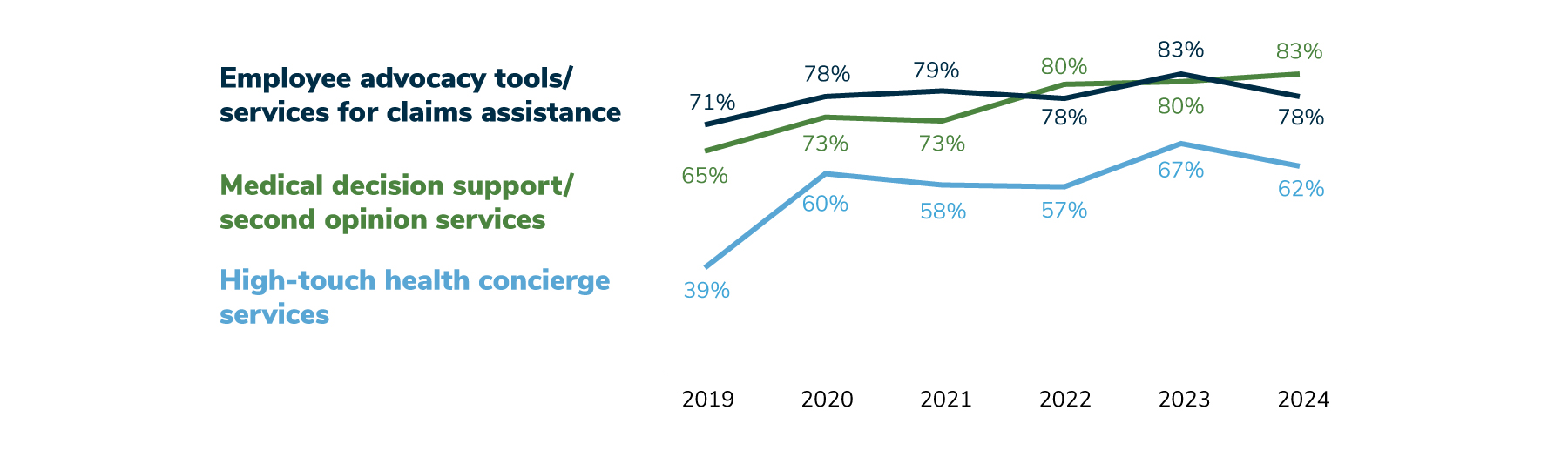

Advocacy tools, medical decision support and high-touch concierge services have all experienced steady growth in the past 5 years. The increased focus on medical decision support/second-opinion services may be due to concern with rising cost and the pent-up demand for health services, as illustrated in Figure 1.5. It is anticipated that 62% of employers will provide high-touch health concierge services in 2024 (down from 67% in 2023), and 78% will offer advocacy tools/services for claims assistance in 2024 (a drop from 83% in 2023) (Figure 2.11).

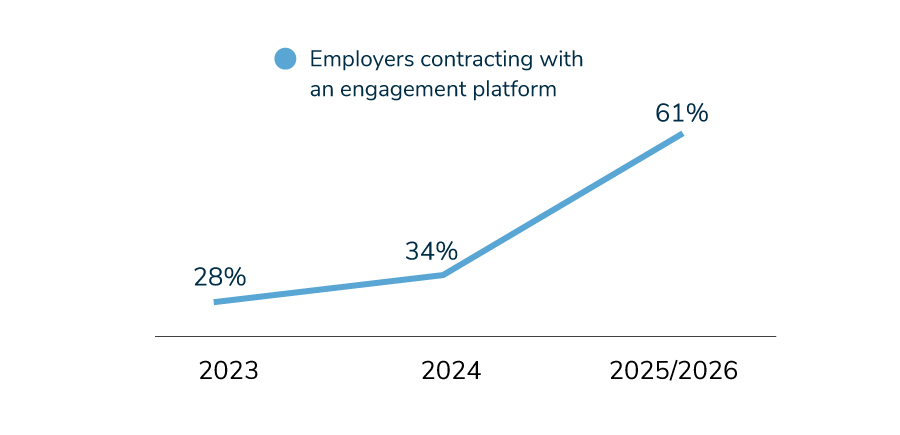

Engagement platforms are a way for employers to promote health and well-being offerings and enable personalized recommendations for employees. While only 28% of employers have one in 2023, upward of 61% may add one by 2026. This jump is one of the biggest potential increases observed in this year’s survey (Figure 2.12). Time will tell whether this increase actually occurs, however, this may reflect the challenges articulated earlier in this report about the lack of integration across vendors, with employers seeking to address those concerns via an engagement platform intermediary.

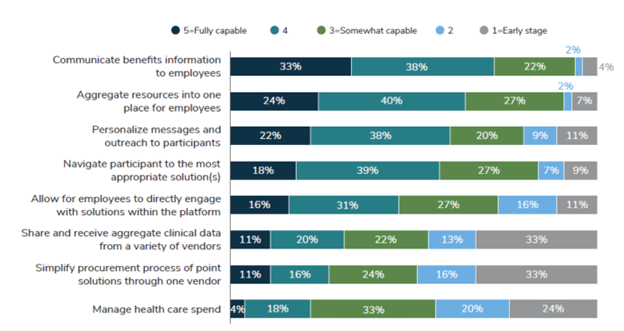

Engagement platforms have a myriad of capabilities to assist both the HR/Benefit team and employees. Figure 2.13 displays employer ratings of engagement platform attributes, from those that have full capability to those in their early stages. A majority of employers believe that engagement platforms are able to communicate information and aggregate resources into one place. On the other hand, employers are not yet seeing an ability to manage health care spend and pull in clinical data from a variety of vendors. Narrowing the gap on these advanced capabilities could help fulfill the promise of engagement platforms.

On-site Clinics Hold Steady While Employers Modify the Services Offered

During and after the COVID-19 pandemic, when some employers closed their on-site clinics, it remained unclear if more employers would maintain, reduce or add clinics in the future. Another factor impacting on-site clinic strategies is to what degree some employers have migrated to a hybrid or remote work environment, reducing the need for health services at the workplace.

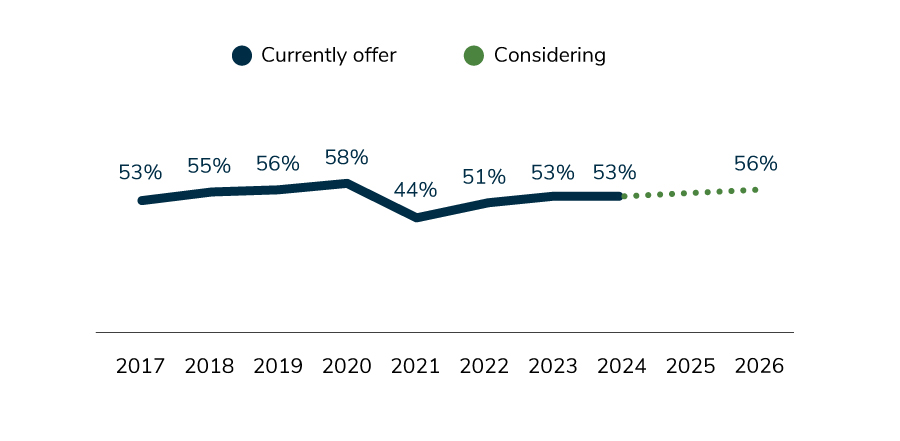

As Figure 2.14 shows, despite the dip seen in 2021, the percentage of employers with on-site clinics has remained basically unchanged and will remain so through 2026.

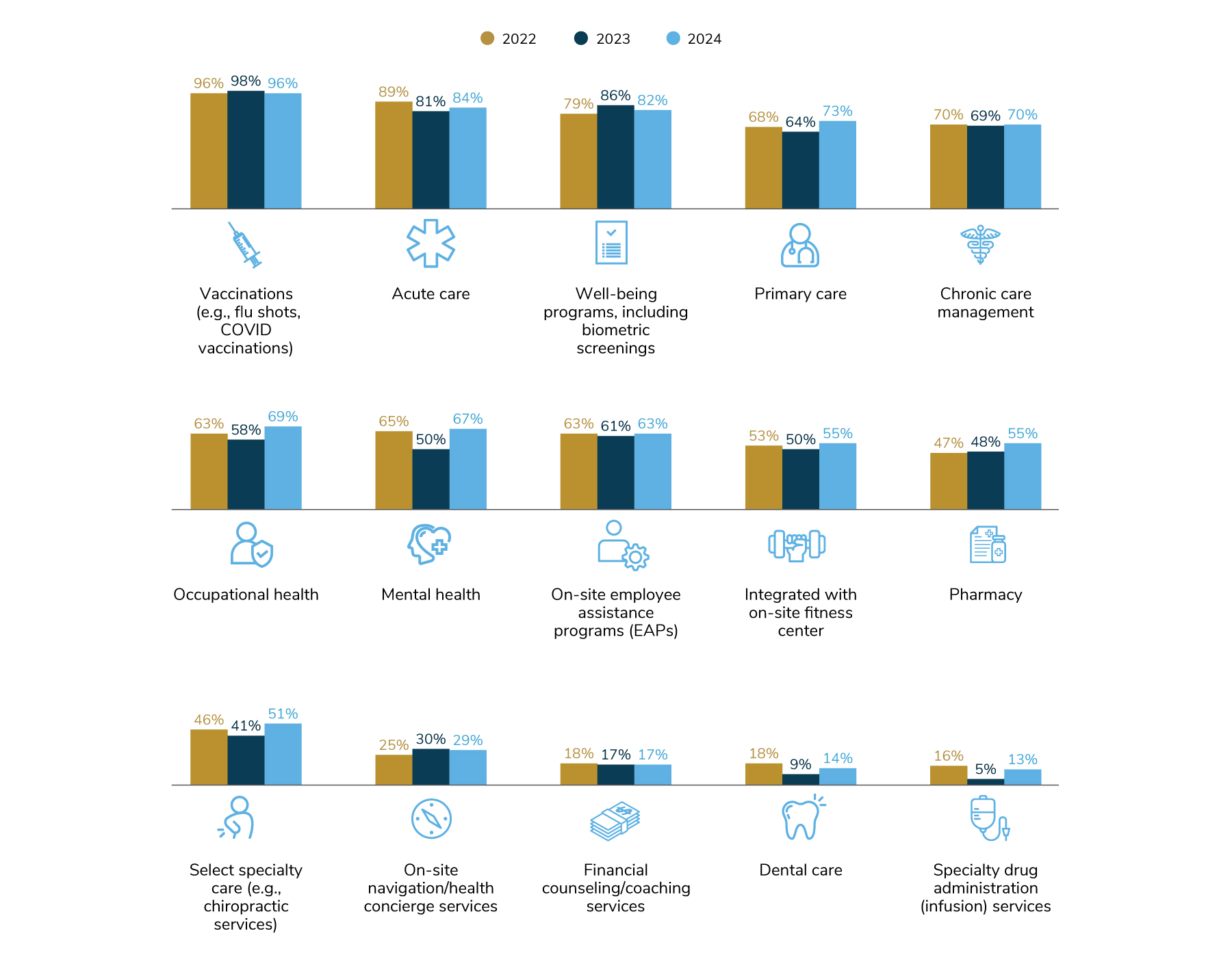

Among those with clinics, what may change are the types of services offered to employees who visit the clinics. While vaccinations, acute care and well-being programs are commonly made available at on-site clinics, other services may be offered increasingly by employers, some of which mirror employers’ focus in health care delivery. For example, primary care, mental health, pharmacy and select specialty care will be offered by more employers in 2024 than in 2023 (Figure 2.15). This could reflect employers’ goal to widen access to care (such as primary care and mental health) to serve the growing needs of employees and offer access to select subspecialties and specialty drug administration.

Quality Care Is Sought Through COEs

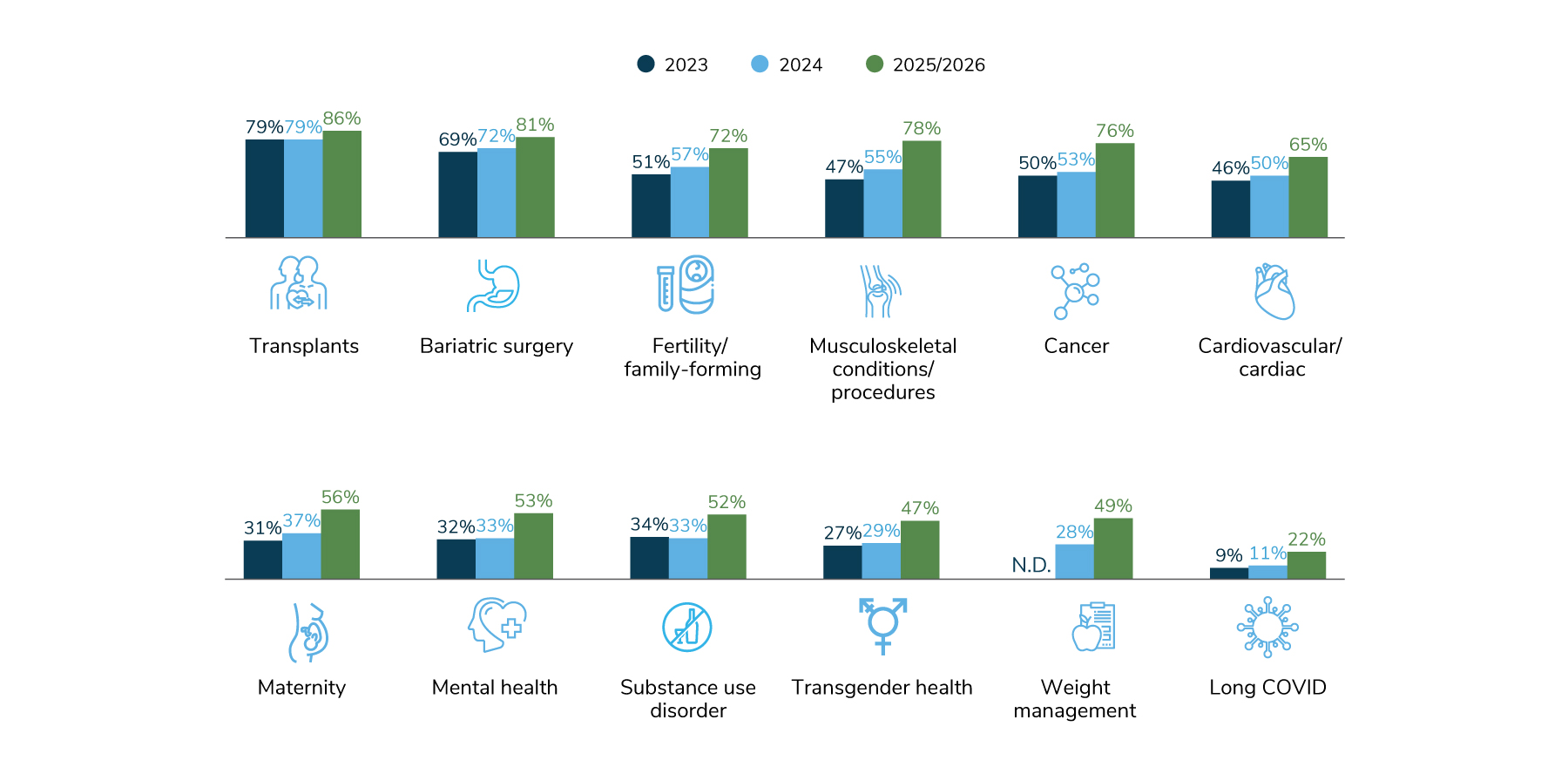

When it comes to employers’ strategy to tackle a specific condition, offering a COE provider network is typically at the top of the list. As mentioned on page 32, 92% of employers offer at least one COE. While some COE types are more common (transplants and bariatric surgery COEs will be offered by over 70% of employers), other COEs will garner equal levels of interest in the coming years. Musculoskeletal and cancer COEs are both slated to experience double-digit increases between 2023 and 2026 (Figure 2.16). This is no surprise due to the fact that cancer and MSK represent the two costliest condition groups for employers completing this survey, as noted in Figure 4.5.

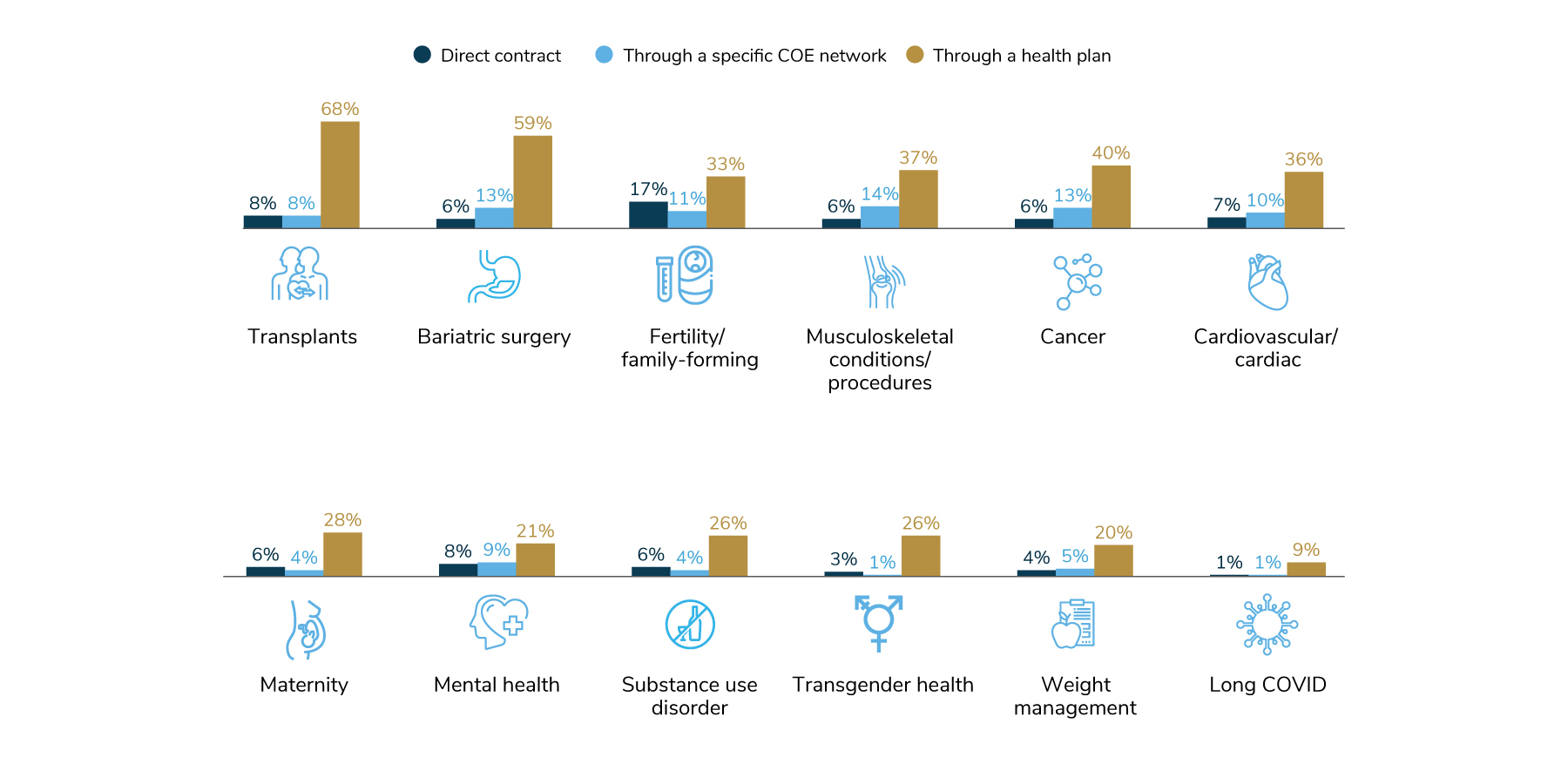

This is another example of how health plan integration can influence employers’ ability to curate a network based on quality and value. When asked how employers offer COEs, they said that for every type of COE, these networks are most often through the health plan. However, fertility COEs are more likely to be provided through a direct contract with a specific provider than any other COE, and cancer and musculoskeletal are sometimes offered through a specialty COE network (Figure 2.17).

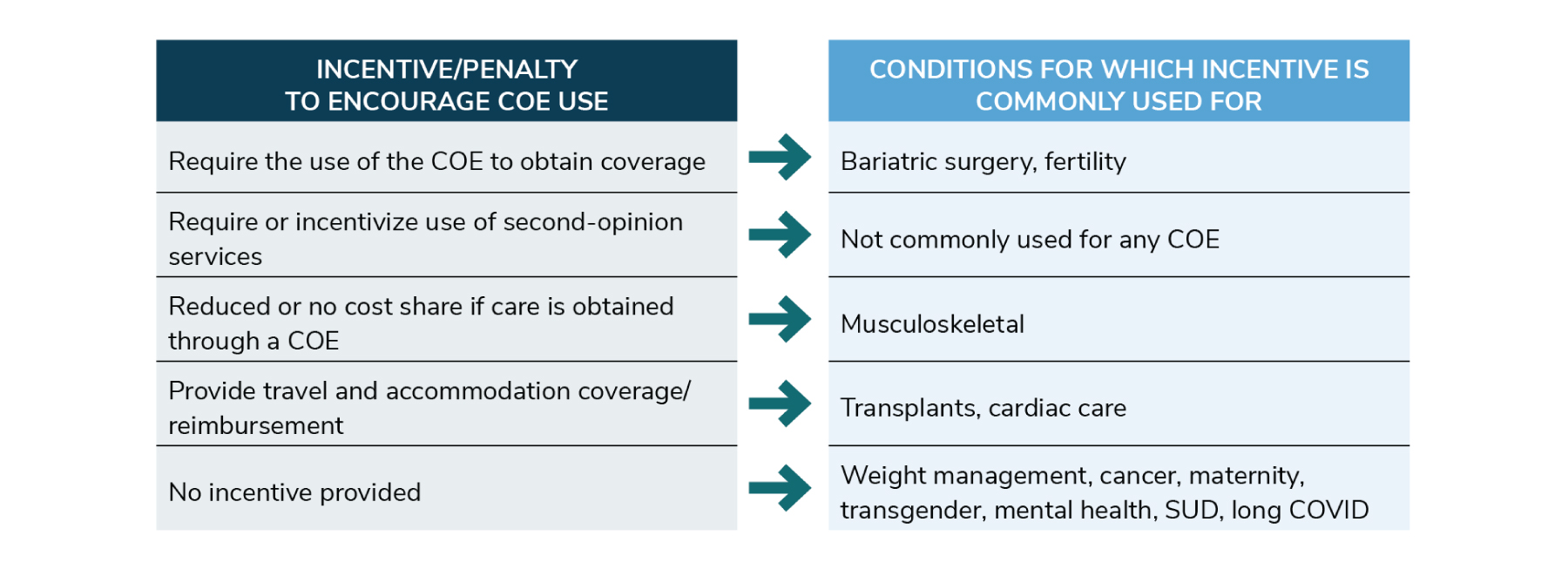

A key part of a COE strategy are the incentives deployed to encourage employees to use a COE. The strategies employers rely on are listed in Table 2.1, with the two types of COEs that tend to use that incentive most often listed alongside it.

To decipher Table 2.1 further, consider the following: While many incentive strategies are used across varying types of COEs, some incentives are more commonly aligned with specific types of COEs. For example, reducing cost share for the use of a COE is the most common incentive for musculoskeletal COEs, while a coverage requirement is more common for bariatric surgery and fertility COEs. Requiring or incentivizing the use of second-opinion services was used by a few employers, but it didn’t peak as the most common approach for any COEs. Lastly, for a number of COEs—weight management, cancer, maternity, transgender, mental health, SUD and long COVID—the most common approach is actually no incentive at all.

Additional Resources

To learn more on how to address the topics in this section, see the following Business Group member resources:

- Value-based Purchasing Employer Guide

- What’s Needed in Primary Care: Innovation With Integration

- Engineering Mental Health: Building a Strategy from the Ground Up

- Shaping the Future of Virtual Health: Creating Agile Solutions

- Evolving On-Site Health Care Delivery: Innovating Beyond the Traditional Model

- Centers of Excellence Considerations for Employers

Part 2: Health Care Delivery

-

Introduction2024 Large Employer Health Care Strategy Survey

-

Full Report2024 Large Employer Health Care Strategy Survey: Full Report

-

Executive Summary2024 Large Employer Health Care Strategy Survey: Executive Summary

-

Part 1Part 1: Employer Perspectives

-

Part 2Part 2: Health Care Delivery

-

Part 3Part 3: Health and Pharmacy Plan Design

-

Part 4Part 4: Health Care Costs and 2024 Initiatives

-

Chart Pack2024 Large Employer Health Care Strategy Survey: Chart Pack

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()