August 25, 2021

Looking for the latest data?

Check out our 2024 Large Employer Health Care Strategy Survey, released in August 2023.

Key Takeaways

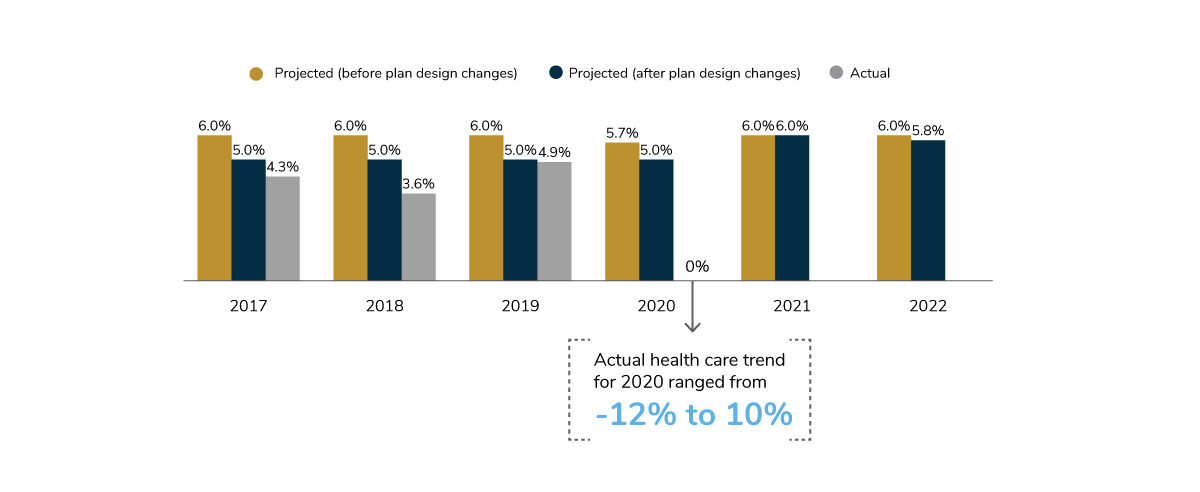

- Health care trend for 2020 came in at 0% and is projected to rise by 6% in 2021. Projected trend for 2022 is 5.8% after plan design changes are made.

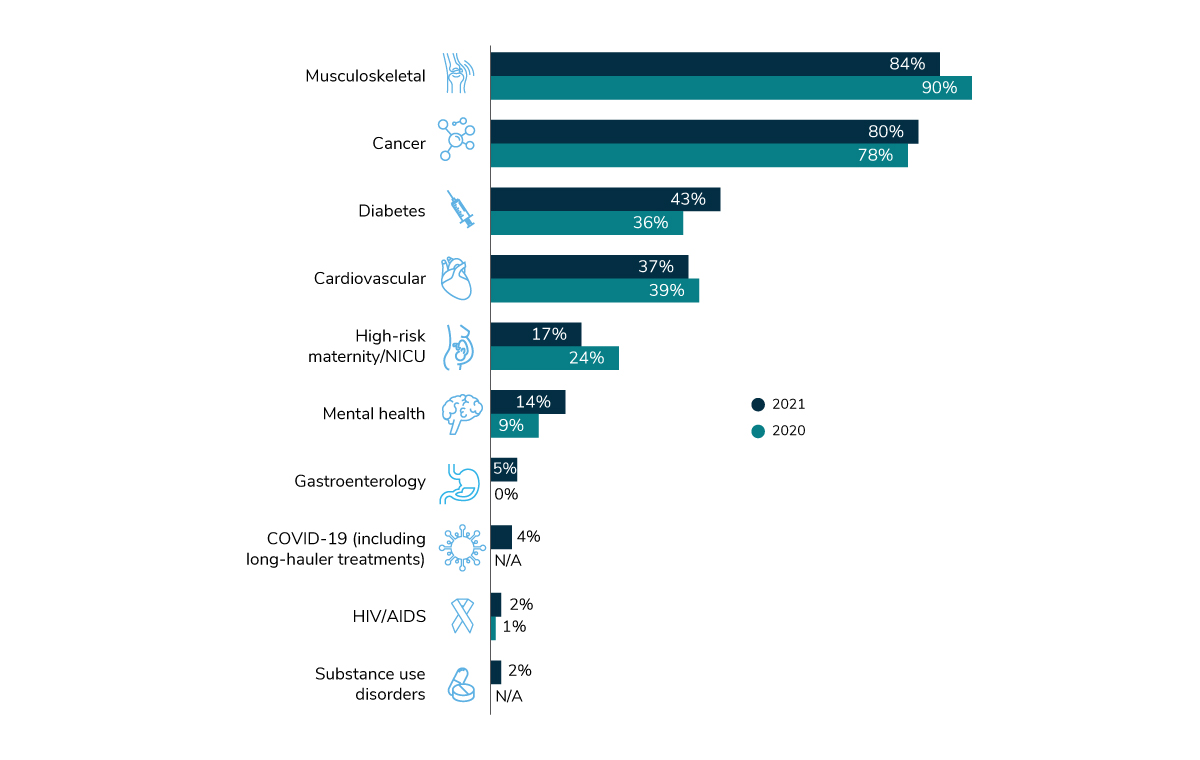

- Employers continue to cite musculoskeletal conditions and cancer as their top two cost drivers. Although cardiovascular conditions have typically taken the third slot, followed by diabetes, they swapped places in 2021. Forty-three percent of respondents selected diabetes, and 37% chose cardiovascular conditions.

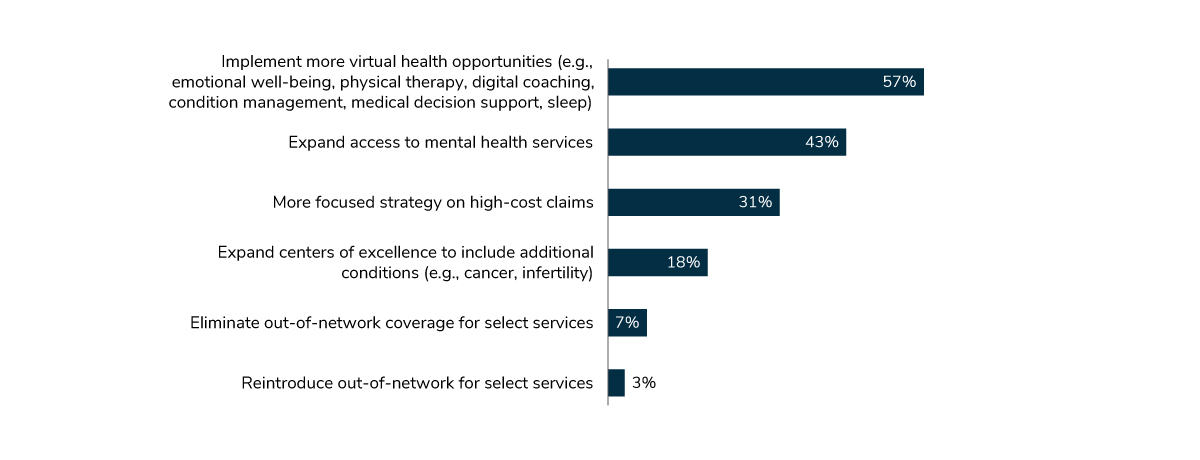

- Employers’ top priorities for 2022 include expanding their virtual solutions, increasing access to mental health services and developing a more focused strategy on high-cost claims.

In many ways, 2021 has turned out to be a transitional year. In 2020, actual health care trend ranged from -12% to 10%, with the median at 0%. Health care costs in 2021 are expected to increase somewhat for both employers and employees. In 2022, the trend is expected to decline slightly, to 5.8%.

The top cost drivers for 2021 mirror those for 2020, with musculoskeletal conditions and cancer taking the top two spots. In previous years, cardiovascular disease was third in line, followed by diabetes, but in 2021, the order flipped. Diabetes has become a more expensive condition to manage than heart disease. COVID-19 was not identified as a top cost driver either year.

Employers’ health care priorities for 2022 are similar to those for 2021. Across both years, employers are expanding virtual health opportunities, increasing access to mental health services and developing a more focused strategy for high-cost claims. Throughout the survey, employers reiterated their commitment to virtual health and mental health services.

Health Care Trends for 2020 and 2021

The health care trend in 2020 was 0%, with many employers experiencing a negative trend, dropping to as low as -12%, in some instances due to deferred and delayed care. Many employers, however, predicted that costs would rebound in 2021 once routine care visits and preventive screening resumed. The projections for 2021 confirm this prediction, with health care trend expected to increase to 6% both before and after plan design changes are made. In 2022, cost trend is expected to decline slightly, dropping from 6% to 5.8% after plan design changes are made (Figure 5.1).

Employer and Employee Contributions for Health Care Continue to Rise

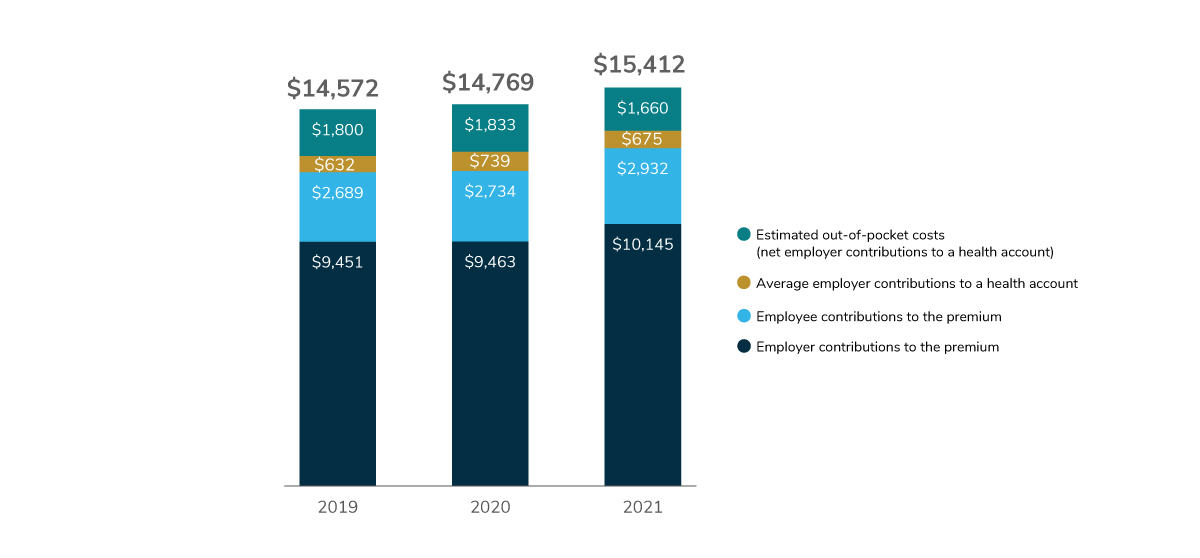

The cost of health care for both employers and employees has been steadily rising. In 2019, health insurance premiums were $12,140, with employers contributing $9,451 and employees contributing $2,689. In 2020, the premiums rose to $12,197, with the employer share increasing by $12 and the employee share rising by $45.

As expected, total per capita costs (premiums + employer contributions to health accounts + employee out-of-pocket costs) are projected to rise more. In 2020, the average total health care costs came to $14,769. For 2021, they are estimated to increase to $15,412 (Figure 5.2).

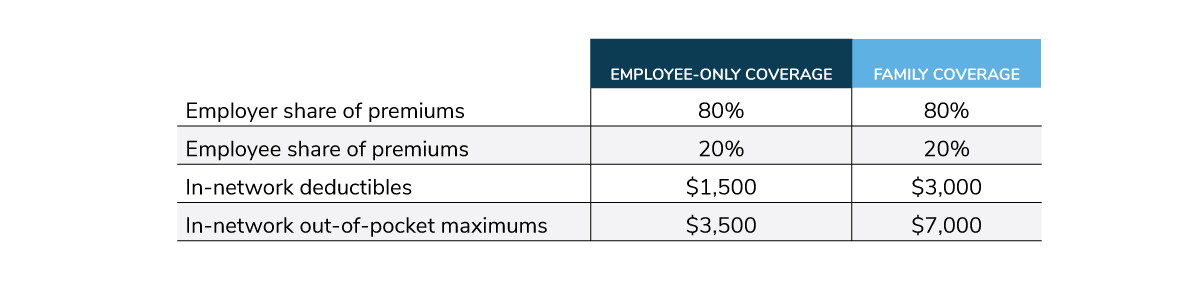

The breakdown of cost share between employers and employees (employee-only and family coverage) for the employers’ plan type with the highest enrollment is shown in Table 5.1. Also included are in-network deductibles and in-network out-of-pocket maximums.

Conditions Impacting Cost

The impact of different conditions on cost has changed little over the past few years. Musculoskeletal conditions continue to be the top cost driver, with 84% of the respondents ranking it first. This is a slight decline from 2020, when 90% of employers designated musculoskeletal conditions as their top choice. Cancer came in second, with 80% of respondents making this choice, a slight increase from 2020 (78%). These numbers mirrored those from previous years despite the fact that COVID-19 was on the list.

The biggest change in conditions selected came with the third and fourth choices. Whereas in previous years, cardiovascular disease came in third, followed by diabetes, this year they traded spots. Forty-three percent of employers selected diabetes, a 7-point increase from 2020. Thirty-seven percent selected cardiovascular disease, a 2-point drop from last year (Figure 5.3).

Large Employers' Top Priorities for 2022

Looking ahead to 2022, employers are continuing to focus on expanding virtual solutions, increasing access to mental health services and developing a more focused strategy on high-cost claims.

While virtual and mental health have emerged in recent years as priorities, there’s no doubt that COVID-19 has further fueled the prioritization of solutions in these two areas. Employers’ interest in high-cost claims reflects concern regarding chronic disease burden, high-cost procedures and high-cost medications (Figure 5.4).

-

Introduction2022 Large Employers’ Health Care Strategy and Plan Design Survey

-

Full Report2022 Health Care Strategy and Plan Design Survey: Full Report

-

Executive Summary2022 Health Care Strategy and Plan Design Survey: Executive Summary

-

Chart Pack2022 Health Care Strategy and Plan Design Survey: Chart Pack

-

Infographic2022 Health Care Strategy and Plan Design Survey: Infographic

-

Part 1Employer Perspectives on the Health Care Landscape

-

Part 2Health Equity Within Health and Well-being Initiatives

-

Part 3Employers and the Health Care Delivery System

-

Part 4Health and Pharmacy Plan Design

-

Part 5Health Care Costs and 2022 Priorities

More Topics

Data Insights

This content is for members only. Already a member?

Login

![]()