August 25, 2021

Looking for the latest data?

Check out our 2024 Large Employer Health Care Strategy Survey, released in August 2023.

Key Takeaways

- Fifty-eight percent of large employers will deploy an advanced primary care model in 2022. Virtual primary care is garnering the most interest.

- Access is the top mental health priority for employers, followed by stigma. Tremendous growth is expected in providing low- to no-cost telemental health in the next 2-3 years.

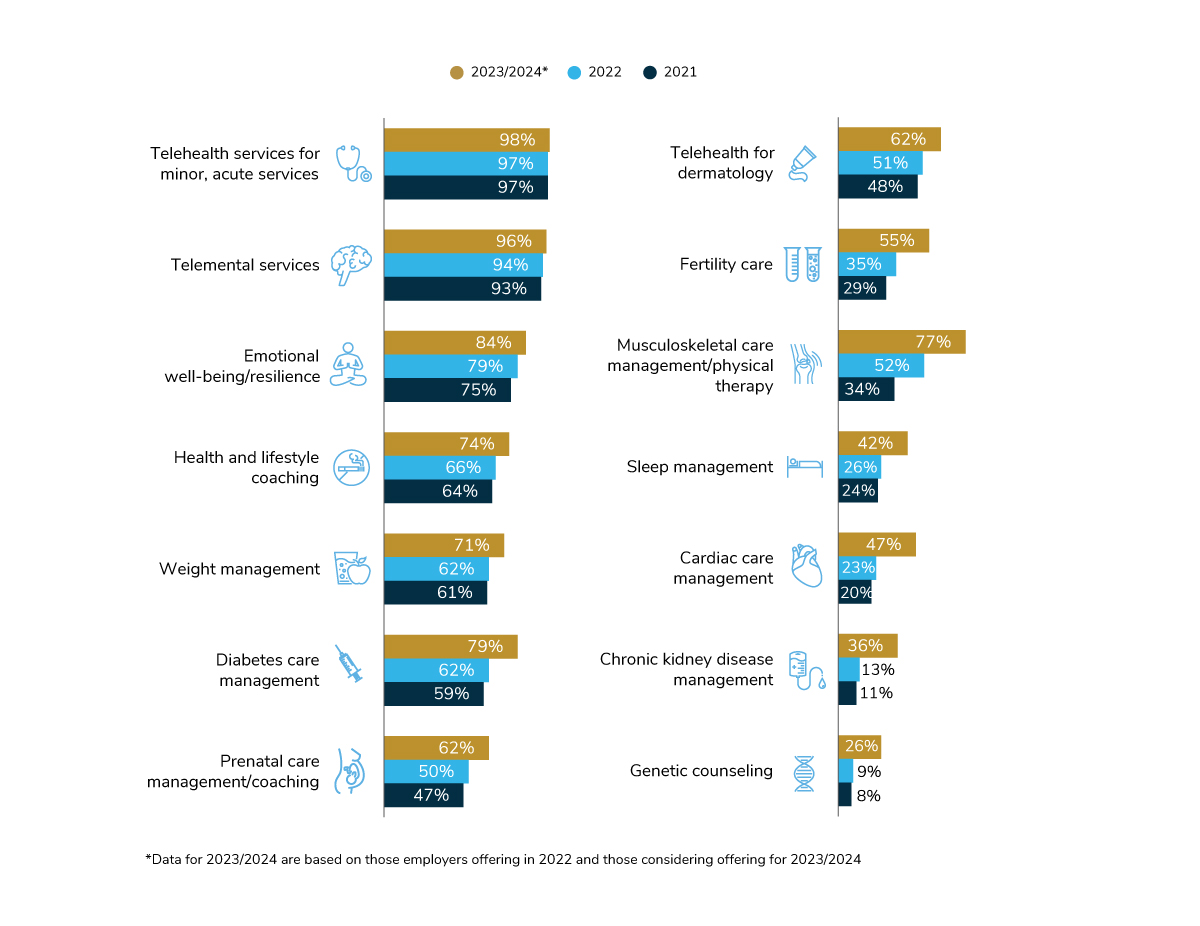

- Telehealth and telemental health will be offered by nearly all employers in 2022. Virtual health for specific conditions (musculoskeletal, diabetes, sleep, cardiovascular) is expected to see double-digit growth.

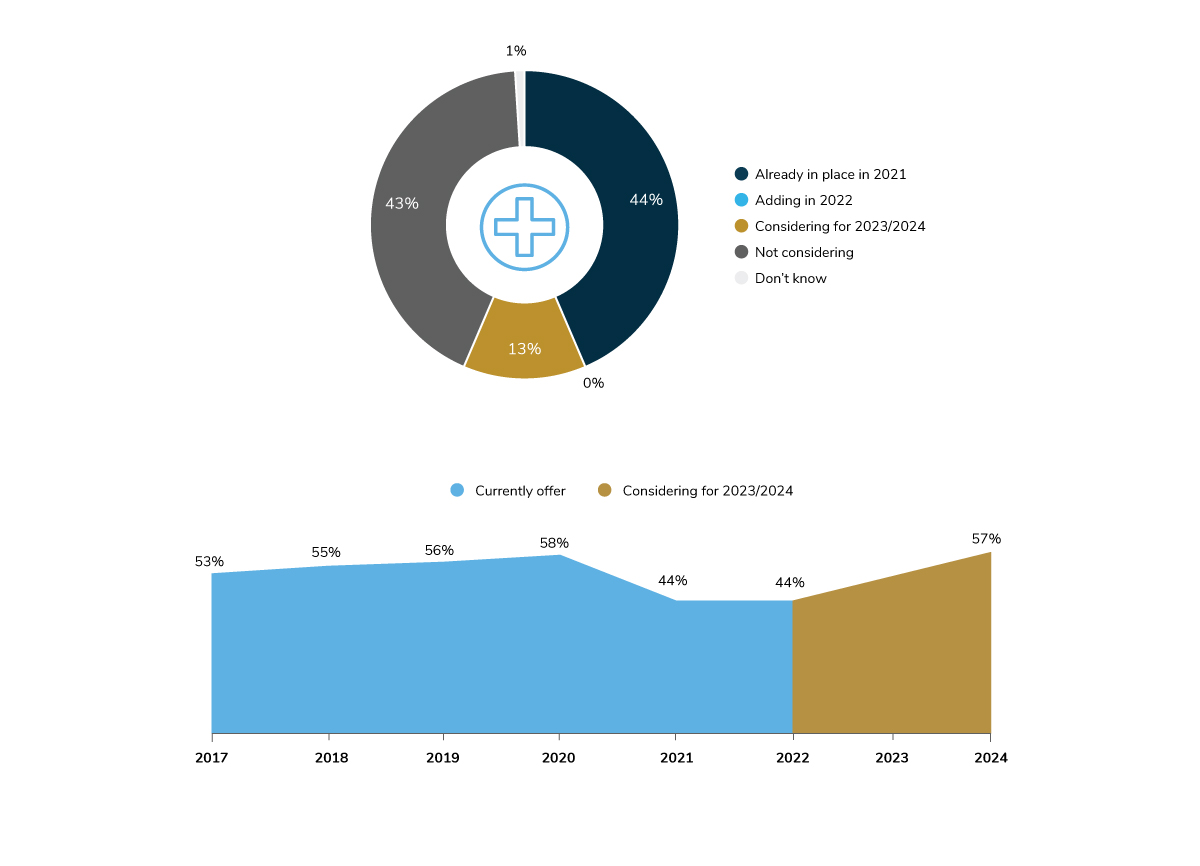

- In 2022, on-site clinic availability will continue at the lower rates seen in 2021. However, it is expected that clinics will return to pre-pandemic rates by 2024.

Advancing Primary Care

Employers continue to assess the primary care experience for their employees. By implementing advanced primary care models, such as virtual-first primary care and patient-centered medical homes, employers can begin to move away from fee-for-service, encounter-based reimbursement to more risk- and value-based reimbursement and provider payment methods.

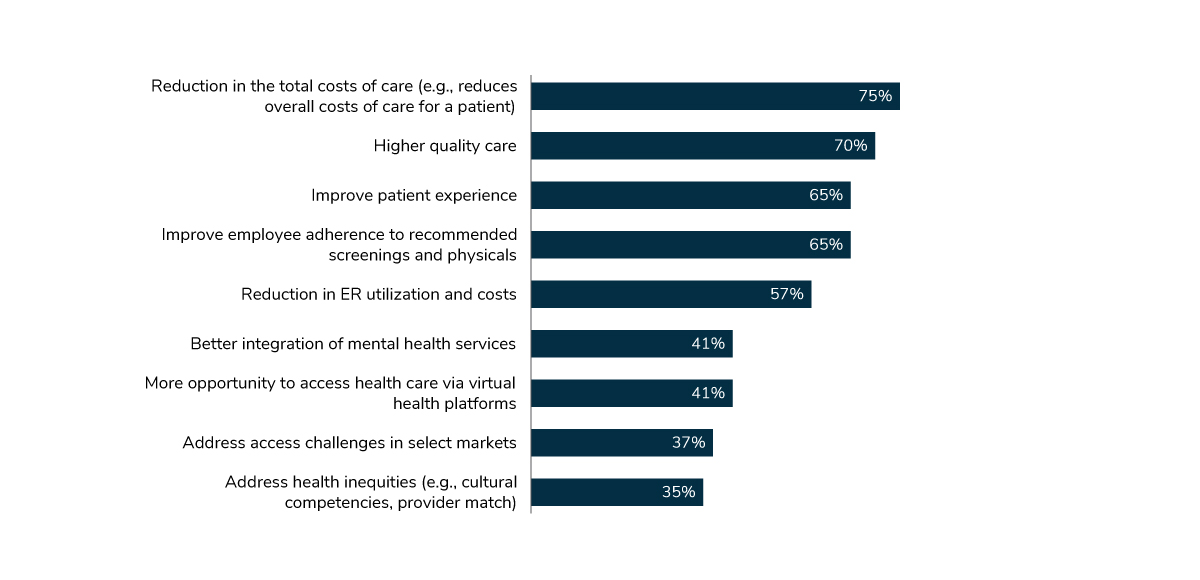

The top objectives for advanced primary care are to 1) reduce overall health care costs; 2) provide higher quality care; and 3) improve the patient experience and adherence to screenings and physicals (Figure 3.1). While traditional primary care delivery approaches may also strive for these goals, employers are seeking arrangements that promote better outcomes and a payment scheme that rewards quality, not quantity.

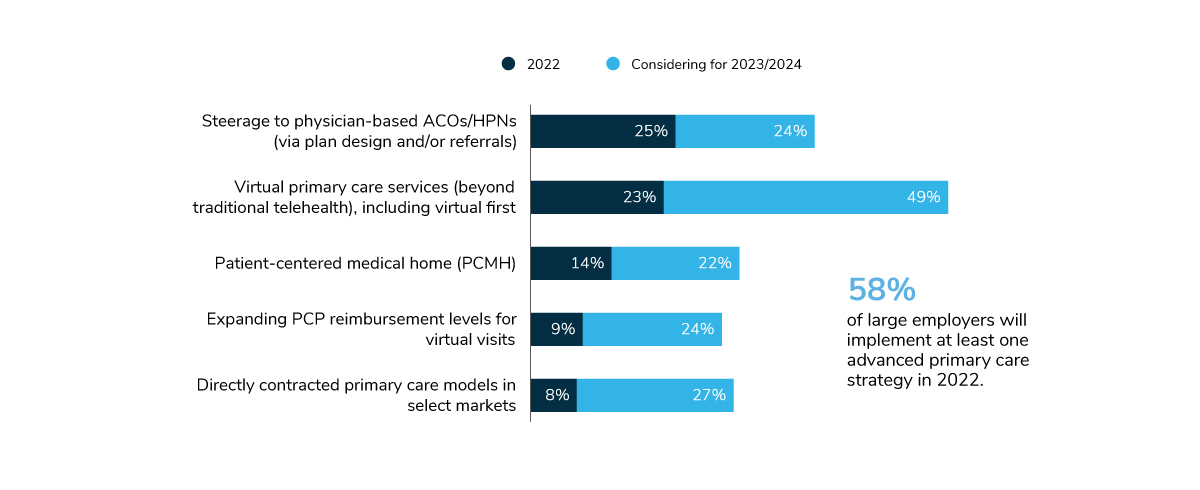

In 2022, 58% of large employers will have at least one advanced primary care strategy in place, up from 51% in 2021 (Figure 3.2). While the rise in prevalence between 2021 and 2022 is negligible, these tactics will take off in 2023 and 2024. For example, 72% of employers are expected to have virtual primary care in place in the next 2-3 years, and 49% plan to steer employees to primary care ACOs/HPNs as well. This tremendous growth on the horizon signals that many employers have big post-pandemic plans to change how primary care is delivered to employees.

Mental Health Culture, Access and Benefit Design

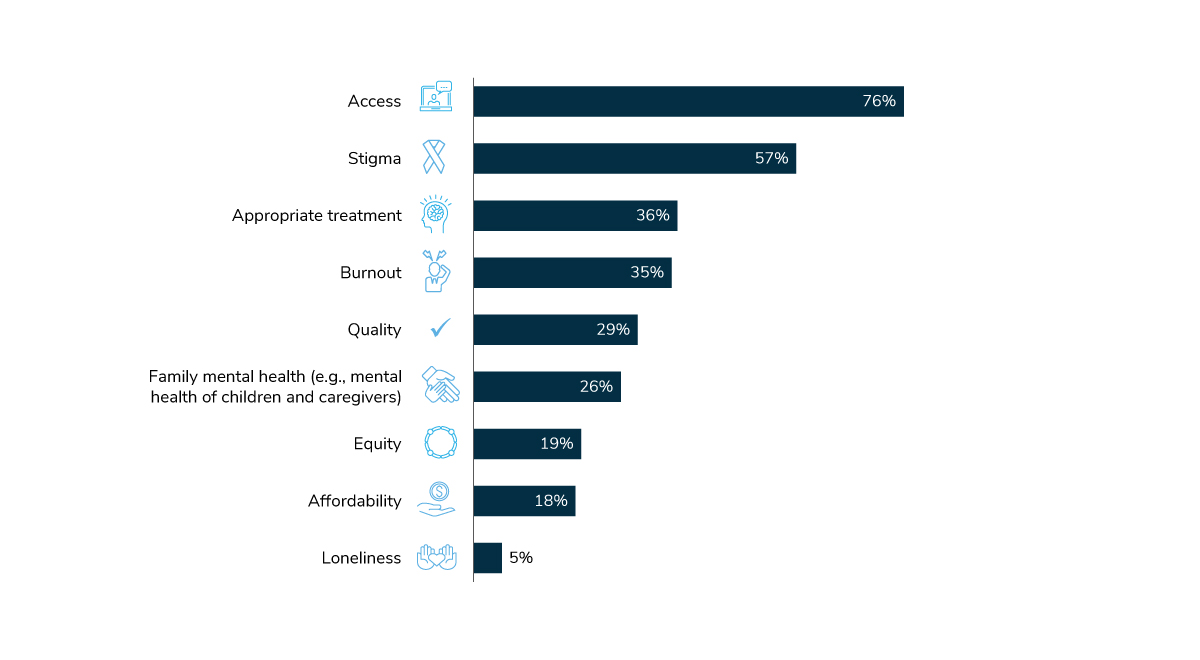

In 2021, employers maintained a swift pace in providing mental health and emotional well-being benefits. A priority for employers is to expand access to mental health services; it’s the top priority area for large employers next year (Figure 3.3).

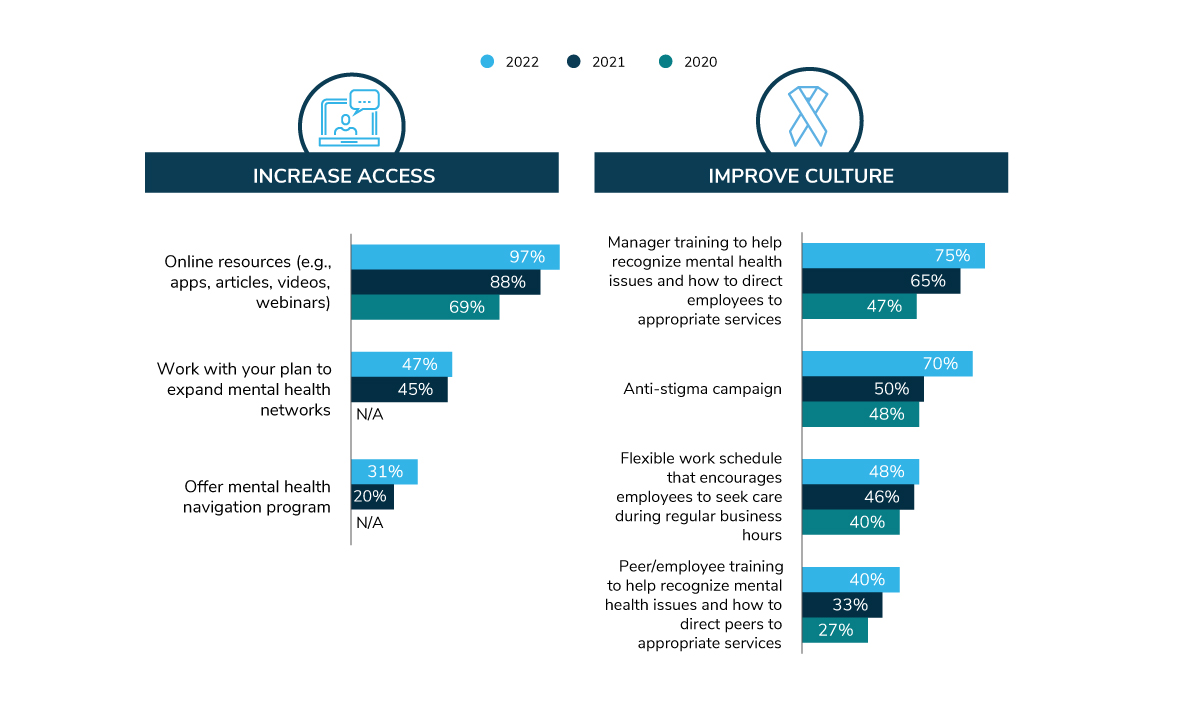

Increasingly, employers have focused on reducing the stigma associated with having a mental health condition and/or seeking professional help with struggles like burnout, stress and other emotional well-being issues. The COVID-19 pandemic accelerated progress in reducing stigma – by laying bare challenges all employees were facing and notably shifting to more open discussions about mental health. In fact, 2022 will be the first time that a majority of employers have an anti-stigma campaign (Figure 3.4).

Employers are providing access to mental health and emotional well-being benefits in a number of ways. Most commonly, employers are curating online resources like apps, articles, videos and webinars—something nearly all employers will do in 2022. Covered in the Virtual Health section, telemental health is offered by 93% of employers, which can bridge access gaps for employees having difficulty finding providers within their communities or close to work. Expanding mental health networks is on the plate of 47% of employers for next year. Finally, 31% will offer a mental health navigation program to help employees find providers, reflecting an 11-point increase from 2021.

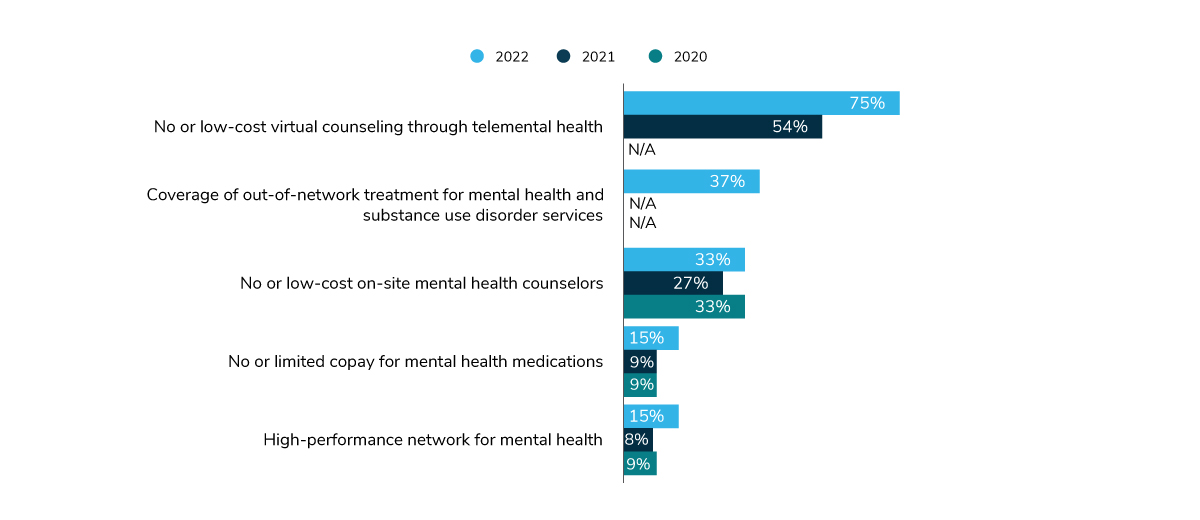

For many employees, a key component of accessible care is affordability and convenience. Employers are lowering the costs of different mental health services across a variety of areas – telemental health, out-of-network providers, on-site clinics and high-performance networks and even at the pharmacy. As Figure 3.5 depicts, employers are looking to telemental health as the prominent way of providing affordable and convenient mental health care to employees, with 3 in 4 employers doing so in 2022.

Virtual Health: Telehealth and Digital Solutions

As mentioned in Part I, 76% of employers accelerated telehealth and virtual health offerings as a result of the pandemic – and plan to keep these offerings over the long term. Multiple years of data confirm that telehealth and telemental health services have officially joined the ranks of benefits that nearly all employers offer – perhaps as common as access to benefits like health insurance and employee assistance programs (EAPs).

Figure 3.6 shows that some virtual health offerings hold potential for further growth, particularly those focused on chronic conditions. As observed in years past, musculoskeletal care management/physical therapy virtual care is expected to see the most growth of any condition-focused offering, increasing from 34% in 2021 to 77% in 2023/2024. However, cardiac care delivered virtually is expected to double in large employer offerings in just 2 years, signaling that companies are looking to expand their suite of virtual condition management tools beyond musculoskeletal or diabetes. Genetic counseling and kidney disease management are also expected to increase in prevalence between 2022 and 2024.

Focus on Telehealth

As seen in Figure 3.6, 97% of large employers offer telehealth to employees (for purposes of this survey, telehealth is defined as access to a remote telehealth provider through a standalone solution or as part of a health plan offering).

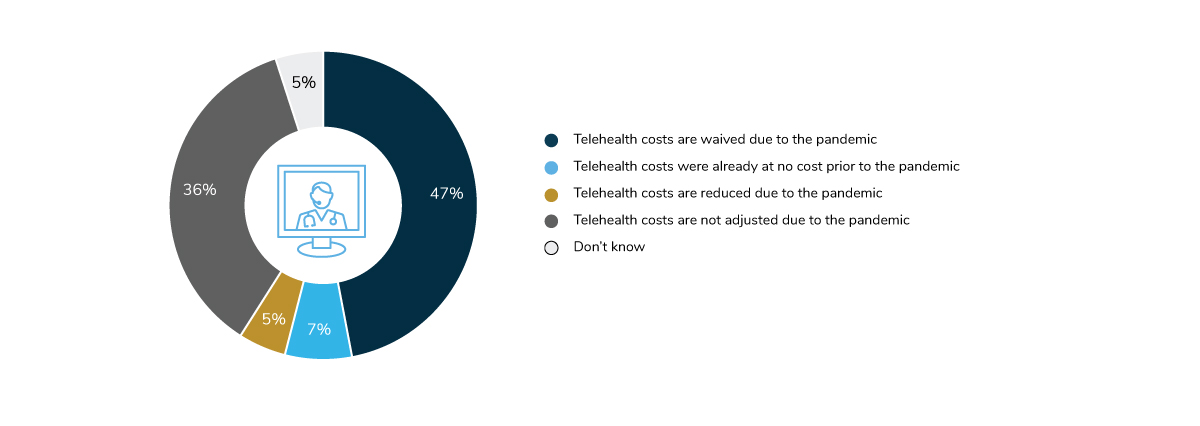

The COVID-19 pandemic nudged employees toward telehealth by highlighting its accessibility, convenience, and for some, a way to get care at a lower out-of-pocket cost. A majority of employers (59%) waived or reduced telehealth cost in 2021, representing an 18-point decline from the year prior (Figure 3.7).

On-site Services: The Post-Pandemic Future

On-site clinics continue to play a pivotal role in employers’ COVID-19 strategy and within employee health and well-being as a whole. However, this is another area of the survey where growth is closely connected to the state of the pandemic. For example, on-site clinics can provide medical services to support screenings, testing and vaccinations in preparation for the reopening of worksites.

In 2021, 44% of surveyed employers had one or more on-site/near-site health/well-being clinics. This number is down from 58% in 2020. One explanation for this decline is that some employers either temporarily or permanently closed their clinics, and many are waiting until after the pandemic to resume or expand offerings. It will take another 2 years for on-site offerings to rebound back to pre-pandemic levels, as shown in Figure 3.8.

On-Site Clinic Offerings: COVID-19 Response and Expansion

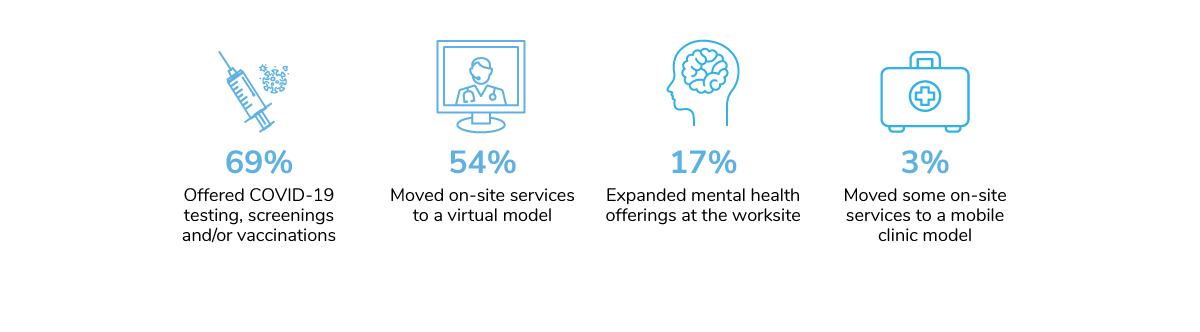

For those locations that remained open, on-site clinic staff were the frontline workers at the worksite, taking part in company efforts to protect employees from COVID-19. Of those with clinics operational during the pandemic, 69% pivoted to perform testing, screenings and/or vaccinations. Fifty-four percent of employers transitioned some of their on-site services to a virtual model, with 17% expanding mental health offerings at worksite clinics (Figure 3.9).

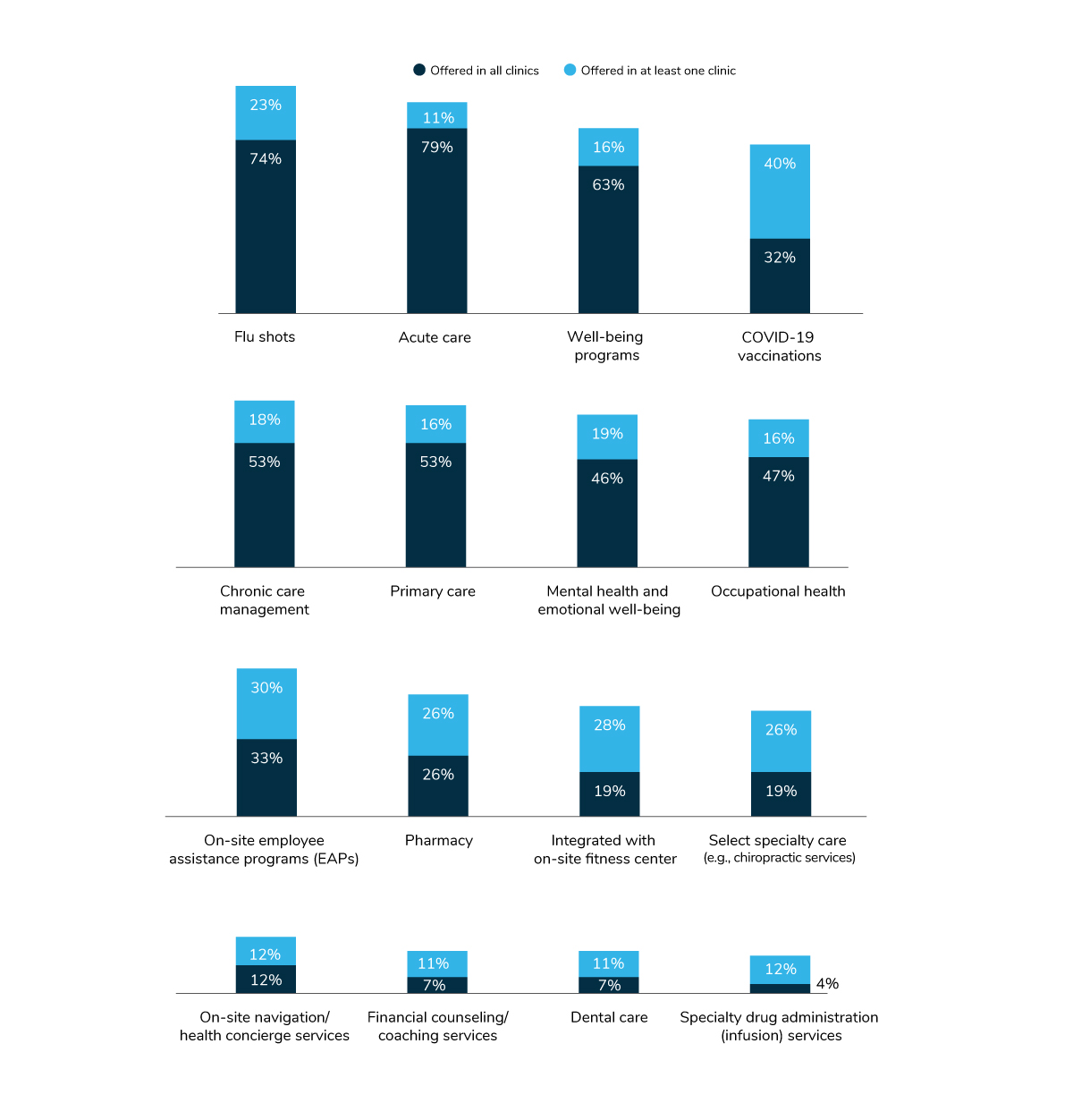

In cataloging all the different services an employer offers on-site (Figure 3.10), mainstays like flu shots and acute care are the most common. Interestingly, 72% of employers with on-site medical clinics have already provided or will provide COVID-19 vaccinations. Other common services include well-being programs (79%), chronic care management (71%) and primary care (69%).

Payment and Delivery Reform: COEs, ACOs and HPNs

As reported on in Part I, a small portion of employers momentarily paused delivery reform efforts in 2021 due to the pandemic. The rate of implementation has been impacted and overshadowed by employer prioritization of critical emerging issues brought on by the pandemic. Furthermore, the pandemic has underscored and magnified foundational flaws with the status quo, which is expected to ramp up efforts to bring about delivery reform. In fact, 13% actually accelerated their movements to centers of excellence (COEs), accountable care organizations (ACOs) and high-performance networks (HPNs), which is reflected in some of the following data.

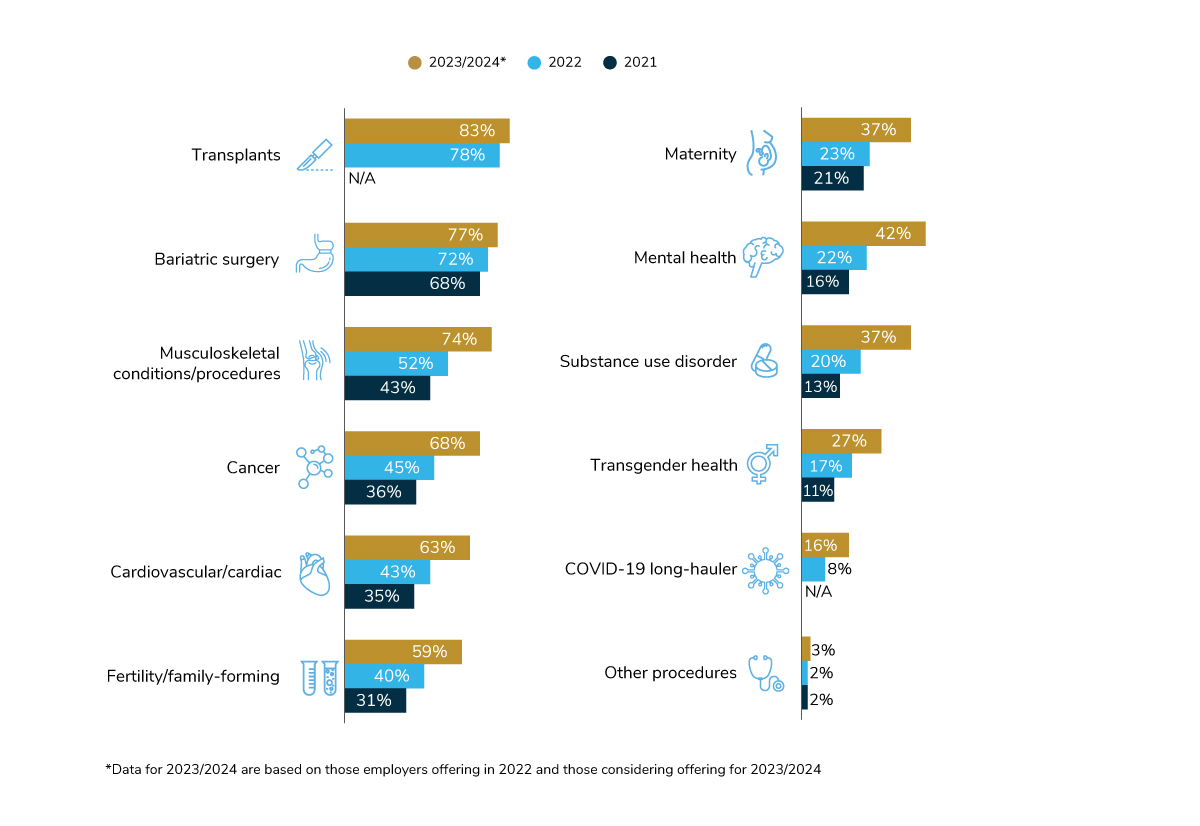

Centers of Excellence

COEs are groups of providers who are selected to perform certain specialized services because of their expertise, outcomes and favorable financial arrangements. Of the 11 conditions for which employers may create a COE arrangement (Figure 3.11), each one is expected to grow in prevalence. In 2022, the most common types of COEs are those focused on transplants (78%), bariatric surgery (72%) and musculoskeletal conditions/procedures (52%). Looking ahead to 2023/2024, the areas that may experience the biggest growth are musculoskeletal (+22 percentage points) cancer (+23 percentage points), cardiovascular care (+20 percentage points) and mental health (+20 percentage points). While not as common, some employers are looking to create a COE for COVID-19 long-hauler patients – 8% in 2022 and 16% in 2023/2024.

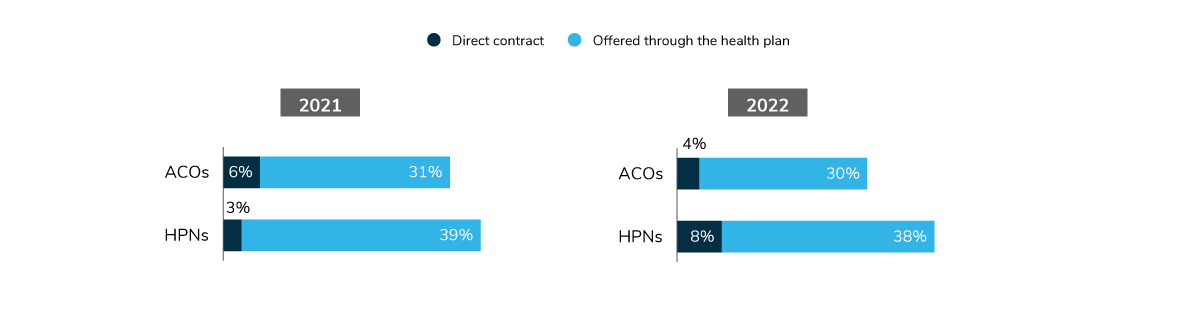

Accountable Care Organizations and High-Performance Networks

ACO and HPN offerings have stayed relatively steady between 2021 and 2022. Thirty-four percent of employers will have an ACO in 2022, either as part of their health plan or directly contracted. High-performance networks are more common, with 46% of employers offering an HPN. As seen in Figure 3.12, there is a slight uptick in employers directly contracting with an HPN in 2022.

Accountable Care Organizations (ACOs)

Health care providers who come together in a value-based delivery model that ultimately accepts responsibility for the quality and cost of care for a defined population.

High-performance Networks (HPNs)

Typically includes smaller provider networks that encourage enrollees to select providers deemed higher performing based on efficiency, quality and other measures.

-

Introduction2022 Large Employers’ Health Care Strategy and Plan Design Survey

-

Full Report2022 Health Care Strategy and Plan Design Survey: Full Report

-

Executive Summary2022 Health Care Strategy and Plan Design Survey: Executive Summary

-

Chart Pack2022 Health Care Strategy and Plan Design Survey: Chart Pack

-

Infographic2022 Health Care Strategy and Plan Design Survey: Infographic

-

Part 1Employer Perspectives on the Health Care Landscape

-

Part 2Health Equity Within Health and Well-being Initiatives

-

Part 3Employers and the Health Care Delivery System

-

Part 4Health and Pharmacy Plan Design

-

Part 5Health Care Costs and 2022 Priorities

More Topics

Data Insights

This content is for members only. Already a member?

Login

![]()