September 28, 2023

Pharmaceutical spending in the U.S. alone now exceeds $600 billion annually, 50% or more of which comes from specialty drugs.1 This is in part due to the rise of very high-cost gene and cell therapies, with newly U.S. Food & Drug Administration (FDA)-approved treatments listing for more than $3 million dollars per treatment, and more such drugs in the FDA’s robust pipeline. In 2022, pharmaceuticals accounted for 24% of self-insured employers health care spending.2-3

Given the rising costs of newer specialty medications and gene therapies, employers would be wise to consider strategies to increase the value of high-cost drugs to best improve health and well-being and to mitigate cost increases to the plan and individual.

Defining 'Value' in Pharmaceutical Spending

The Business Group’s Value-based Purchasing Employer Guide defines value broadly as equaling quality, outcomes and patient experience divided by cost.

The focus of this resource is on the value that accrues to large employers and their plan members. When health care quality, health outcomes and patient experience improve, patients and their employers benefit. When people are healthier, costs tend to come down, and patients and their employers benefit. For other stakeholders, cost reduction can mean less revenue, which presents a challenge to gaining multistakeholder buy-in to new ways of contracting for value.

What Are Specialty Pharmaceuticals?

Specialty drugs are in many ways more complex than their “normal molecule” counterparts. The conditions they treat are often more challenging and include cancer, hemophilia and multiple sclerosis. The way that they are administered is more involved as well. Many are delivered via infusion supervised by clinical experts, sometimes in centers of excellence (COEs). Generally, specialty pharmaceuticals present complexity to employers and their workforce because they are often very expensive, requiring careful consideration of strategies to maintain affordability and ensure appropriate prescribing to create the best outcomes for patients while mitigating adverse impacts on plan costs.

Industry Trends Highlighting the Challenges and Opportunities for Greater Value in Drug Purchasing

There are several trends that both create challenges and present opportunities for employers to drive greater value from the billions of dollars they collectively spend on pharmacy benefits.

Challenge: Increasing Costs of Specialty Pharmaceuticals

Specialty drugs account for 50% of overall drug spending, and there is little reason to anticipate that their growth in utilization and the share of pharmacy costs attributed to these medications will abate any time soon, largely because the number and price of these therapies continues to increase. A very small portion of the population accounts for this spend on specialty, meaning that even relatively minor increases in utilization can meaningfully drive up costs. Already, only 3% of plan members who have out-of-pocket (OOP) drug spending over $1,000 per year, mostly attributed to specialty drugs, drive close to 40% of overall drug spending.2

Increasingly, some specialty drugs have been approved to treat conditions with larger prevalence, such as GLP-1s being used as an obesity treatment. Cancer is another example. According to the Business Group’s annual employer survey, heading into 2024, one in two large employers report that cancer is their top cost driver, and an increasing share of oncology therapy cost comes from oral specialty pharmaceuticals.3 Over 90% of employer respondents said that patient and plan affordability of high-cost drugs in the pipeline was a top concern, and 53% cited plan affordability of gene and cell-based therapies.3

Challenge: The Increasing Prevalence of Extremely High-Cost Immunotherapies and Gene Therapies

A subset of specialty pharmaceuticals, including immunotherapies and gene therapies, cover small populations at extremely high costs. The number of these therapies coming to market with FDA-approval has jumped in the past several years. As of June 2023, 32 immunotherapies and gene therapies are FDA-approved, but the pipeline is accelerating to the point where these treatments will be increasingly more common:4,6

1,500+

Gene and cell therapies in pipeline5

10-20

Approved per year by 20256

$20B

Forecast for gene therapy market in 20267

Immunotherapies, used for certain cancers, harness the body’s immune system to fight off disease, while gene therapies modify or manipulate the expression of a gene to alter the properties of living cells to treat several, mostly rare conditions (e.g., muscular atrophy/dystrophy, hemophilia, lymphoma and multiple myeloma.) In many cases, these therapies are considered “miracle drugs” because they treat and/or cure conditions with little or no previous treatment options. That being said, they present distinct challenges for employers to manage given the rarity of the conditions they treat and very high one-time costs. Zolgensma (gene therapy for spinal muscular atrophy) and Kymriah (immunotherapy for acute lymphoblastic leukemia) are two well-known examples in these categories that were initially priced at $2.1 million and $475,000, respectively.

These therapies are often life-changing and lifesaving; the value to the patient getting the therapies is potentially massive. Unfortunately, the rising costs of newly approved immunotherapies and gene therapies have forced employers to reconsider how they provide affordable, predictable coverage for drugs.

Opportunity: Increased Engagement Between Employers and Health Plans Can Uncover Data and Strategies to Address the Management of Specialty Drugs Under Medical Plans

Much of the spend for specialty medications falls under the medical benefit because these therapies typically are administered intravenously or in a medical setting with expert clinical or physician supervision. This reduces employers’ line of sight to the scope and management of these drugs. Asking health plan partners for greater reporting on specialty drug utilization data is a first step toward building a comprehensive management strategy. Acquiring data about these therapies under the medical plan requires additional conversation and coordination with health plan partners to increase employers’ ability to support plan members in treatment and manage costs.

Affordability, Equity, and Adherence

A literature review of 44 studies on the impact of out-of-pocket (OOP) costs on abandonment of prescriptions (i.e., not picking up a medication from the pharmacy after it’s been prescribed) and discontinuation (i.e., ceasing the use of a prescribed medication before a doctor says to) found that 50% or more of medications with an OOP cost of $100 or more are abandoned behind the pharmacy counter.8 Another study found that 18% of patients with oral cancer medications that cost $2,000 or more OOP waited over 90 days to pick up their medications, despite their cancer diagnosis.9

Affordability becomes an even greater challenge for lower-income workers and those in rural settings. Most plan members taking a specialty medication or on gene therapies that cost $10,000 or more a year will likely hit their deductible or annual OOP max, which can be more than some people’s savings. Those living further from COEs may incur additional costs for travel to and from providers capable of administering complex treatments.

Strategies for reducing OOP spending for plan members include zero OOP coverage for treatment delivered in a COE, indication-based formularies that reduce cost sharing for medications prescribed appropriately and steering employees to patient assistance programs for certain medications.

Opportunity: Virtual Health Has Increased the Ability to Meaningfully Support Patients with Chronic Conditions

With the proliferation of virtual health providers, there are many new capabilities available to employers to provide support to their plan members – especially those with one or more complex chronic conditions – who have higher cost drug spend. Members on high-cost drugs are often able to connect with specialized providers and tools that can help ensure that their medications are working. In turn, these specialists can monitor the effectiveness of the drugs between office visits.

Pursuing Value in Specialty Drug and Gene Therapy Purchasing

There are several ways to pursue value-based care through drug purchasing. Each of these strategies either improves quality of care, health outcomes and the patient experience, or reduces costs. They may also impact multiple parts of the “value equation.”

The next section includes recommendations for how the following drivers of value can be leveraged.

- Focus on the accuracy of diagnosis and treatment pathway selection: Once an accurate and appropriate diagnosis is determined, a personalized treatment plan is necessary for many specialty medications to ensure that a course of treatment is most effective for the patient, as the genetics of the patient, their specific illness and other factors can impact whether they achieve positive outcomes. Unfortunately, complex conditions like cancer and spinal muscular atrophy are sometimes misdiagnosed, so second opinions and COEs for determining treatment plans are key.

- Ensure expert administration of medications at site of care: Specialty medications are often injectables or infusions requiring administration and monitoring by a health care professional with specific expertise. Site-of-care management can increase value by steering patients to facilities that are staffed with expert providers with targeted specialized skills, achieving excellent outcomes and offering a more integrated patient experience.

- Reduce drug costs by getting patients onto the least expensive drug that works: Generics and biosimilars typically represent the least costly, yet most effective approach when used to treat a particular condition. When these are used instead of specialty medications, the value of treatment tends to increase.

- Improve quality of care through contracting: Fee-for-service reimbursement models reward providers for prescribing large volumes of high-cost drugs, regardless of outcome. Value-based reimbursement strategies, such as outcomes-based pricing, discussed later in this resource, can flip the script, better aligning the financial interests of pharmacy benefit managers (PBMs), pharmaceutical manufacturers and providers with high-quality care, positive health outcomes and positive patient experiences.

- Address volatility to the plan by mitigating the risk of cost spikes from extremely high-priced therapies: The overall costs of very high-priced immunotherapies and similar treatments are small compared to specialty medications for more prevalent conditions. Still, the very high cost of these medications can create spikes in spending that strain employer budgets and make it difficult to predict costs each year. Thirty-nine percent of large employers are considering implementing additional tactics by 2026 to manage rising costs, including stop-loss insurance, indication- and outcomes-based pricing and delaying inclusion at launch.3

- Improve adherence to effective medications: Employers and employees pay for drugs at the pharmacy counter, but the drug doesn’t have any positive effect until the patient takes it appropriately. Serious unaddressed side effects, high costs and difficulty accessing treatment can all depress adherence to prescribed medications.8 Medication therapy management (MTM) services provided by PBMs, health plans or third-party vendors can help plan members optimize treatment plans and support patients in getting on medications with minimal side effects.

Employer Strategies for Driving Value and Reducing Volatility in Drug Spending

The following section lays out ways that employers can reduce both costs and volatility, making their drug spend less expensive and more predictable.

1| Use indication-based formularies to encourage the use of appropriate and effective medications.

Employers can use indication-based formularies (IBFs) to vary employee cost-sharing for a drug based on how well it does for a particular condition. Many drugs can be used for multiple indications, but often will be more effective at treating one condition over another. Modifying cost-sharing based on the indication for which a drug is prescribed can increase affordability for patients when it is appropriate and effective for them, while constructing a financial barrier when evidence shows that the drug is less likely to be appropriate or effective. In some cases, an employer may simply not cover a drug if it is prescribed for a condition where it is not effective but provide generous coverage for it when used for different illnesses where it is most effective.

This strategy requires a high degree of clinical nuance and can be used for many different cases, making it difficult to determine its exact prevalence in the health care system. One current example of an IBF is employer coverage decisions about GLP-1 agonists, where some of these medications have a diabetes indication but are being used by patients for the weight loss results. In this case, 94% of large employers report covering GLP-1s for the treatment of diabetes heading into 2024, but only 49% will cover these medications for weight management purposes (i.e., an indication of obesity without comorbid diabetes).3

2| Use indication-based pricing to incent development and use of highly effective, efficient pharmaceuticals.

Related to IBFs, an indication-based pricing (IBP) strategy varies what an employer will pay a provider – and pharmaceutical manufacturer – for a given drug based on what condition it is prescribed for. Payments would be higher for a drug when used for a condition for which it is most appropriate and lower for less appropriate uses. In both instances, the drug is covered, but the reimbursement is lowered in cases where evidence suggests the drug will be less effective.

This approach is less common compared to other strategies to improve value in drug purchasing, but national payers outside of the U.S. have found success with IBP, especially when pharmaceutical manufacturers apply to have an existing drug be approved for new indications. In the U.S., PBMs have used IBP for high-cost cancer, rheumatoid arthritis and other medications through differentiated rebates based on the indication for which a drug is prescribed. This approach, however, requires enough utilization across a population of patients that it becomes unwieldy for an employer to implement by themselves. What employers can do is push their PBMs and health plans to detail how they are negotiating pricing and rebates based on the efficacy of a drug based on indication.

3| Implement value-based contracting for high-cost pharmaceuticals, such as a 'warranty'.

Related to indication-based pricing, alternative reimbursement models give plan sponsors and their partners the opportunity to hold manufacturers accountable for the effectiveness of the treatments they produce. Often called outcomes-based pricing (OBP), value-based contracting for pharmaceuticals says that an employer and its partners will not pay for, or pay as much for, a drug that doesn’t achieve targeted health outcomes improvement. These health outcome targets are contracted for in advance so it’s very clear whether a drug has “worked” and should be fully paid for. This pricing model is sometimes called a “warranty” because, like for a car or a dishwasher, an employer could execute OBP by paying the full cost of a drug when it is administered, but then receive a partial or full refund from the manufacturer if it is not successful in achieving health outcome targets.

There is a tremendous amount of complexity in executing this type of contracting strategy. It often requires coordination between health plans, PBMs and provider groups, a long-term approach to measuring patient outcomes and upfront negotiation on what constitutes “success” from a drug so its impact can be determined. Implementing this strategy also requires measurement of outcomes currently not captured by the clinician or always visible to the payer. This longitudinal approach is made even more difficult given that patients may terminate their employment or change providers, impacting both the ability to measure outcomes and the payment mechanism for the drug. Still, according to one survey, over half of health plans and PBMs have executed at least one outcomes-based pricing contract.10 Additionally, in 2024, 22% of employers will implement indication- and/or outcomes-based pricing arrangements alongside their health industry partners, but this percentage may double by 2026.3 Employers should ask their partners how they use value-based contracting for pharmaceuticals, its impact on overall costs and patient outcomes (including utilization and outcomes data) and how they are driving value in their contracting with manufacturers.

4| Require or heavily incent the use of second-opinion providers when a patient is diagnosed with a rare condition and prescribed high-cost medications.

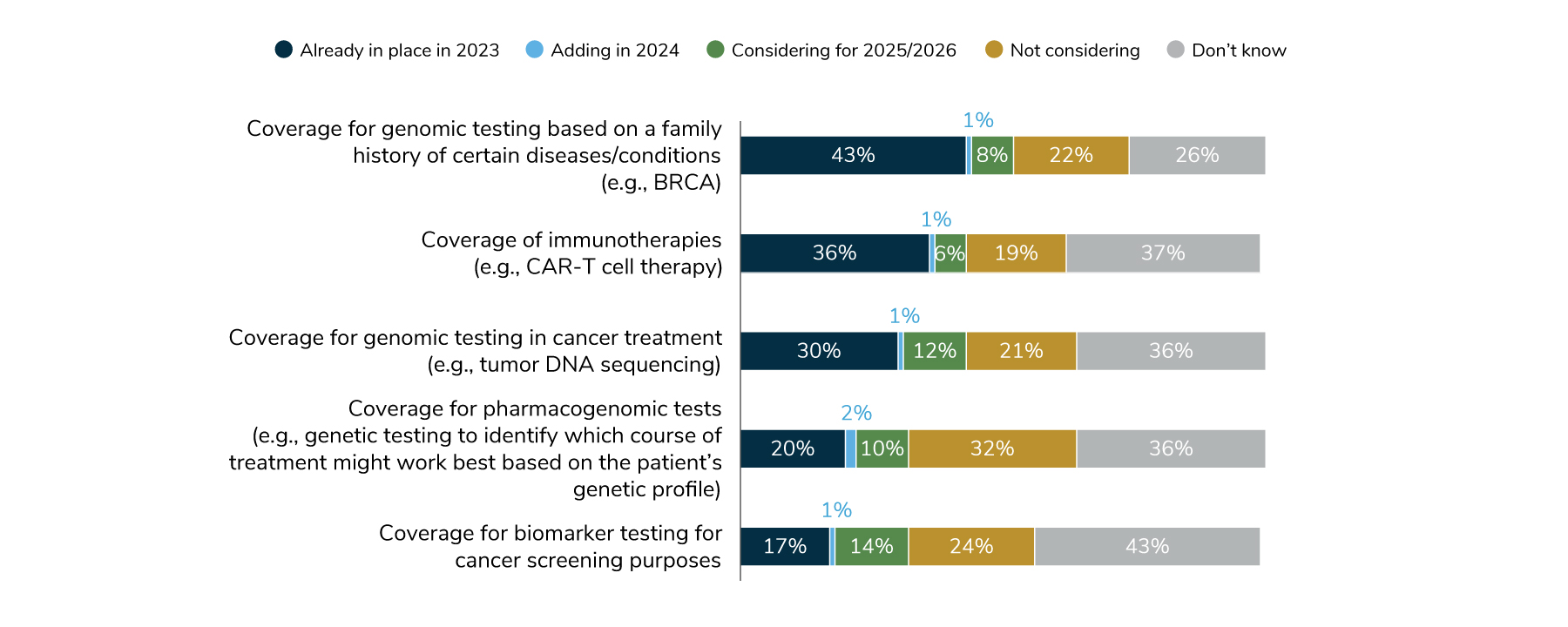

This strategy can increase the likelihood that diagnoses are accurate and that high-cost therapies will improve outcomes. It also requires robust coverage of pharmacogenomics and other genetic testing, illustrated in Figure 1 below, to ensure that patients can get the best information available regarding a diagnosis and effective treatment. To increase appropriateness of prescribing, employers may opt to make coverage conditional on having certain specialty providers prescribe the medication or require a second opinion. Some specialty medications may already have a prior authorization (PA) in place to prevent inappropriate utilization and redirect patients to lower-cost alternatives first. In fact, 67% of large employers reported using PAs for specialty medications under both the pharmacy and medical benefit.3 The “pause” created by the PA is often where a second-opinion provider service can be contacted and/or required before the authorization requirements are met for coverage. Employers can audit their health plans, PBM and specialty provider networks to assess whether their implementation of PAs aligns with the employer’s plan designs to achieve desired results.

5| Require or heavily incent the use of support programs tailored to patients taking particular specialty drugs.

Many vendors, both newer players and established incumbents, have programs tailored to supporting patients with specific conditions requiring use of high-cost drugs. These programs can help monitor effectiveness in between office visits, support patients’ adherence to medications and facilitate different treatments when the current drug is ineffective or not tolerated by the patient. Employers should ask their PBM, health plan, consultant and other partners about their programs or talk to other vendors on the market who provide these services. Make sure to assess whether the program provides unbiased support to employees rather than simply encouraging greater uptake in utilization of the medication and be cautious about any program reimbursements that may be tied to drug rebates. Emphasize the need for transparency in outcomes measured and reimbursements received by the program, to be stipulated in vendor contracts.

6| Encourage patients to use sites of care for drug therapies that offer a better experience at a lower cost.

The price of the same pharmaceutical therapy can vary widely based on the setting in which it is delivered.9 Infused medications that require provider oversight can be administered in inpatient facilities, outpatient offices and increasingly in the home. Use of inpatient and sometimes outpatient facilities owned by a larger health system can come with a “facility fee” separate from the bill for the medication and provider services. Many patients prefer the experience of getting their infused therapies in their community or in their home.

Plan design incentives can encourage the use of lower intensity care settings. Patients on infused specialty medications will often hit their annual deductible, so separate communication about the benefits of particular care settings, specialty networks and other approaches can continue to encourage the use of less expensive sites of care.

7| Consider financing strategies to reduce the volatility of financial impacts of rare, but extremely high-cost drugs.

What sets multimillion-dollar therapies apart from the lower-cost, higher-volume drugs is their volatility, given the rare conditions that they treat. Even for large employers, having just a few patients on the plan who require a very high-cost immunotherapy could mean an abnormally high trend and cost volatility

Over the years, some employers have purchased stop-loss insurance to smooth the financing of high-cost conditions. Others, typically large employers with very stable employee bases such as municipalities, have worked with health plan partners to pay for very high-cost drugs through a “Netflix” model, which essentially equates to a “subscription,” or annual flat payment for a population in the risk pool. The drug is then dispensed to eligible patients within the population covered by the program without additional claim cost. Small- and mid-sized employers can work with their PBM pooling programs to increase their purchasing power and drive deeper discounts. These financing models don’t directly impact the price of drug therapies and likely increase employer cost due to the need for additional partners to implement them. While these models may be useful in managing the financial volatility employers may face, especially mid-size and small employers, they are financing strategies, not value-based strategies.

Conclusion

There is no indication that the share of specialty drug spend in U.S. pharmaceutical spending will decline any time soon. Conversely, all signs point to continued increases in the coming years. A coming wave of gene and cell therapies in the pipeline will necessitate employer and industry partner actions to address rising cost trends, employee expectations and experience and spending volatility brought on by these high-cost therapies and ensure that they are dispensed through the models that focus on maximizing value for the patient and employer.

Addressing these challenges is easier said than done. The steps included in this resource provide many avenues for employers to work with their partners to develop financing strategies, assess future risk and help patients get the right therapies at reasonable costs.

“Value-based purchasing” in pharmaceutical purchasing is complicated and nascent as compared to similar efforts for other health care services (e.g., accountable care organizations, COEs, advanced primary care.) It requires deep coordination between PBMs, health plans, employers and providers, as individual employers rarely have the sufficient scale to attract attention for potential direct contracts with pharmaceutical manufacturers. Still, employers can drive the conversation and industry action by demanding that plan members receive appropriate care and accurate diagnoses from high-quality providers who prescribe affordable and effective medications.

More Topics

Articles & Guides- 1 | Parasrampuria S, Murphy S. Trends in prescription drug spending, 2016-2021. ASPE, Office of Science Data and Policy. September 2022. https://aspe.hhs.gov/sites/default/files/documents/88c547c976e915fc31fe2c6903ac0bc9/sdp-trends-prescription-drug-spending.pdf. Accessed August 2, 2023.

- 2 | Rae M, Kamal R, Cox C. What are recent trends and characteristics of workers with high drug spending? Peterson-KFF Health System Tracker. September 29, 2020. https://www.healthsystemtracker.org/chart-collection/who-is-most-likely-to-have-high-prescription-drug-costs/#Share%20of%20people%20with%20large%20employer%20coverage%20who%20have%20annual%20out-of-pocket%20retail%20drug%20spending%20in%20excess%20of%20$1,000%20in%202018,%20and%20their%20relative%20contribution%20to%20total%20retail%20drug%20spending%20and%20out-of-pocket%20retail%20drug%20spending. Accessed August 2, 2023.

- 3 | Business Group on Health. 2024 Large Employer Health Care Strategy Survey: Executive Summary. August 2023. https://www.businessgrouphealth.org/resources/2024-large-employer-health-care-strategy-survey-executive-summary. Accessed August 2, 2023.

- 4 | Center for Biologics Evaluation and Research. Approved cellular and gene therapy products. U.S. Food & Drug Administration. June 30, 2023. https://www.fda.gov/vaccines-blood-biologics/cellular-gene-therapy-products/approved-cellular-and-gene-therapy-products. Accessed August 9, 2023.

- 5 | Lohr A. 2023's market outlook for cell and gene therapies. cell & gene.https://www.cellandgene.com/doc/s-market-outlook-for-cell-and-gene-therapies-0001. Accessed August 2, 2023.

- 6 | U.S. Food & Drug Administration. (2020, Tue, 03/24/2020 - 22:21). Statement from FDA Commissioner Scott Gottlieb, M.D. and Peter Marks, M.D., Ph.D., Director of the Center for Biologics Evaluation and Research on new policies to advance development of safe and effective cell and gene therapies. March 24, 2020. https://www.fda.gov/news-events/press-announcements/statement-fda-commissioner-scott-gottlieb-md-and-peter-marks-md-phd-director-center-biologics. Accessed August 2, 2023.

- 7 | Verdin P, & Mon Tsang T. (2021). Next-generation therapeutics thrust into the spotlight. Biopharma Dealmakers. https://doi.org/10.1038/d43747-021-00105-y. Accessed August 2, 2023.

- 8 | Ismail W W, Witry MJ, Urmie JM. The association between cost sharing, prior authorization, and specialty drug utilization: A systematic review. Journal of Managed Care & Specialty Pharmacy. May 2023: 29(5): 449–63. https://doi.org/10.18553/jmcp.2023.29.5.449. Accessed August 2, 2023.

- 9 | Doshi JA, Li P, Huo H, Pettit AR., Armstrong KA. Association of patient out-of-pocket costs with prescription abandonment and delay in fills of novel oral anticancer agents. Journal of Clinical Oncology. February 10, 2018: 36(5): 476–82. https://doi.org/10.1200/JCO.2017.74.5091. Accessed September 5, 2023.

- 10 | McCarthy KF, Cricchi, L, Shvets E, Santiesteban D. Avalere survey: Over half of health plans use outcomes-based contracts. Avalere Health (blog). November 4, 2021.https://avalere.com/insights/avalere-survey-over-half-of-health-plans-use-outcomes-based-contracts. Accessed August 9, 2023.

- 11 | Levy J, Ippolito B. Branded price variation in the United States drug market, 2010 to 2019. Value in Health. August 4, 2021. 24(9): 1237-1240. https://doi.org/10.1016/j.jval.2021.04.1272. Accessed August 2, 2023.

- 12 | Business Group on Health. Definitions and Measures of Value in Value-based Purchasing.November 2022. https://www.businessgrouphealth.org/resources/value-based-purchasing-employer-guide-definitions-and-measures. Accessed August 2, 2023.

- 13 | Liu A. A $3M gene therapy: Bluebird bio breaks its own pricing record with FDA approval of Skysona. Fierce Healthcare. September 19, 2022. https://www.fiercepharma.com/pharma/3m-gene-therapy-bluebird-breaks-own-record-fda-approval-skysona. Accessed August 2, 2023.

- 14 | Henigson J. My life was upended for 35 years by a cancer diagnosis. A doctor just told me I was misdiagnosed. March 26, 2021. The Washington Post. Accessed August 2, 2023. https://www.washingtonpost.com/lifestyle/2021/03/26/my-life-was-upended-35-years-by-cancer-diagnosis-doctor-just-told-me-i-was-misdiagnosed/. Accessed August 2, 2023.

- 15 | Nevo Y, Wang C. Spinal muscular atrophy: A preliminary result toward new therapy. Neurology. February 10, 2016. 86(10): 884-885. https://doi.org/10.1212/WNL.0000000000002453. Accessed August 2, 2023.

- 16 | Michaeli DT, Mills M, Kanavos P. Value and Price of Multi-indication Cancer Drugs in the USA, Germany, France, England, Canada, Australia, and Scotland. Applied Health Economics and Health Policy. July 11, 2022. 20(5): 757-768. https://doi.org/10.1007%2Fs40258-022-00737-w. Accessed August 2, 2023.

This content is for members only. Already a member?

Login

![]()