August 22, 2023

Based on the findings of the 2024 survey, the following emerged as top focus areas among employers.

1| Mental health challenges remain on the rise and are cited as the top area of significant prolonged impact resulting from the pandemic. In response, employers continue to focus on expanded access to support and services.

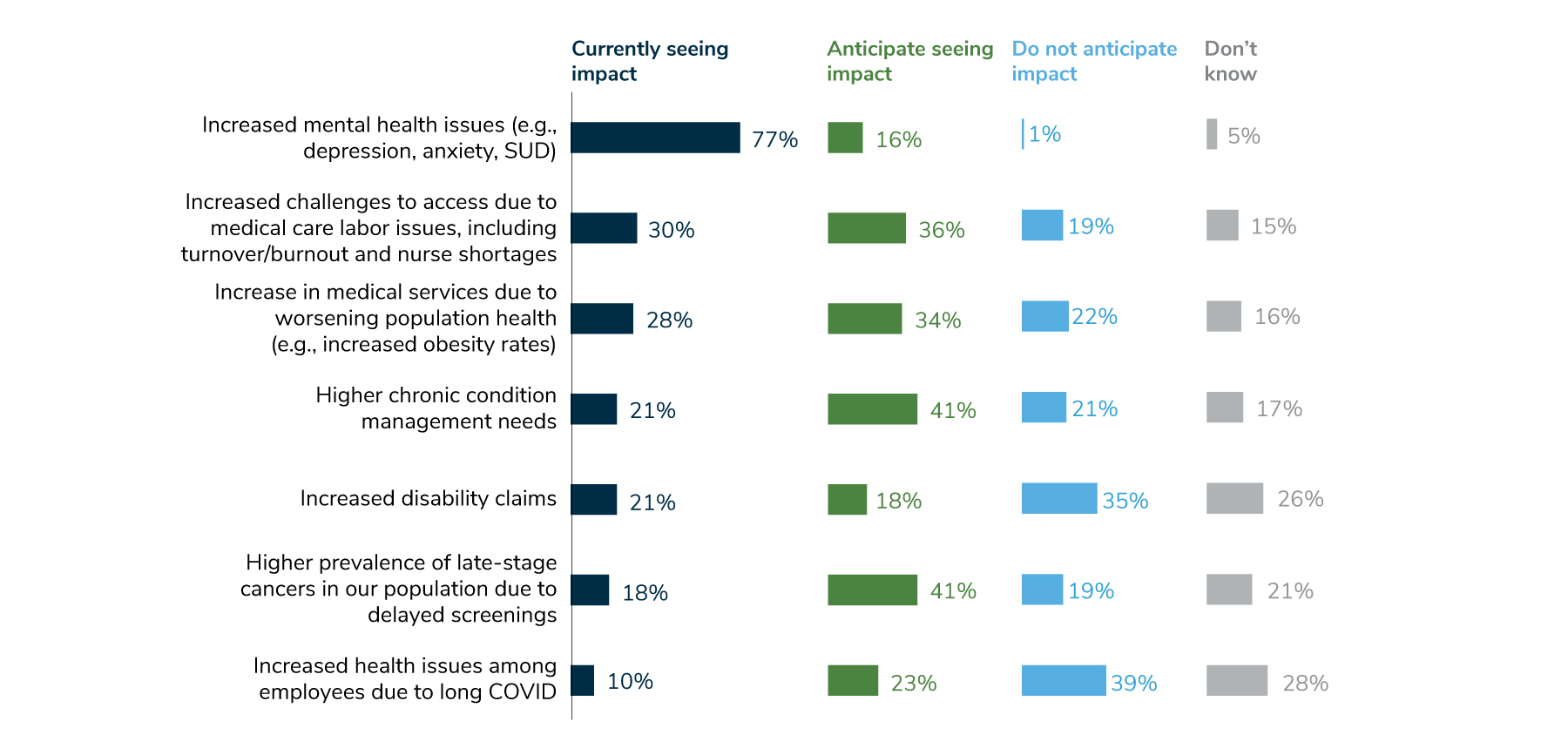

In recent years, employers saw an increase in mental health needs, such as depression, anxiety and substance use disorder, and this year, that trend accelerated. Whereas last year, 44% of employers saw an increase in mental health concerns, this year, 77% of employers reported an increase, with another 16% anticipating such an increase in the future. To address this in 2024, employers are highly focused on access to mental health services – more so than any other mental health concern. Key ways employers are increasing access to mental health services include providing more options for support and lowering cost barriers to care.

2 | Pharmacy costs continue to have a significant impact on trend and affordability.

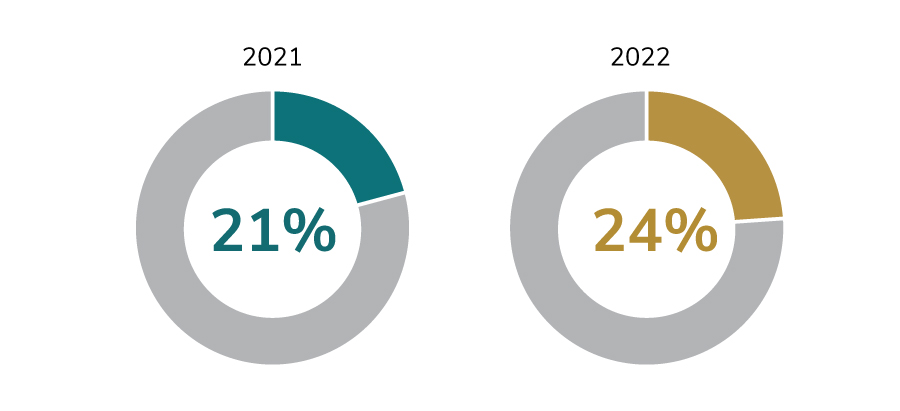

Ninety-two percent of employers are concerned or very concerned about high-cost drugs in the pipeline, and 91% are concerned or very concerned about pharmacy cost trend overall. Those concerns appear to be well-founded, as employers experienced an increase in the median percentage of health care dollars spent on pharmacy, from 21% in 2021 to 24% in 2022. Various pharmacy management strategies, such as implementing a transparent pharmacy benefit manager (PBM) and plan design changes to address costly medications and treatments, are planned by employers for 2024.

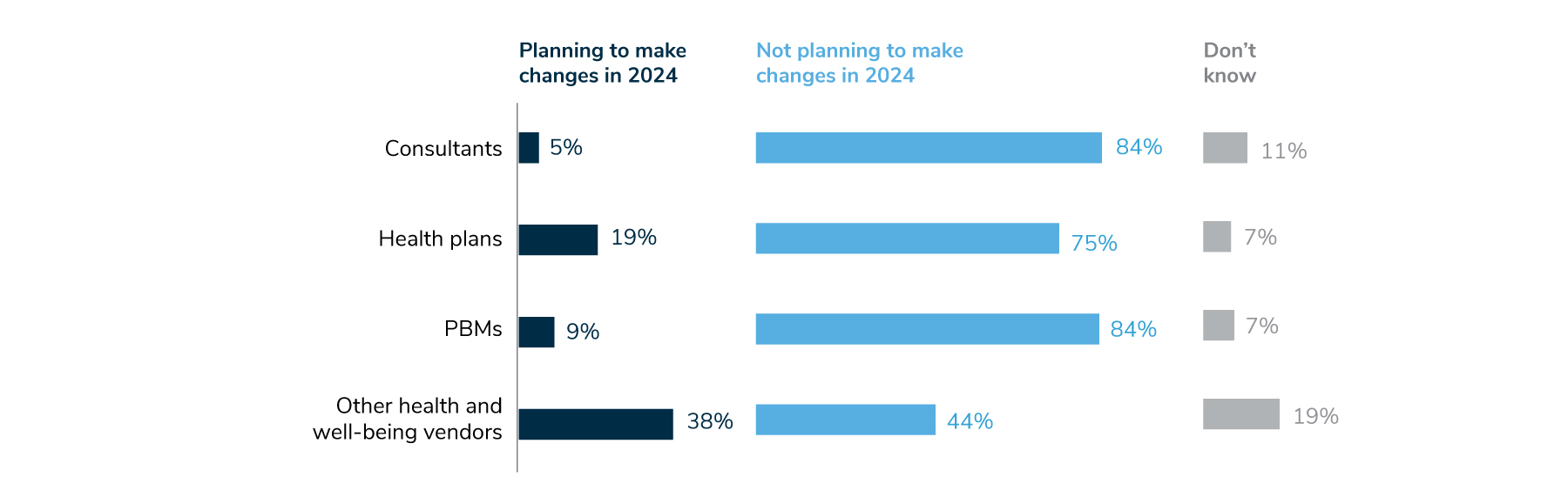

3 | Employers are evaluating partnerships and vendors to ensure they create value and result in higher quality, cost-effective services.

There is a growing focus on holding vendors accountable to deliver greater transparency of results, pricing and contractual terms. Employers are also interested in streamlining partnerships and vendor offerings and expect to conduct requests for proposals and other evaluations to support this goal. In addition, nearly half of employers will require vendors to report on health equity measures to enable evaluation of progress in this area.

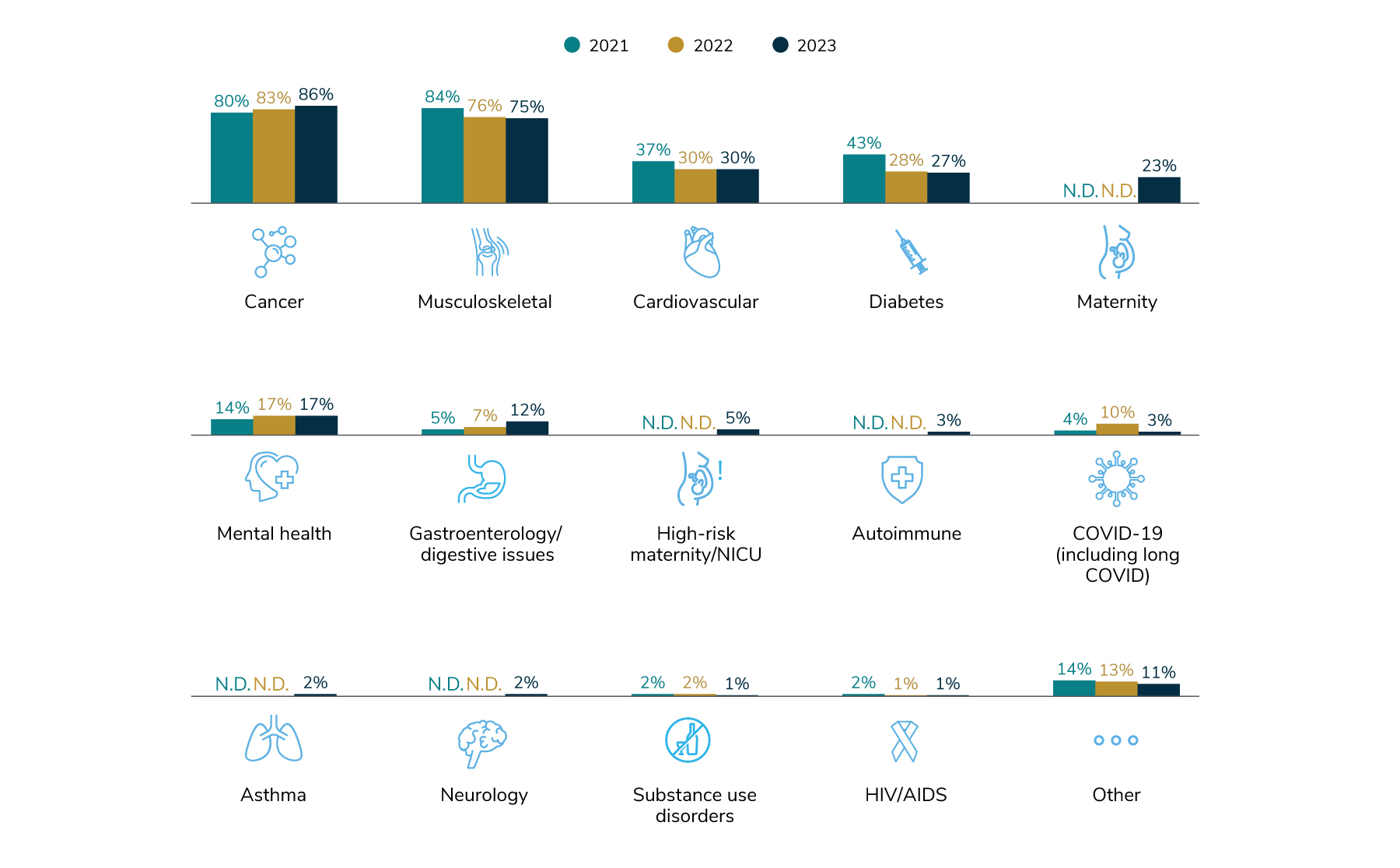

4 | One in two employers say cancer is the number one driver of health care costs, and 86% say it’s among their top three.

Increased prevalence of late-stage cancer diagnoses—a lingering effect of the COVID-19 pandemic—is one reason for this problem. In fact, 41% of employers are anticipating more late-stage cancers in their population due to delayed screenings (Figure 1). Employers are taking steps to address this by focusing on advanced screening measures and maintaining 100% coverage for recommended prevention and screening services, as detailed in Parts 1 and 2 of the full report. Employers are also keeping an eye on clinical advancements in oncology, including biomarker testing and immunotherapies, and are focused on guiding members to high-quality care, in hopes of improving health outcomes for patients affected by cancer. Fifty-three percent of employers will offer a cancer-focused center of excellence approach in 2024, with an additional 23% considering this approach by 2026.

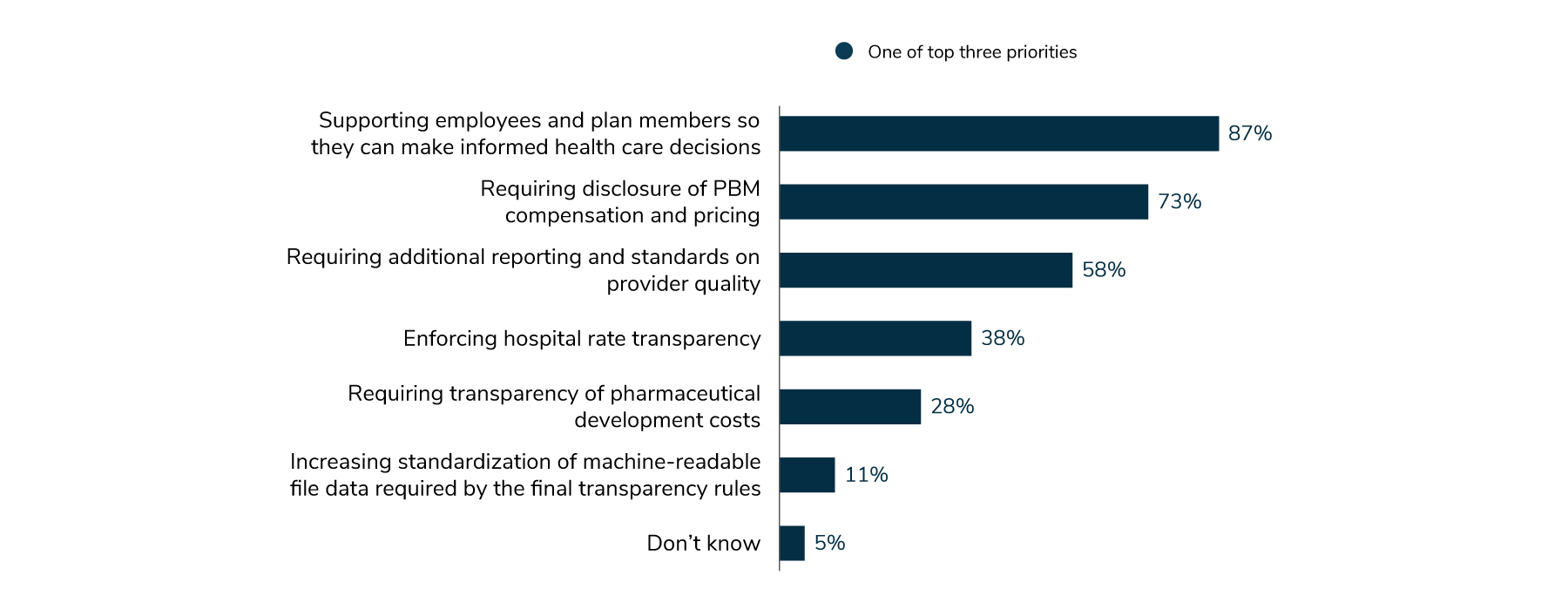

5 | Employers look to transparency as a way to contain costs and improve quality.

Employers are prioritizing greater transparency of cost and quality data so they and their employees can make informed decisions about their health care (87%). Employers are supportive of engagement platforms as a tool for employees to find needed information to identify the best solutions for their health care needs. In addition, 73% of employers see requirements for more transparency in PBM pricing and contracting as a priority, and 58% would like to see additional reporting and better provider quality measurement standards.

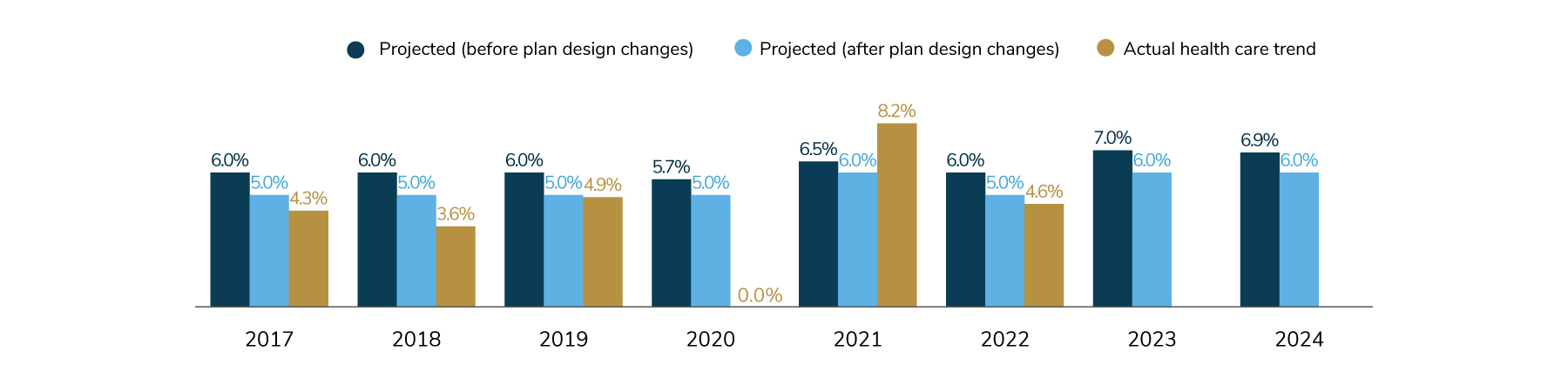

6 | After plan design changes, health care costs may increase by 6% in 2023 and 2024. This is higher than historical increases.

Concerns abound regarding plan and patient affordability, underscoring the unrelenting demand for delivery system and payment transformation. Employers are focusing on outcomes improvement, lowering the total cost of care, reduction in unnecessary services and prioritization of prevention and primary care.

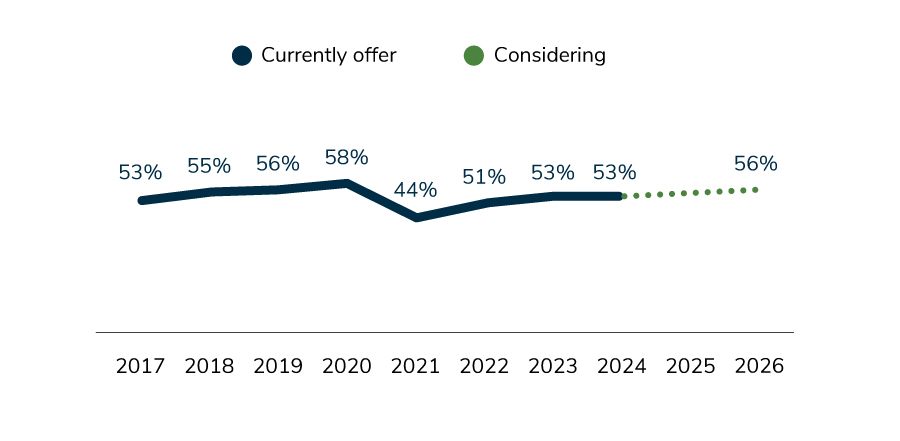

7 | On-site clinics may have reached a plateau, with 53% of employers currently offering them and 53% expected to do so in 2024.

A factor impacting on-site clinic strategies is to what degree some employers have migrated to a hybrid or remote work environment, reducing the need for health services at the workplace. Employers are, however, adjusting what is offered on-site to be reflective of their other care delivery priorities. This could reflect employers’ goal to widen access to care (to include primary care and mental health) to serve the growing needs of employees and offer access to select subspecialties and specialty drug administration.

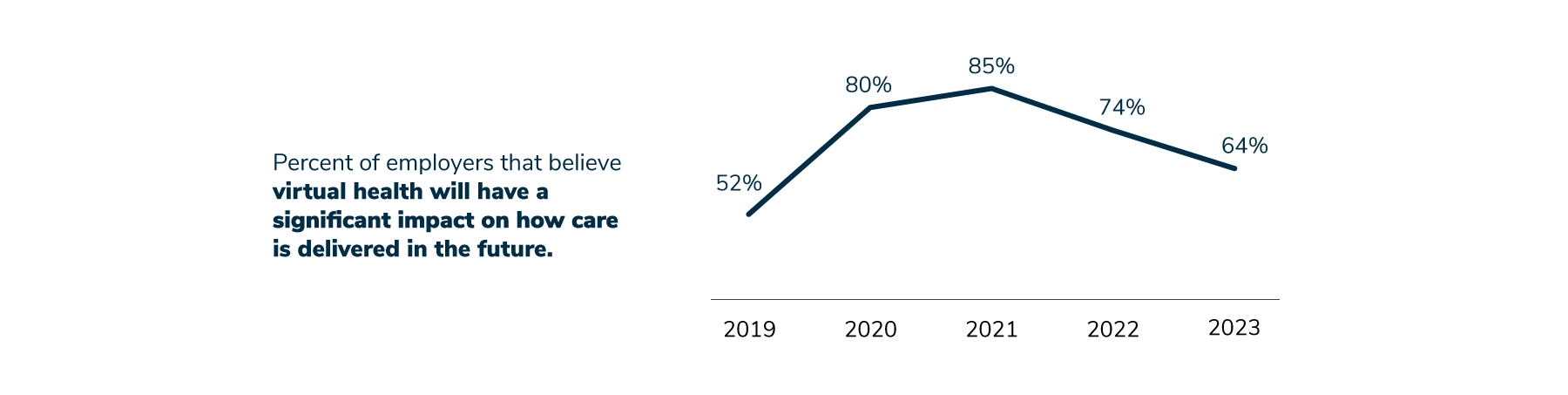

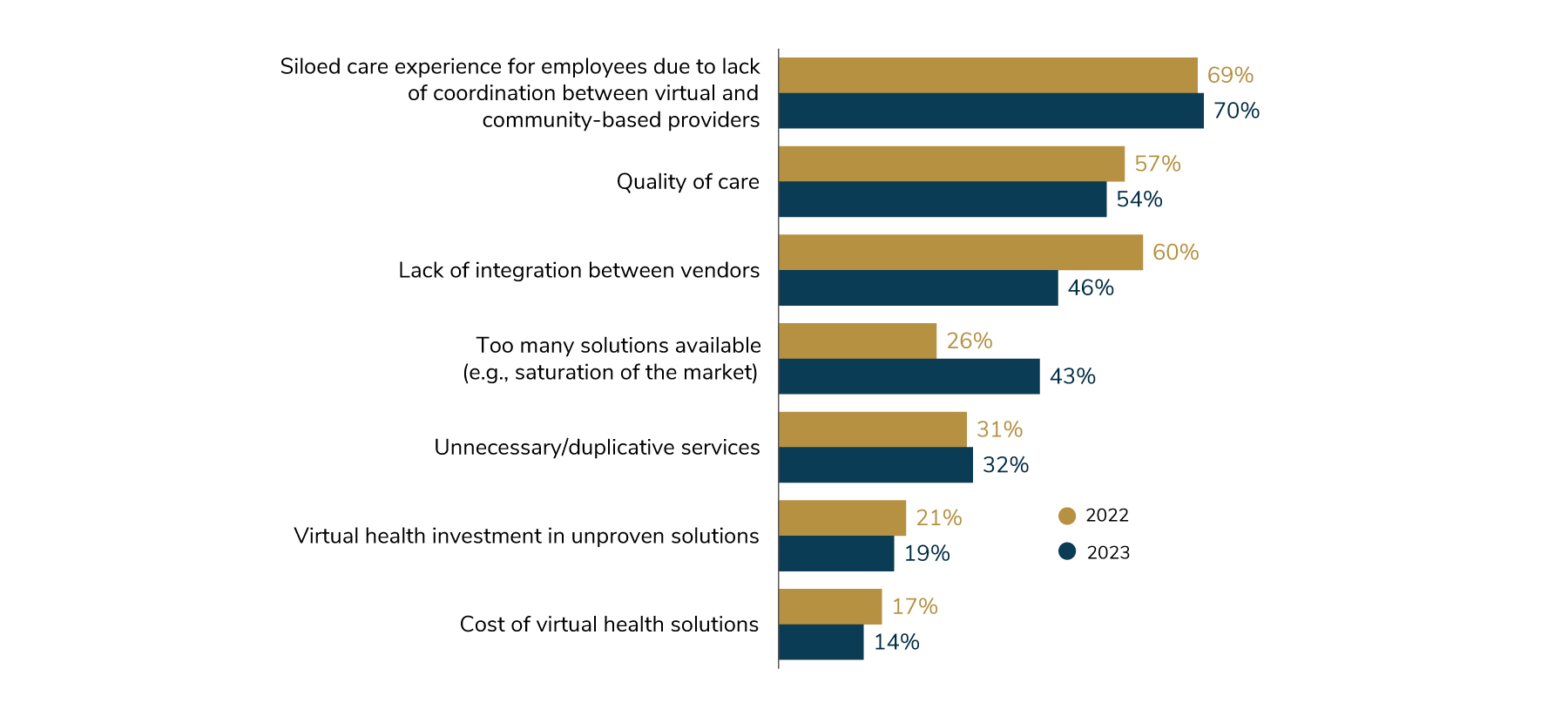

8 | Employers are moderating their expectations regarding how transformative virtual health is in terms of overall health care delivery.

Their changing views are due to concerns regarding whether or not all forms of virtual health result in positive impacts on outcomes, quality, cost, experience and integration. Employers are also concerned that there are too many virtual solutions, leading to market saturation, and too many choices for employees. This concern relates to finding #3 above, which reports that employers have indicated they will be assessing their vendor partnerships and seeking to streamline and consolidate them in the coming years.

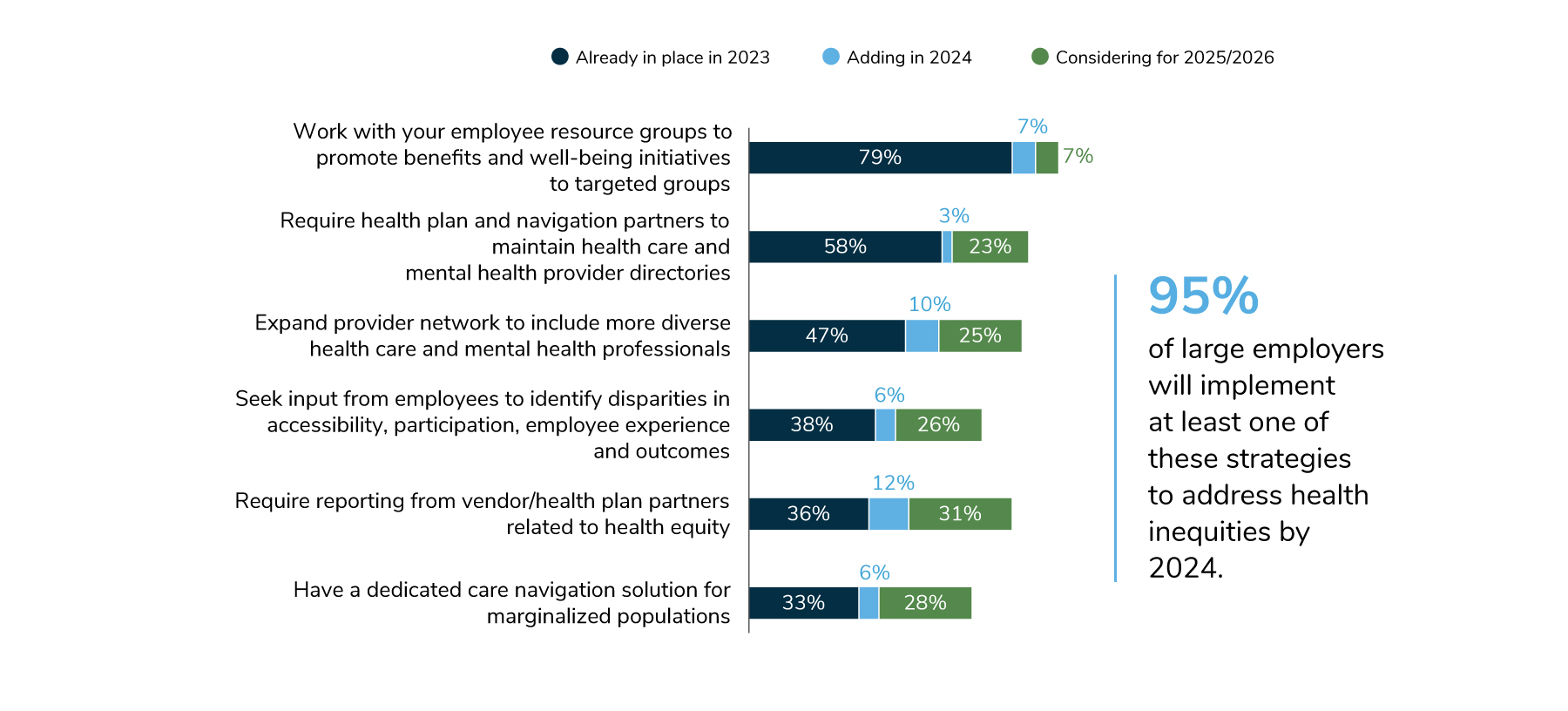

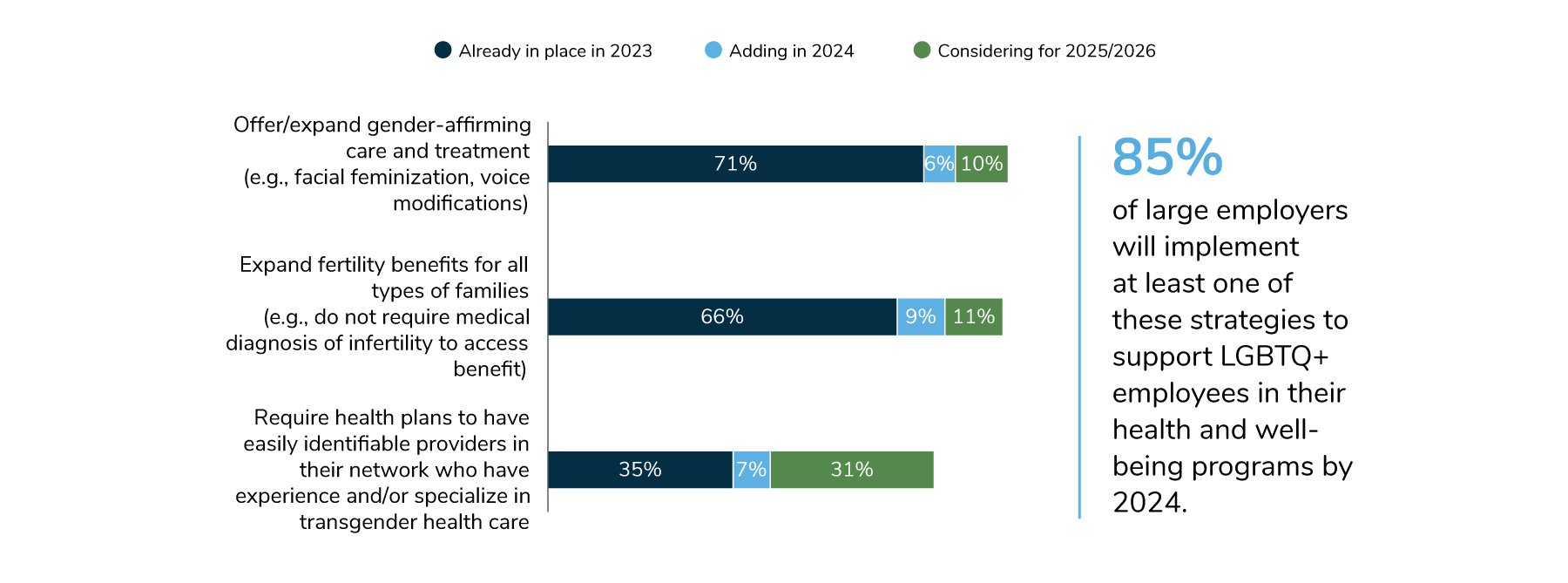

9 | Employers’ health equity approaches continue to evolve and expand, with a focus on serving specific communities and populations within the workforce.

In 2024, many employers (86%) will collaborate with employee resource groups (ERGs) to promote benefits and well-being initiatives to targeted groups, and 61% will require health plan and navigation partners to maintain directories of health care and mental health providers. To facilitate measurement, nearly half of employers will require vendors to report on health equity measures. Eighty-five percent of employers will implement at least one strategy to support the health and well-being needs of their LGBTQ+ employees; some are expanding fertility and family-forming benefits, while others are offering health plans with lower cost sharing to address affordability concerns. In total, 95% of employers will implement at least one strategy to address health inequities by 2024.

You can download the full Executive Summary by clicking the download button below.

2024 Large Employer Health Care Strategy Survey: Executive Summary

-

Introduction2024 Large Employer Health Care Strategy Survey

-

Full Report2024 Large Employer Health Care Strategy Survey: Full Report

-

Executive Summary2024 Large Employer Health Care Strategy Survey: Executive Summary

-

Part 1Part 1: Employer Perspectives

-

Part 2Part 2: Health Care Delivery

-

Part 3Part 3: Health and Pharmacy Plan Design

-

Part 4Part 4: Health Care Costs and 2024 Initiatives

-

Chart Pack2024 Large Employer Health Care Strategy Survey: Chart Pack