April 21, 2022

The purpose of structure in global benefits governance is to understand clearly who is responsible for what and to develop a transparent process to mitigate risk while implementing the employer’s strategy. For many companies, global benefits governance evolved from ensuring that their retirement plans were meeting legal and fiduciary requirements to adding a wider collection of benefits to their overall governance strategy. As companies expanded their governance to include other benefits (typically risk and medical), the structure has also expanded to include a Center of Excellence (COE) and/or regional lead model.

When developing global governance, it is important for a company to examine how their international benefits function is structured, how this aligns with country-specific realities and whether this structure fits in with the overall company culture.

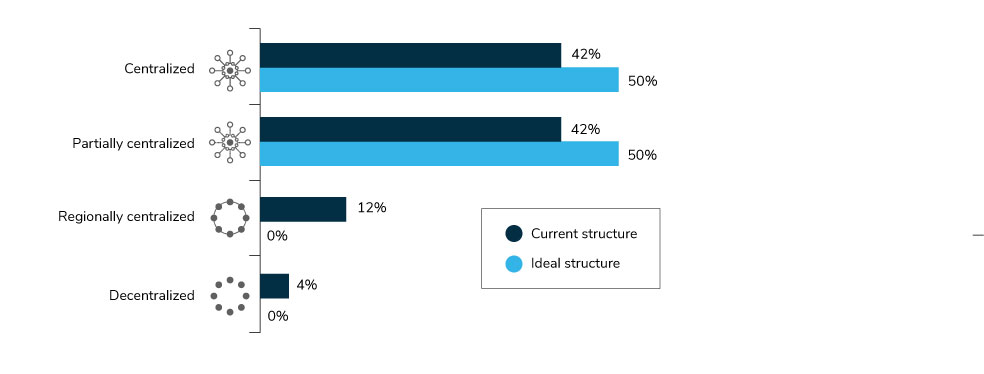

Companies may opt for one following four classifications:

Centralized: All decisions regarding plan design, vendor selection and budget must be approved by corporate prior to implementation.

Partially centralized: Some decisions on plan design, vendor selection and budget are reported to or approved by corporate based on established dollar limits or other agreed upon thresholds.

Regionally centralized: Decisions on plan design, vendor selection and budget are made regionally but not necessarily reported to or approved by corporate.

Decentralized: Decisions on plan design, vendor selection and budget are made locally with minimal or no input/approval from corporate.

In a 2021 survey conducted by Business Group on Health, most responding companies identified their governance structure as either centralized or partially centralized. This was the fourth survey in 14 years showing a large shift away from a decentralized approach to governance. Figure 1 compares global employers’ current governance structure versus their ideal state:

Source: Global Benefits Governance Survey 2021

Roles and Responsibilities

As part of the governance process, companies should outline roles and responsibilities at the corporate, regional and local levels across the benefits spectrum.

Key governance components include:

| Strategy | Administration | Approval Process | Mergers, Acquisitions and Divestiture Activities | Global Consistency Strategy Integration |

For example, global COE colleagues are typically in a strategic role, tasked with developing benefit design and supporting local efforts, while local colleagues typically oversee day-to-day administration and line of sight to the local business and culture. These two groups work closely together in the governance process via annual renewal (or other cadence established by the organization).

What Structure Makes the Most Sense Varies by Company

Employers should ask the following questions as they evaluate their governance structure:

Global Broker

If a company has a global broker relationship, the broker partner often replicates the company’s own hierarchy to ensure an effective relationship and strengthen their governance structure and process.

- Is the company structured in the same way for all its functions? For example, if it is centralized in the area of international benefits, is finance similarly structured? Do these similar (or different) structures in various divisions of the company create challenges or is the company structurally cohesive?

- What are the current lines of decision-making and accountability in global benefits and in other relevant units of the company? What works? What would benefit from change and why?

- Is there a policy that articulates the roles and responsibilities of the individual stakeholders involved in the governance process?

- Are there any stakeholders whose views and perspectives have been overlooked thus far but who should contribute to the conversation about governance?

- What opportunities exist to build or reaffirm relationships with key stakeholders in the governance process?

Global Consistency Strategy Integration

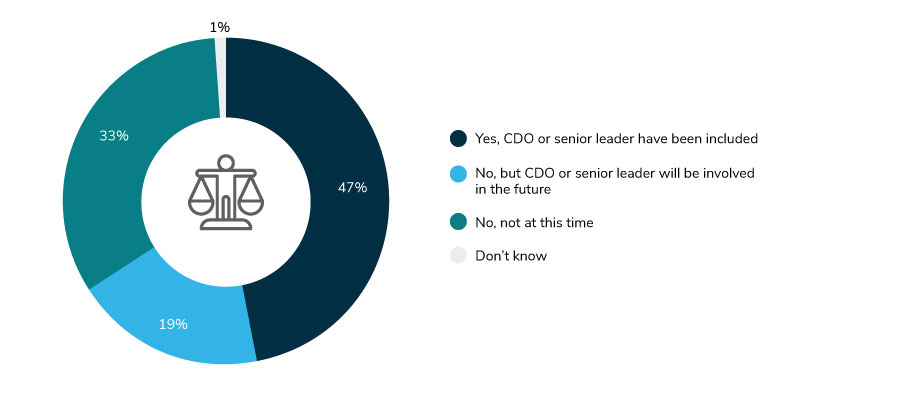

In building their global consistency strategy, companies may consider incorporating other departments to foster a robust governance process. More companies are bringing their diversity, equity and inclusion (DEI) partners (e.g., chief diversity officer [CDO]) to the table to ensure inclusivity in design (Figure 2). It may make sense to coordinate with risk management on whether a captive makes sense as companies go through the renewal process. The renewal process can help provide the data on what financing mechanisms work best for each company as well as the space for reviewing benefits with an equitable lens.

Employers have transitioned from a decentralized governance structure to a more centralized one. This evolution of overall structure and ensuring that governance is in alignment with the structure in place helps companies meet their challenges in a constantly evolving workplace. Being strategic, inclusive and transparent about roles and responsibilities for internal and external stakeholders allows the governance process to run efficiently.

Source: Equity, Diversity and Inclusion in Employer-Sponsored Health and Well-being Initiatives Survey 2021

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()