August 20, 2021

Produced in partnership with Groom Law Group, Chartered

On July 1, 2021, the Office of Personnel Management, Department of the Treasury, Department of Health and Human Services (“HHS”), and Department of Labor (“DOL”) (collectively, the “Departments”), released the interim final rule, “Requirements Related to Surprise Billing; Part I” (“the IFR”). The IFR generally applies to group health plans and health insurance issuers (collectively for this summary referred to as “plans”) for plan (or policy) years beginning on or after January 1, 2022. The rules apply to health care providers and facilities, as well as providers of air ambulance services, also beginning on January 1, 2022.

This is the first in a series of rules implementing the Consolidated Appropriations Act of 2021’s (“CAA”) surprise billing and transparency requirements. The following chart inventories the CAA provisions relevant to large employer group plans and provides current impressions of possible guidance timing. All provisions will be effective January 1, 2022, but some may not have implementing regulations by that point.

This guidance covers…

No Surprises Act: Balance Billing Protections

- Comments to the IFR due September 7, 2021

Guidance expected prior to January 1, 2022 for CAA provisions covering…

- Independent dispute resolution (IDR) provisions

- Price comparison tools

- Air ambulance reporting

- Advanced explanations of benefits (EOBs)

May not get guidance before the January 1, 2022 implementation deadline

- New section 408(b)(2) disclosure requirements for brokers and consultants,

- Transparency in plan and insurance identification cards,

- Continuity of care,

- Accuracy of provider network directories

- Prohibition on gag clauses, and

- Pharmacy benefit and drug cost reporting

The Departments expect that any provisions for which guidance is not provided prior to the deadline should be implemented by plans using a good faith, reasonable interpretation of the statute once the provisions take effect until the rulemaking is finalized.

The IFR is largely focused on how the surprise billing protections apply to plans, as well as how the Qualified Payment Amount (QPA) is calculated. There are some rules related to the initial payment for surprise billing claims from providers and notices of denial, as well as provider-focused rules (not covered in detail here). The IFR generally hews closely to the CAA’s provisions and provides some clarity regarding the calculation of the QPA amount.

Applicability

The provisions of the IFR generally apply to health plan coverage starting in plan years beginning on or after January 1, 2022. It also applies to indemnity-only plans, though it recognizes certain provisions may not be relevant in that context. The IFR does not apply to health reimbursement arrangements or other account-based plans, plans exempted from the IFR by statute (e.g., excepted benefits), and retiree-only plans.

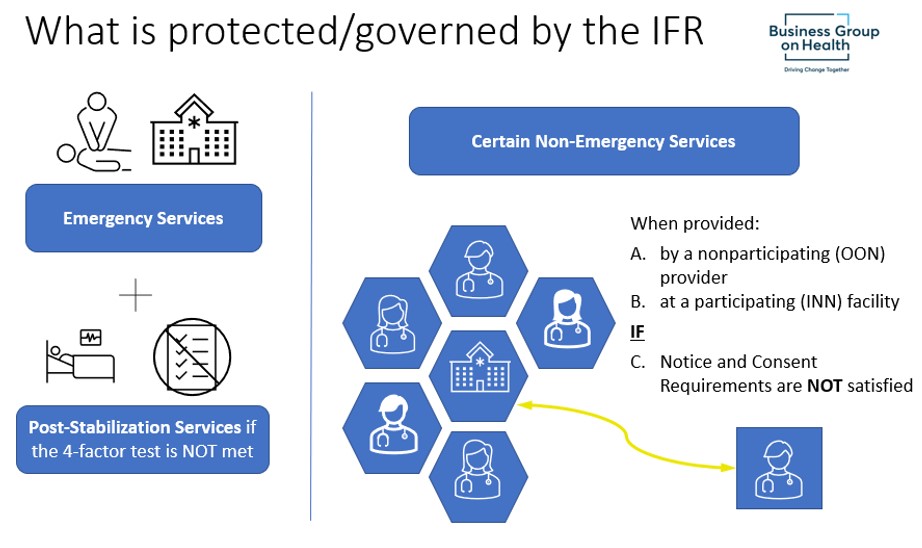

Coverage of Emergency Services

For plans that cover emergency services, the coverage will now have to meet certain additional standards. Among others, emergency services coverage must be provided without regard to whether the provider or facility is a “participating provider” or “nonparticipating provider” (sometimes called “in-network” or “out-of-network”).

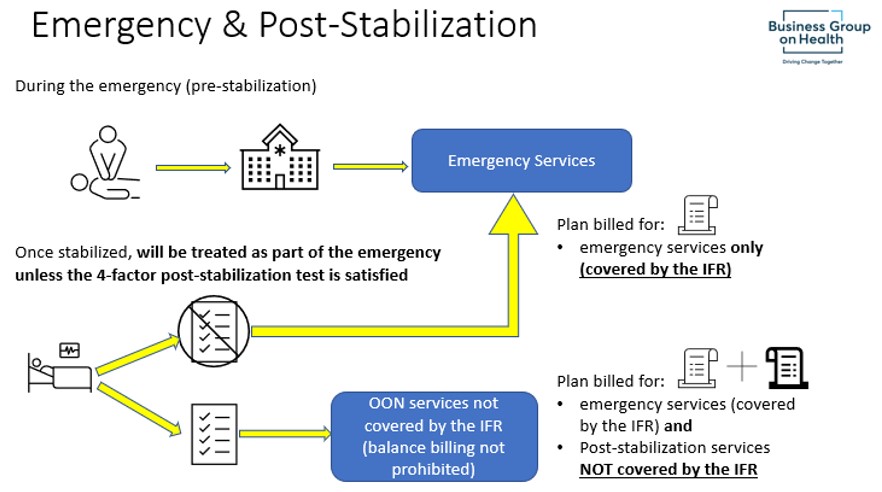

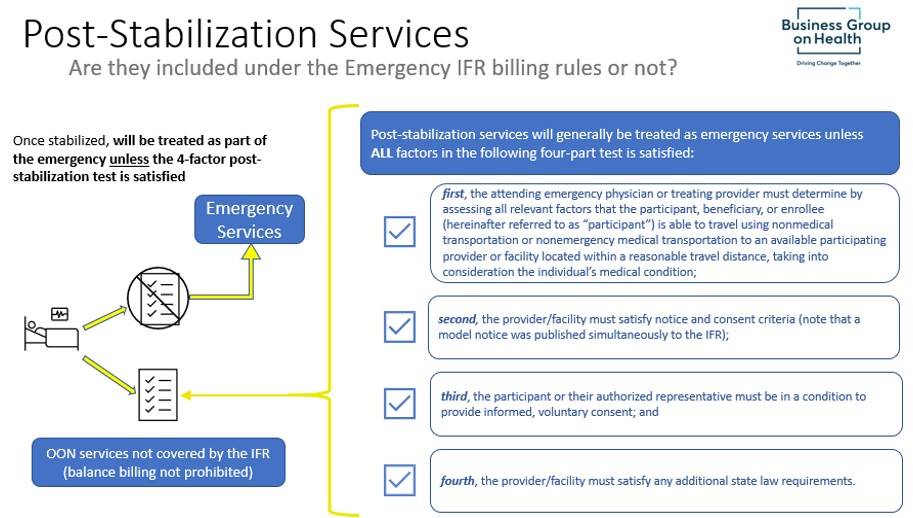

Once the individual requiring emergency services is stabilized, any post-stabilization services will be treated as a continuation of the emergency services (and protected under the IFR) unless the 4-factor test detailed below is met.

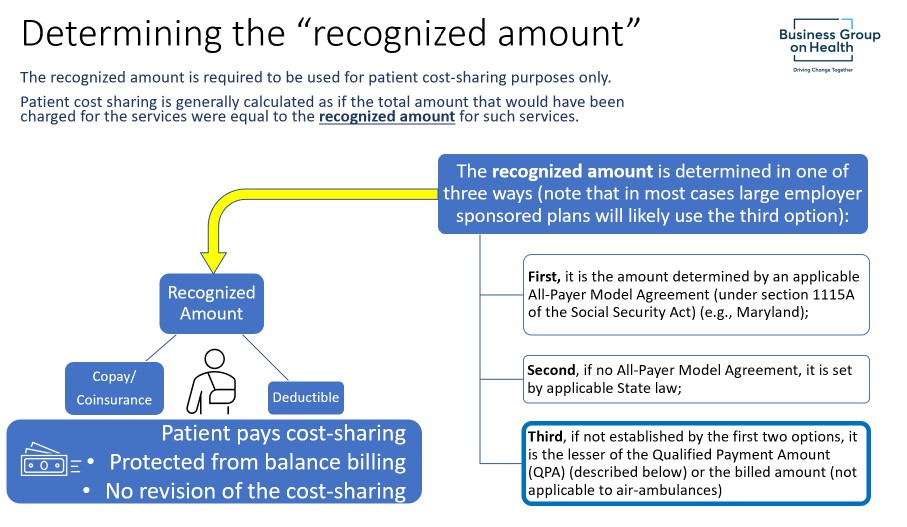

For the individual receiving emergency services: If they are treated by an out-of-network provider, then additional protections require that they be treated the same as in-network for most purposes. A critical difference for the out-of-network emergency services coverage is that the IFR provides a specific “recognized amount” on which the individual’s cost-sharing calculation is based. This is done so that the individual has early certainty about the amount they will have to pay for the emergency services.

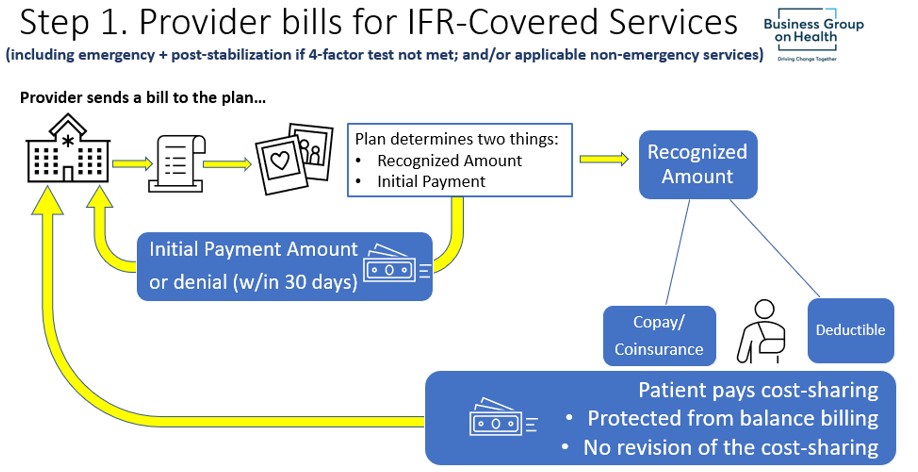

For the plan: Beyond calculating the individual’s cost-sharing using the “recognized amount” (explained below), the plan must generally make an initial payment (or deny payment) to the provider within 30 days of receiving the bill. After the initial payment, the “out-of-network rate” is determined and any payment difference is reconciled.

Notably, the Departments explain that a plan’s denial of a claim for not actually being an emergency cannot be solely based on the final diagnosis code that the provider submits to the plan for payment. Even if the billing code submitted does not indicate that the services were for an emergency, the plan must use a “prudent layperson” standard or point of view based on the patient’s circumstances when considering whether to treat the services as emergency services.

Coverage of Nonemergency Services Provided by Nonparticipating Provider at Participating Facility

The treatment of services in this category generally follow the guidelines under the emergency services rule unless the provider satisfies notice and consent requirements (except for ancillary providers, as discussed below), which could permit the provider to bill outstanding balances to the patient in some circumstances.

If a plan covers items and services (other than emergency services) furnished to a participant by a nonparticipating provider at a participating health care facility, unless the provider has satisfied the notice and consent criteria, the plan:

- 1 | Must not impose cost-sharing greater than would apply if services had been provided by a participating provider;

- 2 | Must calculate the cost-sharing requirements as if the total amount that would have been charged for the items and services by a participating provider were equal to the recognized amount for the items and services;

- 3 | Must make an initial payment within 30 days;

- 4 | Must pay a total plan or coverage payment directly to the nonparticipating provider that is equal to the amount that the out-of-network rate for the items and services involved exceeds the cost-sharing amount for the items and services, less any initial payment amount; and

- 5 | Must count cost-sharing toward in-network deductibles and out-of-pocket maximums.

Details of “Notice and Consent”

The protection from balance billing does not apply when a provider gives notice and receives consent from the participant. Notice and consent can only be sought for certain non-emergency services or certain post-stabilization services. A nonparticipating provider or nonparticipating emergency facility may obtain notice and consent from the individual in order to balance bill for post-stabilization services only in the case where a participant has received emergency services and the individual’s condition has stabilized, and then only if the four-part test for notice and consent, described above, is met.

Notice and consent does not apply to emergency services (pre-stabilization) or air ambulance services. The IFR contains a number of provisions detailing requirements for the notice and consent process, including the use of a standard notice document, who may act as an authorized representative, the precise timing of when notice and consent may be obtained, the standards for consent (including that it may be revoked), and the languages in which the notice must be available. The IFR specifies that notice and consent does not apply to emergency services (with some exceptions for post-stabilization services), specific services that are ancillary and services for an unforeseen urgent medical need. The IFR requires that providers retain notice and consent documents for at least 7 years.

Providers/facilities must timely notify plans when the notice and consent criteria have been satisfied, as well as provide a copy of the consent. The IFR requires plans to assume that notice and consent have not been satisfied if they have not received that notice. If the notice is received, plans are permitted to rely on the notice, unless they know, or reasonably should know, that the notice and consent were not proper.

Both the emergency services and nonemergency services by a nonparticipating provider at a participating facility rules tie their application to defined facilities. For emergency services, there are specific definitions for the emergency department of a hospital, independent freestanding emergency department, and participating and nonparticipating emergency facilities. For the nonparticipating provider at a participating facility rule, there are definitions for health care facilities and participating health care facilities.

Payment Provisions for Plans and Individuals under the IFR

The IFR provides specific timing, amount determinations, and other requirements for claim payments when the services are governed by these rules.

Claim Submission and Initial Payment

What is the “Recognized Amount”?

Plans must base the cost-sharing paid by a participant for items and services subject to the surprise billing rules on the recognized amount, which is an amount that is separate and distinct from the amount that the plan pays the provider.

For emergency services furnished by a nonparticipating emergency facility or provider and for non-emergency services furnished by nonparticipating providers in a participating health care facility, cost sharing is generally calculated as if the total amount that would have been charged for the services were equal to the recognized amount for such services.

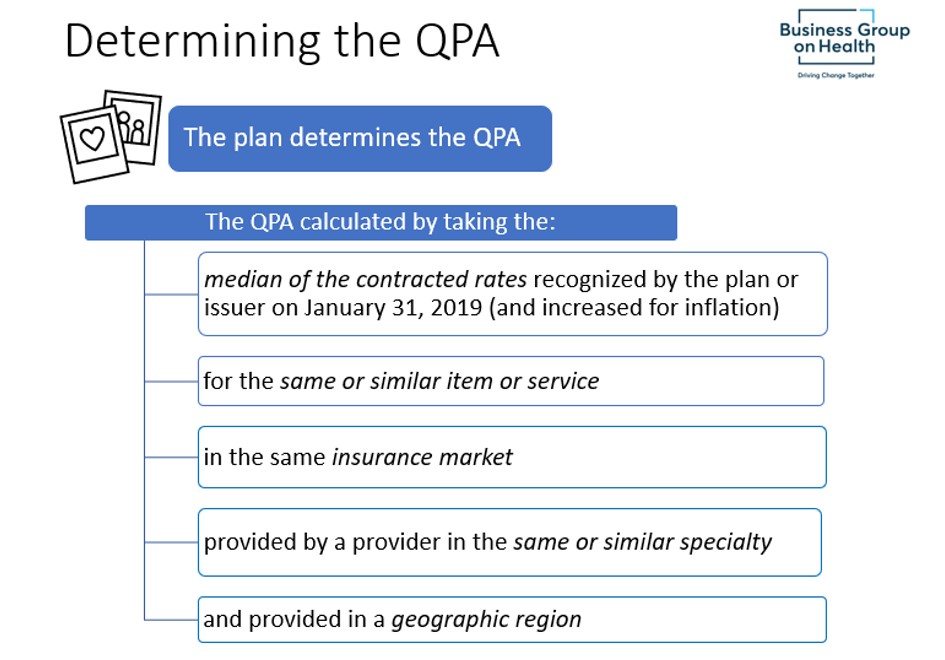

What is the Qualified Payment Amount (QPA)?

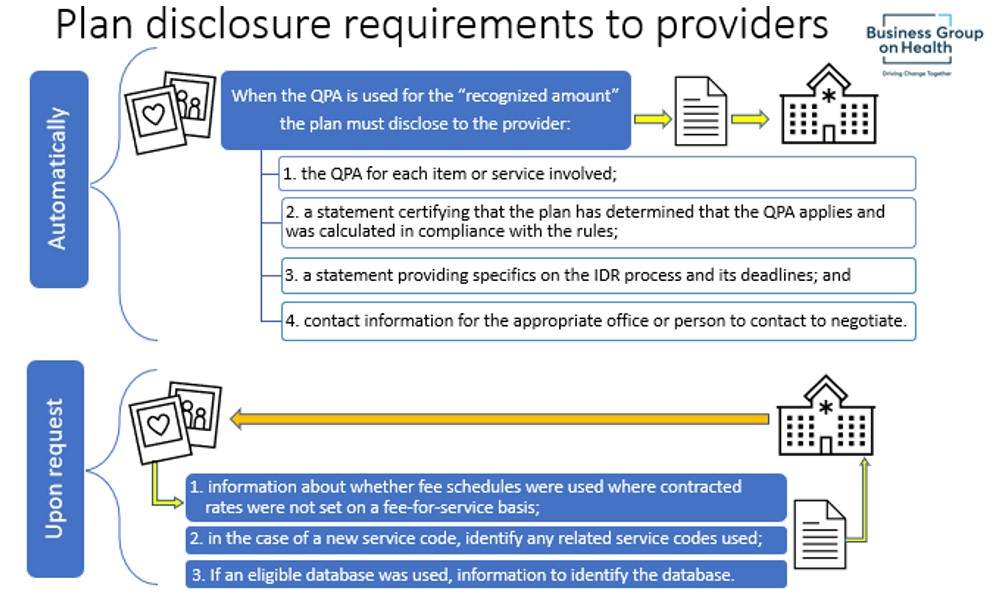

The QPA is a determined amount and used as part of the recognized amount process. The QPA may, but is not required to be, used by the plan or the provider for determining or setting the “out-of-network rate” (described under Step 2). The plan is required to disclose certain QPA information to the provider (detailed to the right).

Each element (italicized) required for the QPA determination is defined in the IFR, and special rules apply where pricing is set by reference to another unit of measure (for example, time or miles). There are very detailed rules about anesthesia, as well as a unique QPA calculation for air ambulance services that, among other requirements, specifies an indexing calculation for the applicable air mileage rate year over year. The IFR also includes detailed instructions for both determining if sufficient information to calculate the QPA is available (general rule is that you need at least three contracted rates) and performing the QPA calculation when there is insufficient information.

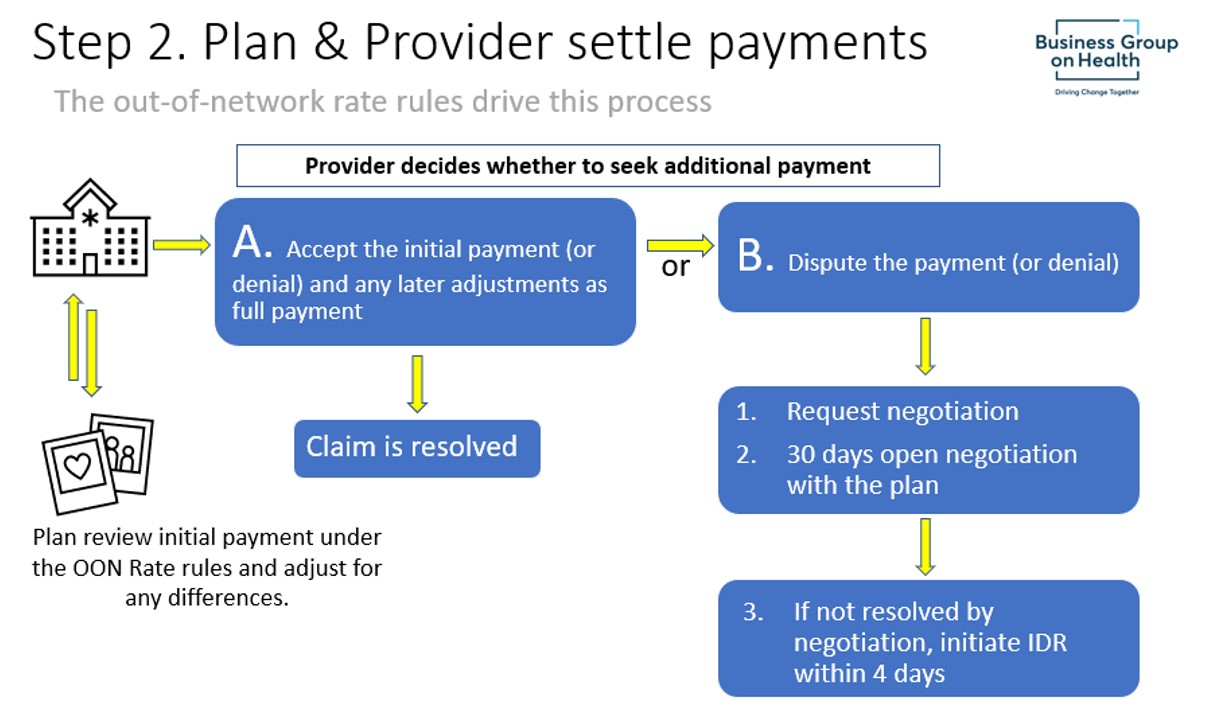

The Plan’s Full Payment Amount to the Provider

The Plan’s Full Payment Amount to the Provider (AKA – resolving the claim; or AKA – determining the “out-of-network rate”)

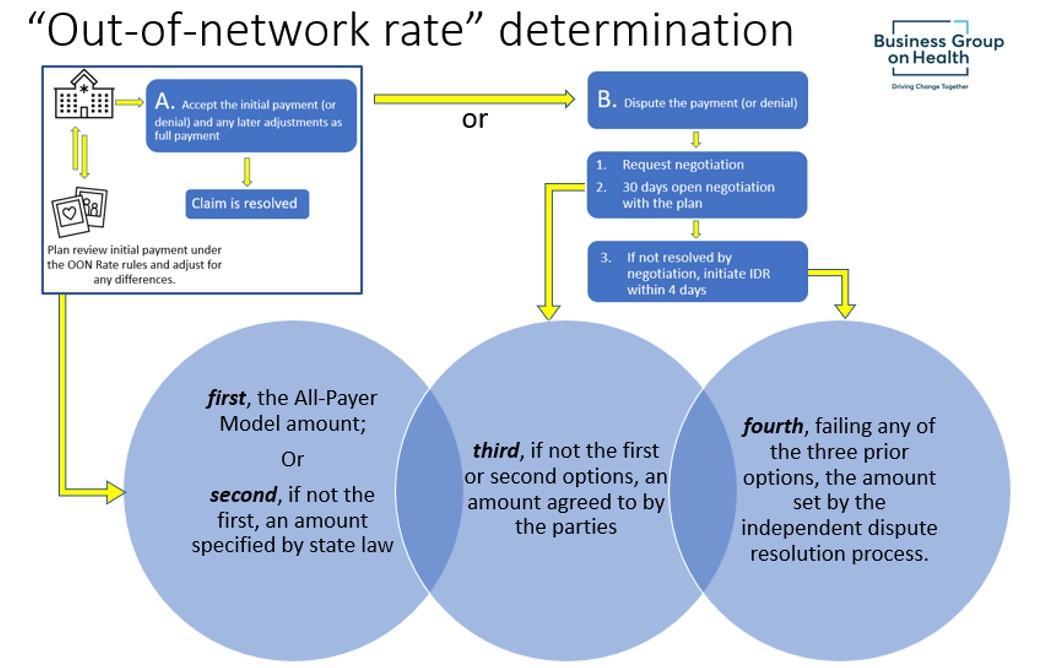

Out-of-Network Rate

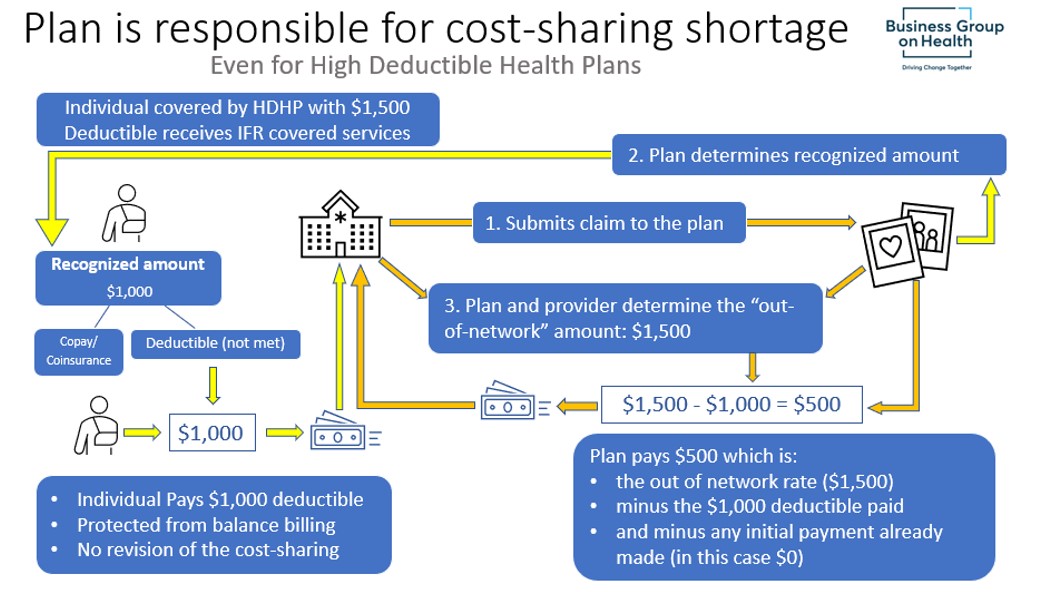

The IFR defines an out-of-network rate as, generally, the total amount paid by a plan for items and services subject to these provisions, without including cost-sharing paid by the individual. Where the out-of-network rate exceeds the amount upon which cost sharing is based, a plan must pay the provider or facility the difference between the out-of-network rate and the cost-sharing amount, even in cases where an individual has not satisfied their deductible. In terms of payment to the provider, the plan must make a total payment equal to one of the following four amounts, less any cost-sharing from the participant, beneficiary, or enrollee:

First, the All-Payer Model amount;

Second, if not the first, an amount specified by state law;

Third, if not the first or second option, an amount agreed to by the parties; and

Fourth, failing any of the three prior options, the amount set by the independent dispute resolution process.

The following is an illustration of how the out-of-network rate determination aligns with finalizing the claim(s) between the plan and the provider.

The plan also makes up any shortage in the difference between the original cost-sharing calculated using the recognized amount and what cost-sharing would have been given the final out-of-network rate.

Special Rule Saving HSA Qualification for HDHPs

The statute provided a special rule for High Deductible Health Plans (“HDHP”) with Health Savings Accounts. If a plan must pay the provider or facility the difference between the out-of-network rate and the cost-sharing amount before the individual has satisfied their deductible, the individual is not treated as ineligible to contribute to an HSA and the plan will continue to be treated as an HDHP.

6. Disclosure Requirements and Model Notice

The IFR also specifies that certain QPA information that must be disclosed to providers.

Participant Disclosures

Plans and issuers are also required to provide certain disclosures to participants about the surprise billing protections. In general, plans will need to make such disclosures publicly available, post on a public website of the plan and include on each explanation of benefits for relevant items or services. The Departments issued model disclosure notices (available through links here) that providers and facilities, as well as plans, may, but are not required to, use.

The Departments may engage in more detailed rulemaking in the future. Until those rules are issued, plans and issuers should “exercise good-faith compliance” with this disclosure provision.

We provide this material for informational purposes only; it is not a substitute for legal advice.

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()