August 18, 2020

Looking for the latest data?

Check out our 2024 Large Employer Health Care Strategy Survey, released in August 2023.

The effects of COVID-19 continue to hover over the workplace. A silver lining, however, is that the pandemic has expanded and accelerated the use of telehealth and virtual

health. Employers also have a heightened awareness of the need for accessible mental health services, which has led to additional benefits. Among these new benefits are more virtual health options to address mental health and emotional well-being gaps. On the other hand, employers expect increased health care costs in the coming years because of missed and delayed care during the pandemic.

Key Takeaways

- The COVID-19 pandemic has had mixed effects on employer plans. From a positive perspective, it has accelerated the use of virtual health – a trend that is likely here to stay. It has also raised awareness of the importance of mental health services across a number of dimensions.

- Negative impacts, including delays in care and missed screening opportunities, have given rise to late-stage diagnoses due to pent-up demand for and partial resumption of in-person services. As a result, employers expect health care costs to rebound or even rise.

- Many benefits that employers put in place during the pandemic will become permanent. These include expanded telehealth or virtual health offerings (76%), better access to virtual health (68%) and new mental health benefits (62%).

The effects of COVID-19 continue to hover over the workplace. A silver lining, however, is that the pandemic has expanded and accelerated the use of telehealth and virtual health. Employers also have a heightened awareness of the need for accessible mental health services, which has led to additional benefits. Among these new benefits are more virtual health options to address mental health and emotional well-being gaps. On the other hand, employers expect increased health care costs in the coming years because of missed and delayed care during the pandemic.

COVID-19 Accelerated Virtual Health Offerings

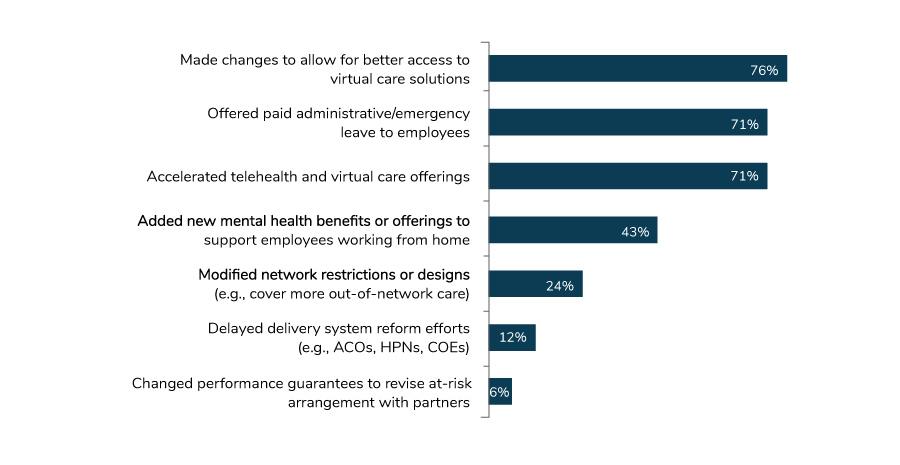

In response to the pandemic, employers increased virtual health offerings across the board in 2021. Eighty-four percent expanded their virtual health services (Figure 1.1). This is even more than did so in 2020, when 76% of employers made changes to allow for more virtual services and 71% accelerated telehealth and virtual health options.

Employers also view many of the changes they made in response to COVID-19 as permanent. For example, 76% of employers that accelerated telehealth or virtual health are planning to keep these changes in place, as are the 68% that provided better access to virtual health and the 62% that added new mental health benefits. However, 61% of employers that offered additional pandemic-related paid leave to employees expect to scale back on this benefit once the pandemic ends (Figure 1.2).

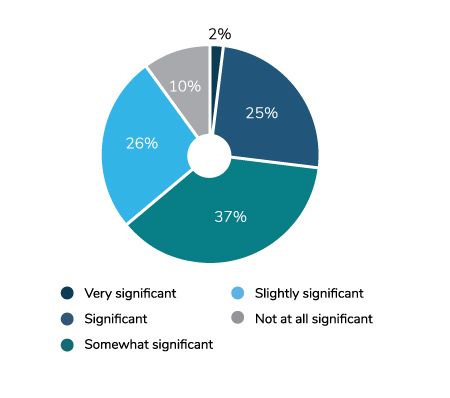

Overall, 85% of employers believe that virtual care will have a significant impact on how health care is delivered in the future, a 5-point increase from last year (Figure 1.3).

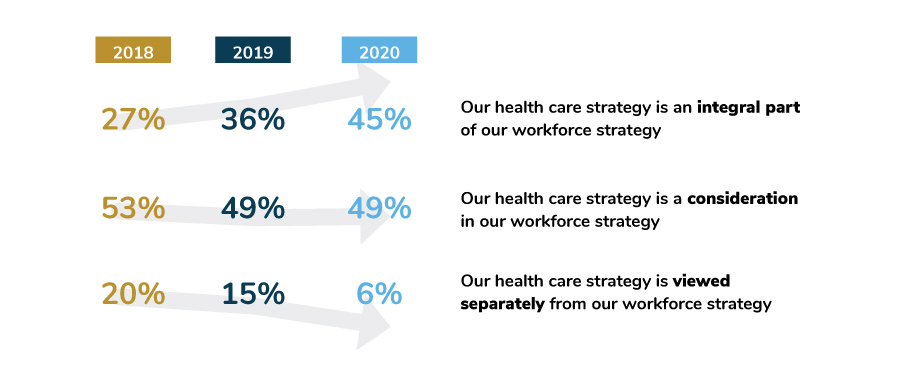

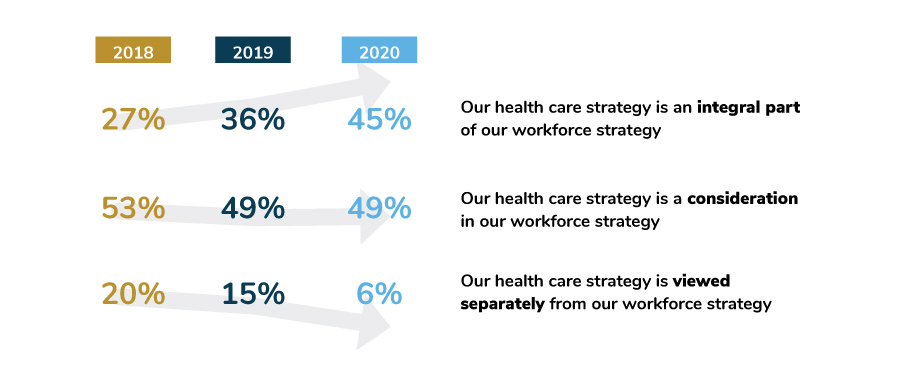

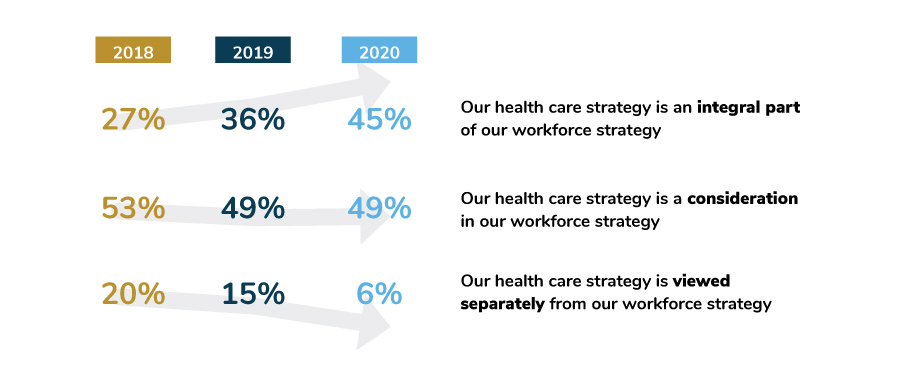

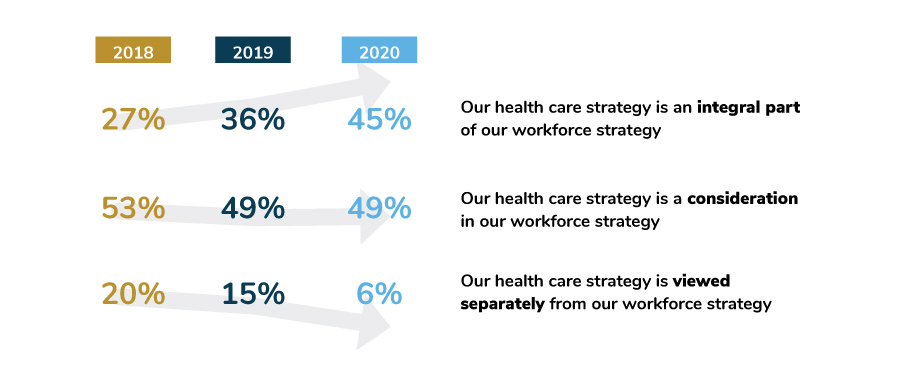

Given the acute focus on employee health and well-being during the pandemic, it is surprising that this year, those who viewed health care and well-being strategy as integral to workforce strategy declined slightly. Whereas there was a 9-point increase in employers’ views on this issue between 2019 and 2020 (36% vs. 45%), there was a 3-point decline between 2020 and 2021 (Figure 1.4).

Although the reasons for this are not completely clear, it could be that the emphasis on health and well-being strategy was redirected to the immediacy of the pandemic and keeping employees safe, healthy and productive. In any case, there is an expectation that the topline number will return to past levels of increase in the coming years.

Employers' Approach to Delivery Reform

Virtual health has been important in providing physical and mental health care services during the pandemic. It also has been a complement to the traditional health care delivery system. Survey responses bear this out: 61% of employers are augmenting their efforts to transform the delivery system by accelerating virtual health to address challenges within the more traditional delivery system. Employers’ willingness to do so has increased steadily since 2019, moving from 31% (2019) to 55% (2020) to 61% (2021) (Figure 1.5).

Impact of COVID-19 on Overall Health and Well-being

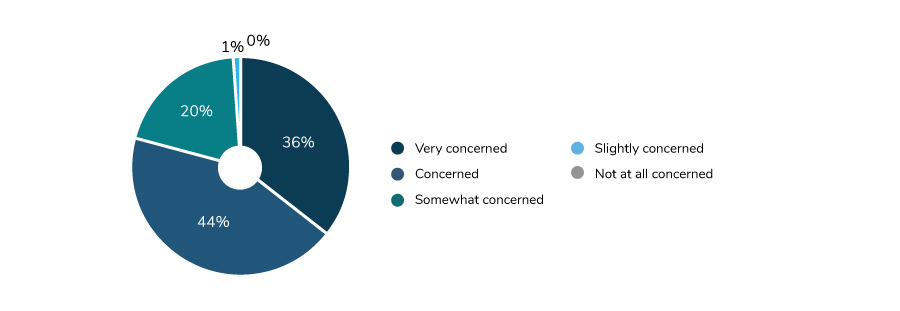

Although the COVID-19 pandemic has had some silver linings, it has had many negative impacts. Staying at home during numerous lockdowns meant that doctor visits and preventive screenings were delayed or missed altogether. Social isolation and uncertainty due to the fluid nature of the pandemic proved to be an impetus for depression, anxiety and substance use disorders. As a result, employers anticipate seeing an increase in medical services, late-stage cancer diagnoses, greater numbers of people with long-term mental health and substance use issues and other adverse effects. These could last well into the future (Figure 1.6).

Evolving Views on Point Solutions and Pharmacy Benefit Manager and Health Plan Consolidation

As employers expand their focus to other areas involving cost and quality of care, they are shifting their attention to the impact of consolidation on these two variables. For the first time, this year’s survey asked about point solutions consolidation. More than half of employers said that it could lead to better integration of patient data and improve the consumer’s experience and utilization. However, only 30% thought that consolidation would reduce the cost of programs (Figure 1.7).

Similarly, employers see some potentially positive outcomes from pharmacy benefit manager (PBM) and health plan consolidation. Forty-three percent of employers think that consolidation may reduce the total cost of care and support value-based care models.

Employers do, however, have some concerns about PBM and health plan consolidation. Only 22% think that it will improve the consumer experience and an even lower number—18%—think that it will improve the quality of care (Figure 1.8).

Policy Perspectives

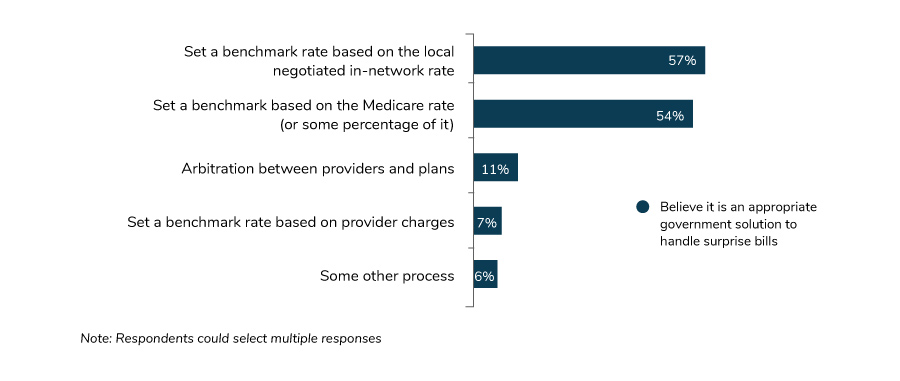

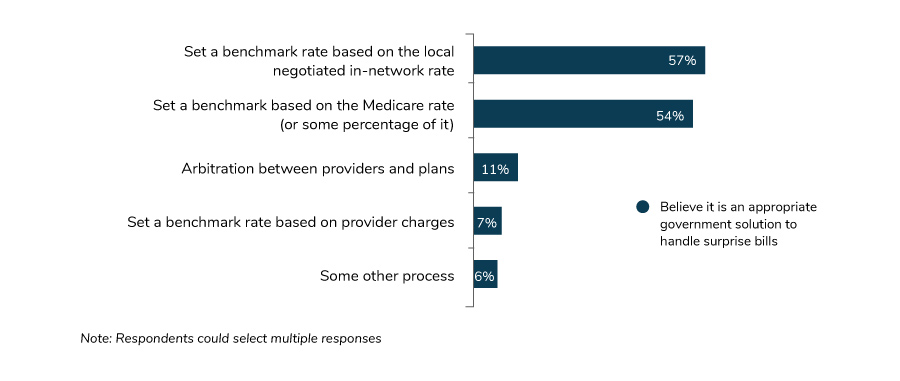

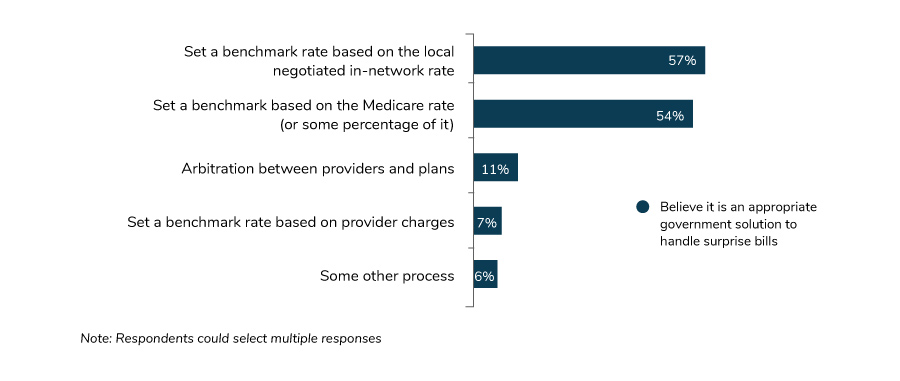

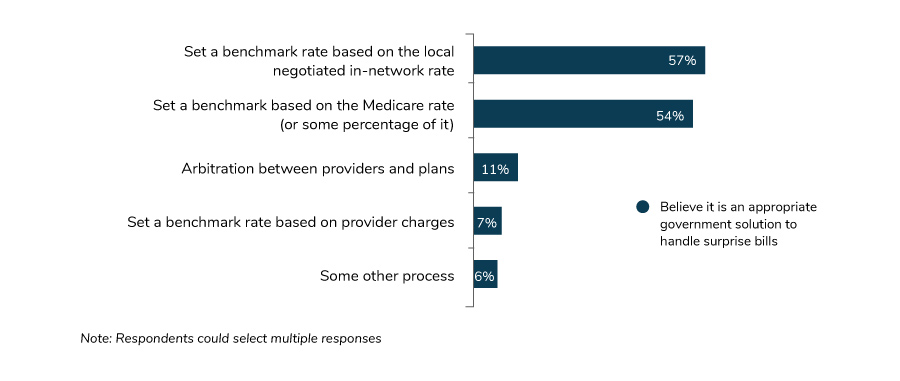

On the policy front, employers are focused on the big picture surrounding health care reform: cost, quality and increased access to affordable options. Lowering overall health care costs tops the list at 69%, followed closely by increasing quality (65%). Increasing affordable coverage is third, at 52% (Figure 1.9).

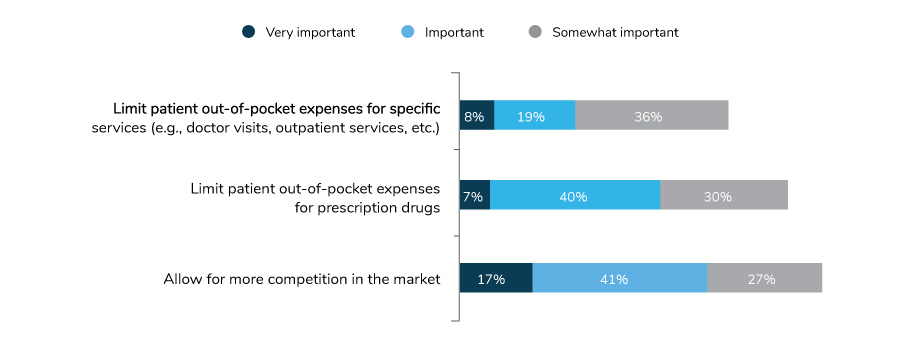

Employers continue to support improvements to health savings accounts (HSAs). In line with an increased emphasis on telehealth, 80% of employers support permanently allowing telehealth to be covered before the deductible is met. Flexibility to cover high-value services such as primary care and chronic care management also received strong support (78%), as did allowing people over the age of 65 to continue contributing to their HSAs (70%) (Figure 1.10).

While employers support transparency and have long invested in tools and navigation services that provide cost information to employees and their families, the employer obligations in the recent transparency rules are challenging. While many employers embrace greater transparency and increasing patient visibility of cost, employers have indicated that these new regulations will increase their compliance burden (Figure 1.11). Employers will need effective collaboration with their partners to bring the transparency regulations to complete fruition, as these third-party partners maintain most of this data on behalf of employers.

As a strategy to increase access to affordable health insurance, employers favor lowering the eligibility age for Medicare (51%). Their second choice, offering a public option on the exchanges, lagged at 35%, followed by allowing employees to use the exchanges to find health insurance (34%) (Figure 1.12).

In a few areas, it appears that employer appetite for Congressional involvement and support is growing. In efforts to reduce costs, employers have focused on the price of prescription drugs among other efforts. This year, telehealth is almost of equal concern. This change becomes evident when looking at which areas employers would like to see activity from Congress. While implementing price controls for prescription drugs is still their top concern, at 48%, eliminating barriers for telehealth (e.g., licensing) is a close second, at 41%.

As employers continue to address these pressing issues, they are also looking 5 and 10 years out and considering whether they will still be offering employer-sponsored coverage for their workforce. Ninety-seven percent believe that they will still be providing health insurance 5 years from now, with 82% confident that they will still be providing health insurance in 10 years. Despite discussions of a public option as well as potential workforce demographic shifts (e.g., gig workers), employers anticipate no significant changes in their willingness or need to provide employer-sponsored health coverage in the future (Figure 1.14).

-

Introduction2021 Large Employers’ Health Care Strategy and Plan Design Survey

-

Full Report2021 Plan Design Survey: Full Report

-

Executive Summary2021 Plan Design Survey: Executive Summary

-

Infographic2021 Plan Design Survey: Strategic Implications of COVID-19

-

Chart Pack2021 Plan Design Survey: Chart Pack

-

Part 12021 Plan Design Survey: Employer Perspectives on the Health Care Landscape

-

Part 22021 Plan Design Survey: Health Care Strategy, Plan Design and Medical Costs

-

Part 32021 Plan Design Survey: Health Care Delivery System

-

Part 42021 Plan Design Survey: Pharmacy Strategy and Design