November 30, 2022

In March 2015, the first biosimilar drug was granted Food and Drug Administration (FDA) approval in the United States. Employers rejoiced at the prospect of what this could mean for drug spend going forward. At launch (in the U.S.), the list price differential for biosimilar drugs to their branded counterparts is approximately 15%-35% lower.1 Such savings may grow as more biosimilars come to market, stimulating market competition and creating the potential for deeper discounts on some very high-cost specialty medications.

But this potential has yet to be realized. Instead of seeing a biosimilar marketplace roar to life, the industry saw a painstakingly slow trickle of products reach the market over the last 6 years, with many more currently stuck in the pipeline. To date, the FDA has approved a total of 39 biosimilars, spanning five therapeutic categories: oncology, supportive care oncology, autoimmune conditions, ophthalmology and diabetes. Of these, 25 have been launched on the market, with the majority indicated for oncology or supportive oncology care. As a result, almost all current biosimilar costs have been flowing through the medical benefit. The first biosimilar to flow through the pharmacy benefit, Semglee, is the first biosimilar approved for diabetes care. It was also the first interchangeable biosimilar on the U.S. market. An interchangeable biosimilar is one that can be prescribed by the pharmacist without receiving a new prescription, much like a generic can be substituted for a name brand. At present, only three biosimilars have earned an interchangeable designation from the FDA; two are currently on the market. More manufacturers are expected to request interchangeable status for their products in the next year.

Biosimilar 101

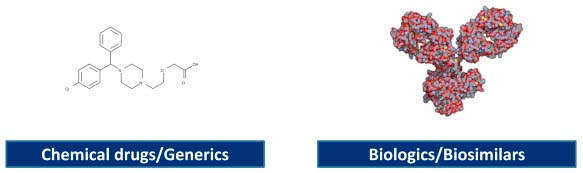

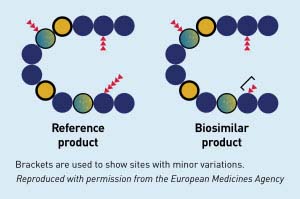

A biosimilar can be viewed as a “generic” version of a brand-name biologic drug. However, contrary to most generics, a biosimilar drug is not an exact chemical replica of its brand-name counterpart. In fact, biologics and biosimilars are not generated from chemical structures at all, but rather are made within living systems (e.g., yeast, bacteria or animal cells) and are much more structurally complex than small molecule generics (Figure 1). Given these natural sources of origin, the biosimilar drug’s structure ends up being highly similar to but not exactly the same as its biologic reference product (Figure 2). This may result in minor differences in clinically inactive drug components, but “no clinically meaningful differences” in terms of drug safety, purity and potency.2, 3 Because analytical, animal and clinical studies are based on a comparison of the biosimilar to the reference product, the FDA is able to approve a biosimilar without requiring as many clinical trials as were dictated for the reference product. Essentially, the biosimilar sponsor is able to rely on the safety and efficacy work completed by the reference product’s sponsor and focus on a comparative assessment.4

Source: Bonini, S, and Bonini M. Biosimilars and drug development in allergic and immunologic diseases. March 27, 2017. The Journal of Allergy and Clinical Immunology, 139(5); 1461-1464. https://www.jacionline.org/article/s0091-6749(17)30506-7/fulltext. Accessed October 26, 2021.

Source: FDA. Biosimilar and interchangeable products. October 23, 2017. https://www.fda.gov/drugs/biosimilars/biosimilar-and-interchangeable-products. Accessed October 26, 2021.

Over the next few years, the biosimilar market is expected to grow substantially:

Pipeline outlook

There are over 30 biosimilars poised to enter the market from 2023 through 2029 across multiple drug classes, including immunology, diabetes, bone health, ophthalmology and supportive care. Many of these drugs are currently high-spend categories for employers.5 As of the fourth quarter of 2020, savings from biosimilars between 2021 and 2025 are projected to be $38.4 billion, with an upper-bound estimation of $124.5 billion.10

Patent expiration on the horizon may mean cost savings opportunities within the pharmacy benefit

The biologic patent expiration of Humira in 2023 will mark the largest loss of exclusivity in the history of the US pharmaceuticals. Additionally, Enbrel’s patent expiration occurs in 2029. As the industry awaits these expiration dates, more biosimilars for reference products treating inflammatory autoimmune diseases, such as rheumatoid arthritis, are stacking the pipeline, awaiting permission to launch. Currently, seven biosimilars are approved for Humira, with up to 12 potentially launching next year, but none have been permitted to launch at this stage.6,9 Only one of these, Cyltezo, has gained interchangeability status thus far.

Health plans are increasingly indicating that biosimilars have provided meaningful cost savings7 and have moved to prefer these products on formulary

Some have even begun to promote biosimilar utilization by offering members education and monetary incentives to make the switch.8

Headwinds and Tailwinds to Uptake

While shifting market dynamics offer new hope for savings from biosimilars, employers should be aware that the same traditional barriers that have stood in the way of uptake since 2015 are still at play and will likely remain so in the coming years unless action is taken.

Biosimilar adoption still faces hurdles, such as:

- Payer formulary restrictions;

- Physician and patient skepticism;

- Lower provider reimbursement for a biosimilar compared to that for the original product;

Approved But Not Interchangeable?

FDA approval does not automatically guarantee interchangeability with the biosimilar’s brand-name counterpart. Additional FDA approval is needed for a biosimilar to be considered interchangeable, or before it can be substituted automatically for its brand-name counterpart. If the biosimilar does not receive the designation of interchangeability, it can still be prescribed and used to treat disease but will not be considered for automatic substitution.2

- Reference product rebating practices precluding biosimilars from being the lowest net cost option (e.g., Remicade is heavily rebated on the medical side and lowered its unit cost due to biosimilar competition, effectively blocking uptake of biosimilar equivalents);

- Lack of interchangeability, requiring providers to change their prescribing patterns; and

- Patent litigations and settlements.

These barriers are precisely why it’s taken biosimilars such a long time to gain traction beyond some success in the oncology space. While it is not yet clear whether the imminent release of Humira biosimilars in 2023 will help push biosimilars forward, news of the FDA granting interchangeable status for Cyltezo, a biosimilar for Humira launching on July 1, 2023, is encouraging for future approvals for other monoclonal antibody drugs, a major target for biosimilar manufacturers.11 Uptake for biosimilars may take more time, but biosimilars have already demonstrated an impact on the market purely by introducing competition and forcing reduced average sales price (ASP) for reference products, as seen with Remicade (a medication for ulcerative colitits) experiencing a 29% drop in ASP since 2020, after the introduction of the biosimilars Inflectra and Renflexis.13

Biosimilars in the oncology class have done relatively well compared to their counterparts in other disease categories. Some attribute this to relatively lower rebates within the oncology medical channel, meaning biosimilar uptake is not disincentivized by lower net price created through the (presumably temporary) high rebates. Furthermore, with oncology networks largely adopting at-risk payment models (where buy-and-bill doesn’t hold much weight), oncologists are not incentivized to prescribe a more expensive drug. Finally, it is more likely for an oncologist to start treatment with a brand-new oncology biosimilar, bypassing the use of a brand-name drug. This has been considerably different from the biosimilar uptake in other drug classes, where a satisfied patient on a long-term medication is more reluctant to switch to a different chronic medication regimen.6

Buy-and-Bill

The buy-and-bill process involves a health care provider purchasing, storing and administering a drug product to a patient. Once the drug is administered, a medical claim is submitted, and the provider is reimbursed. However, self-insured plans receive rebates for provider-administered injectable and infused medications billed under the medical benefit.

In general, health plans are more willing to execute a preferred biosimilar strategy and have systems in place to manage the use of these drugs under the medical benefit. A health plan’s early adoption and step-therapy strategy that prefers biosimilars (i.e., making biosimilars a first-line treatment) instead of a parity strategy (i.e., offering the same level of coverage for biosimilars) can dramatically drive a biosimilar’s market share.

Now, with more opportunities emerging on the pharmacy side (due to upcoming Humira and Enbrel patent expirations), the focus has turned to how pharmacy benefit managers (PBMs) will support biosimilar adoption. There is concern from biosimilar stakeholders that rebate guarantees included in many contracts may present considerable challenges to uptake. Ultimately, all stakeholders will need to be involved to capitalize on the opportunity offered by biosimilars. Table 1 identifies some of the factors most relevant to each stakeholder group.6,12

Table 1: Factors for Different Stakeholders That Influence Biosimilar Uptake

| Providers | Payers | Patients |

|---|---|---|

|

|

|

Employer Recommendations

With biosimilars now poised to have a significant impact on prescription drug cost in more drug classes, there are key actions employers can take right now to drive utilization and integrate biosimilars into a strategy centered on high-value, cost-effective care.

Employer Opportunities to Collaborate With Health Plans and PBMs

- 1 | Examine your health plan and PBM contracts for updated biosimilar definitions and discuss with your partners how the upcoming biosimilar launches may impact current preferred status of specialty medications on formularies.

- 2 | Evaluate rebate guarantees and how any anticipated switch to biosimilars and resulting reduction in rebates can impact your vendor’s performance against such guarantees.

- 3 | Determine the impact biosimilar adoption could have on current or future plan costs to your organization. Ask your vendor partners to run a customized utilization/modeling report for all biologics for which there are biosimilars in development to understand the potential for savings. Ensure that your vendor partners are considering ongoing utilization optimization reviews, particularly as more and more biosimilars are approved.

- 4 | Talk to your vendor partners about their proposed coverage of biosimilars and policies to encourage their use. Ask how they will be encouraging the use of biosimilars when they happen to be in the same formulary tier as other biologics.

- 5 | Consider a plan design strategy that encourages making biosimilars the lower cost option and/or a required first-line treatment for therapy for new patients, when appropriate and available, and promote specialty pharmacist support for doing so. Consider creating a dedicated tier for biosimilars in your plan design as a way to encourage utilization.

- 6 | Together with your vendor partners, evaluate options to provide incentives and education to plan members who are currently on reference biologics to switch to biosimilars when the net cost of the biosimilar is less than the reference product.

- 7 | Talk to your vendor partners about the need for rebate transparency and forecasting. Conduct timely rebate reviews to evaluate what portion of rebates is attributed to drugs with biosimilar equivalents and validate if the reference product used was the lowest net cost option.

- 8 | Ask your partners how biosimilars will impact any existing and future value-based pricing arrangements negotiated with manufacturers or providers.

- 9 | Ensure that your vendor contracts do not exclude biosimilars from rebate pass-through commitments.

- 10 | Ask about efforts being made to educate physicians, especially in high performance networks, to encourage the acceptance and adoption of biosimilars as safe, efficacious and cost-effective alternatives and encourage plan partners to develop provider and/or drug policy strategies to leverage biosimilars instead of branded biologics.

Employer Opportunities to Educate and Incentivize Patients/Members

- 11 | Determine what overtures you may make to care management and patient support teams as a strategy to educate your members about biosimilars and their safety.

- 12 | Determine what other patient impacts, especially on out-of-pocket cost, may occur as patients switch to biosimilars (such as the impact on patient copay assistance programs or lost coupons).

- 13 | Encourage existing patients to switch to biosimilars by communicating efficacy and similarity of the biosimilar compared to the reference product. Guarantee monitoring of patients who switch to biosimilars to ensure effectiveness and reduce any concerns about side effects.

- 14 | Consider patient incentives or lower out-of-pocket costs for biosimilars and communicate the financial impacts to patients.

- 15 | Discuss switching to biosimilars for patients using medications prescribed for the long term, such as anti-inflammatory drugs, carefully, as this may be a difficult transition. Use patient-friendly language, emphasize the importance of shared decision-making between the patient and the physician, keep an open channel for any patient questions to be addressed and make information such as FDA resources readily accessible to ease the transition.

When employers are asked about pharmacy benefit concerns, cost is typically the most significant one. Experts agree that biosimilars offer one of the greatest opportunities to reduce drug costs in meaningful ways. However, a change like this requires timely collaboration among stakeholders, understanding where the barriers to adoption may be, overcoming the inertia of the pharmaceutical market and combating misaligned incentives. Employers have the opportunity to fully leverage the advantages biosimilars offer by adapting to the shifting market promptly and ensuring that a multifaceted approach puts the patient at the center of their decision-making process.

More Topics

Articles & Guides- 1 | FDA. FDA Approves First Interchangeable Biosimilar Insulin Product for Treatment of Diabetes. July 28, 2021. https://www.fda.gov/news-events/press-announcements/fda-approves-first-interchangeable-biosimilar-insulin-product-treatment-diabetes. Accessed October 10, 2022.

- 2 | American Cancer Society. What are biosimilar drugs? March 9, 2020. https://www.cancer.org/treatment/treatments-and-side-effects/treatment-types/biosimilar-drugs/what-are-biosimilars.html. Accessed October 25, 2021.

- 3 | PhRMA. Biologics & biosimilars. August 2022. https://phrma.org/policy-issues/Research-Development/Biologics-Biosimilars. Accessed October 25, 2021.

- 4 | American Cancer Society. Understanding biologic and biosimilar drugs. July 27, 2018. https://www.fightcancer.org/policy-resources/understanding-biologic-and-biosimilar-drugs. Accessed October 25, 2021.

- 5 | Cardinal Health. 2022 Biosimilars Report: The U.S. Journey and Path Ahead. 2022. https://www.cardinalhealth.com/content/dam/corp/web/documents/Report/cardinal-health-2022-biosimilars-report.pdf. Accessed October 10, 2022.

- 6 | O’Brien R. Presentation to Business Group on Health’s Pharmacy Benefit Committee. Real Endpoints. June 16, 2021.

- 7 | Jeremias S. Biosimilar acceptance may be greater among payers than previously thought. October 20, 2021. American Journal of Managed Care. The Center for Biosimilars. https://www.ajmc.com/view/panel-biosimilar-acceptance-may-be-greater-among-pharmacy-benefit-managers-than-previously-thought. Accessed October 25, 2021.

- 8 | Hagen T. Cigna offers patients $500 debit card to switch to biosimilars. June 24, 2021. American Journal of Managed Care. The Center for Biosimilars. https://www.centerforbiosimilars.com/view/cigna-offers-patients-500-debit-care-to-switch-to-biosimilars. Accessed October 25, 2021.

- 9 | AmerisourceBergen. Biosimilar approval and launch status in US. https://www.xcenda.com/biosimilars-trends-report. Accessed October 13, 2022.

- 10 | Mulcahy A. et al. Projected US savings from biosimilars, 2021-2025. January 3, 2022. The American Journal of Managed Care. https://www.ajmc.com/view/projected-us-savings-from-biosimilars-2021-2025. Accessed November 23, 2022.

- 11 | Sagonowsky E. Boehringer's interchangeable tag for Humira biosim is a 'landmark' win for the field: analyst. October 19, 2021. Fierce Pharma. https://www.fiercepharma.com/pharma/boehringer-nabs-interchangeable-tag-for-humira-biosim-landmark-win-for-field-analyst. Accessed November 23, 2022

- 12 | Hyde A. Presentation to Business Group on Health’s Pharmacy Benefit Committee. Arthritis Foundation. November 3, 2022.

- 13 | Magellan Rx Management. 2022 Medical Pharmacy Trend Report. 2022. https://issuu.com/magellanrx/docs/medical_pharmacy_trend_report_2022?fr=sNjc2MTU1NTUwMjE. Accessed November 23, 2022.

This content is for members only. Already a member?

Login

![]()