November 27, 2023

Complementing the intensifying focus on genomic science and genetic testing, therapeutic interventions called “gene therapies” have entered the landscape alongside traditional pharmaceutical treatment options. Though these therapies may deliver unprecedented and potentially curative patient success stories, their price tags pose significant cost and plan management concerns. Moreover, their efficacy and effectiveness evidence is only a few years old. We’ve merely scratched the surface of what’s to come in terms of pipeline, long-term durability of clinical outcomes and financial impact to the health system overall, including total cost of care analyses. Nevertheless, with over 1000 gene therapies in clinical development in the U.S.45 and more than 2000 worldwide,4 employers are seeking a broader understanding of these medications and their impact, as well as strategies to maintain sustainable trend while balancing member access.

Click here for a list of currently approved gene therapies on the U.S. market.

Background

Gene therapies are intended to treat, cure or prevent diseases or medical conditions – from certain cancers and viral infections, to those that stem from an unfavorable variation in an individual’s genetic makeup. Such variation – most often the target of gene therapy – could mean that a whole gene or part of a gene is defective or missing from birth or that a mutation occurred due to environmental or lifestyle factors in adult life.

While these therapies have potential to be curative and/or dramatically improve quality of life for patients, long-term outcomes remain largely unknown. Further, while gene therapy is generally well tolerated with a minimal side effect profile, early trials have revealed other clinical considerations, including:

- The potential for an unfavorable immune system reaction (i.e., the body goes into an inflammatory autoimmune attack mode);

- The risk of targeting the wrong cells and damaging them, causing other illness or disease;

- The risk of infection caused by viral delivery; and

- The possibility of tumor growth at the injection site.

Gene Therapy, Cell Therapy, Immunotherapy, CAR-T: What’s the Difference?

Gene therapy is the introduction, removal or change in the content of a person’s genetic code with the goal of treating or curing a disease.

Cell therapy is the transfer of intact, live cells into a patient to help lessen or cure a disease.

Immunotherapy or biological therapy is the treatment of disease by activating or suppressing the immune system.

CAR-T therapies are a type of immunotherapy that makes use of genetically modified T cells. In other words, it uses gene therapy as a means to immunotherapy.

A complex science also brings with it complex clinical hurdles, including:

- The difficulty of delivery in a real-world setting;

- The possibility of needing multiple therapies down the road when the new gene eventually stops being expressed (i.e., gets diluted out); and

- The fact that there is not always a good animal model for testing these new therapies.47

Coverage Sustainability Considerations for Plan Sponsors

- 1 | High prices and ancillary costs: With price tags exceeding a million dollars or more, these therapies increase the volatility of health care expenses and threaten the sustainability of affordable coverage. The price alone is not the whole story, however. The complex administration of these drugs raises a host of additional considerations for employers, leaving payers grappling with how to cover the total cost of these therapies, which often incorporate extended hospital stays and supplementary services and medications.48 In the case of Hemgenix, a gene therapy for adults with Hemophilia B, a one-time injection is priced at $3.5 million.49

- 2 | Gaps in utilization management, transparency and adaptive adjudication: Another cost challenge is adjudication under the medical benefit, as opposed to the pharmacy benefit. When using the medical benefit, standard utilization management and formulary strategies used by pharmacy benefit managers (PBMs) likely will not suffice or even apply in the case of most gene therapies. Further, employers report challenges when it comes to understanding the full picture of drug spend within the medical benefit; a lack of transparency may obscure the ultimate cost of these therapies for plan sponsors. The merging of various PBM and health plan entities may offer future hope for more integrated reporting and effective management of drug costs under the medical benefit, but to date, there remain significant transparency deficiencies for employers. Finally, these treatments do not fit within the current payment system structure – insurers cover specialty drug infusions and episodes of hospital care; they do not handle treatments that combine both.48

- 3 | Record-breaking price tags poised to expand market share: By the year 2025, the Food and Drug Administration (FDA) expects to be approving 10-20 gene and cell therapies annually.50 Therefore, gene therapy claims will increase steadily for plan sponsors in the coming years.

Where Can Employers Expect to See an Increase in Gene Therapy Claims?

Currently, two thirds of all gene therapy trials are targeted toward various types of cancer.7 The remaining pipeline will likely bring new treatments for Parkinson’s, Huntington’s, severe combined immunodeficiency syndrome (SCID), liver disease, heart disease, diabetes, hemophilia, AIDS, and many other conditions.51,52

- 4 | Existing “cost-containment” approaches do not address the real issue: Gene therapies have escalated market conversations about Rx stop-loss or reinsurance, long-term financing and risk pool models. These approaches may provide a temporary respite with respect to price absorption, but they are not true cost-containment measures and ultimately have no impact on list prices. In fact, when asked about these options, the majority (79%) of large employers do not feel confident that they will manage the impact of high-priced therapies.5 Further, while these approaches may alleviate upfront budgeting constraints, employers will still be responsible for rendering payment, be it in the form of high stop-loss premiums, per member per month (PMPM) costs or “mortgage-like” payments for months and years down the road.

Current Plan Management Approaches

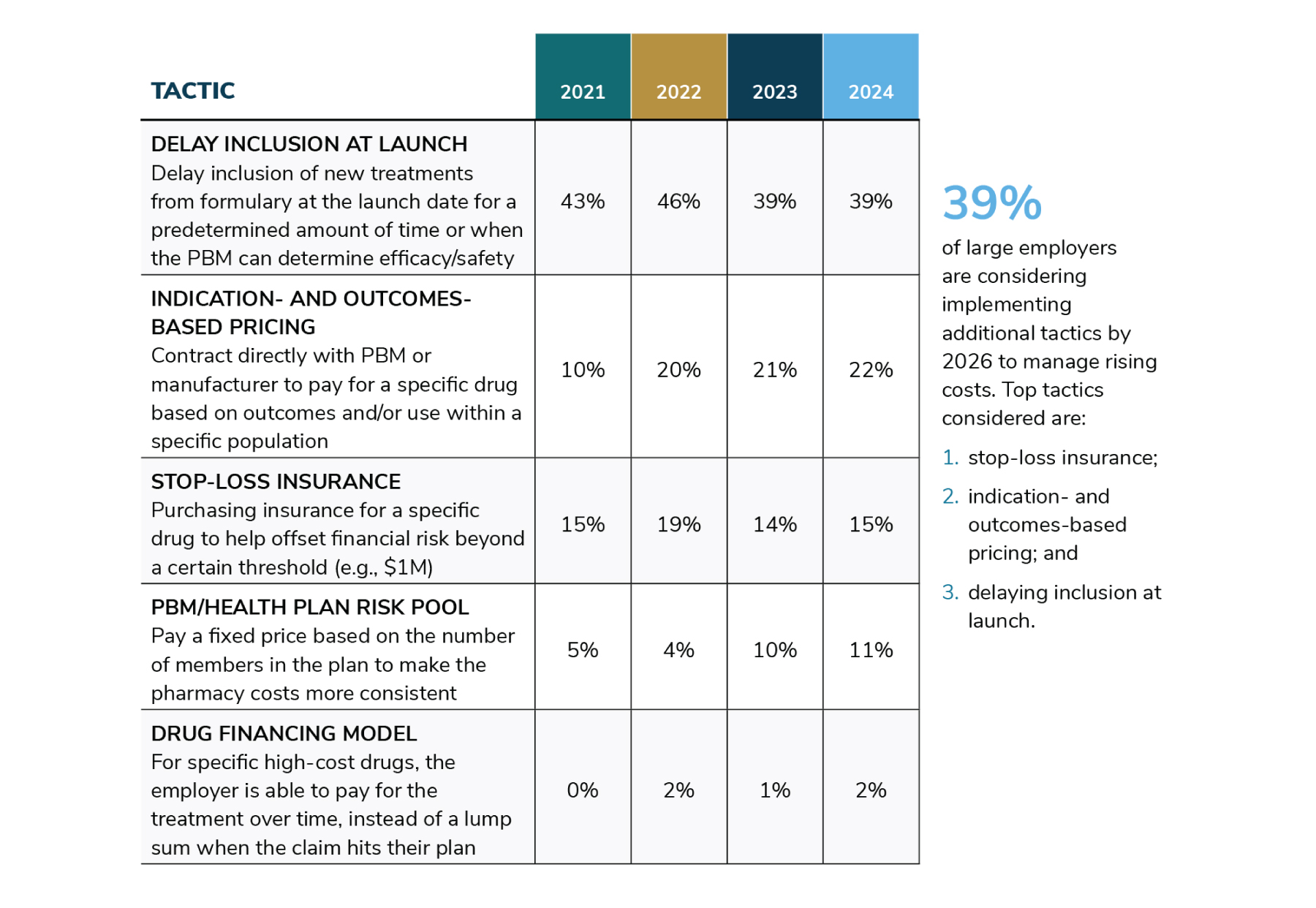

These million-dollar therapies have sparked urgent focus on managing this rising cost for a sustainable coverage environment. When asked about their top pharmacy benefit concern, employers ranked patient and plan affordability of high-cost drugs in the pipeline among top concerns with the top of the list with 92% of respondents either concerned or very concerned according to the 2024 Large Employer Health Care Strategy Survey. When asked how they are currently managing these therapies, responses were as follows (Figure 1):

Source: Business Group on Health. 2024 Large Employer Health Care Strategy Survey. August 22, 2023. https://www.businessgrouphealth.org/resources/2024-large-employer-health-care-strategy-survey-health-and-pharmacy-plan-design. Accessed September 21, 2023.

What Can More Employers be Doing?

- Monitor the gene therapy pipeline and request that plan partners provide:

- Advanced notification when an anticipated high-priced therapy may come to market; and

- Their evaluative strategy related to the therapy’s safety, efficacy, as well as the plan’s coverage considerations.

- Evaluate the potential prevalence of plan exposure via eligible member claims for products as early as possible, working with plan partners.

- Monitor drug spend under the medical benefit carefully and request full transparency on price, discount and/or rebate negotiations that may be taking place with respect to these therapies.

- Create urgency with plan partners on integrated total cost of care forecasting and implications.

- Ask plan partners what considerations are to be made relative to Centers of Excellence and bundled payments for the administration and follow-up of complex therapies.

- Ask what value-based, outcomes-based and/or risk-sharing payment models plan partners are considering with manufacturers, keeping in mind the following:

- Definitions of value vary by stakeholder, and stakeholder measurements are exceedingly complex;

- Long-term durability of curative efficacy may warrant contracts that allow for extended outcome evaluation periods; and

- Value-based arrangements often leverage manufacturer rebates as a form of payer repayment, but the majority of gene therapies may be adjudicated through the medical benefit, where rebates are less prevalent.

More Topics

Articles & Guides- 1 | National Institutes of Health. NIH Fact Sheets. Genetic Testing: How It Is Used for healthcare. June 30, 2018. https://archives.nih.gov/asites/report/09-09-2019/report.nih.gov/nihfactsheets/ViewFactSheetef83.html. Accessed December 2, 2020.

- 2 | Halbisen AL, Lu CY. Trends in Availability of Genetic Tests in the United States, 2012-2022. J Pers Med. 2023;13(4):638. Published 2023 Apr 6. doi:10.3390/jpm13040638. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10142561/. Accessed September 20, 2023.

- 3 | U.S. Food & Drug Administration. Approved Cellular and Gene Therapy Products. June 30, 2023. https://www.fda.gov/vaccines-blood-biologics/cellular-gene-therapy-products/approved-cellular-and-gene-therapy-products. Accessed September 20, 2023.

- 4 | Hunt, T. The Cell And Gene Therapy Sector in 2023: A Wave Is Coming - Are We Ready? January 9, 2023. https://invivo.pharmaintelligence.informa.com/IV146781/The-Cell-And-Gene-Therapy-Sector-In-2023-A-Wave-Is-Coming--Are-We-Read. Accessed September 23, 2023.

- 5 | Business Group on Health. 2024 Large Employer Health Care Strategy Survey. August 22, 2023. https://www.businessgrouphealth.org/resources/2024-large-employer-health-care-strategy-survey-intro. Accessed September 20, 2023.

- 6 | Informed DNA. Cost & Delivery Institute Presentation: Genetic Benefits Management: Best Practices. January 22, 2020.

- 7 | Hauser D, Obeng A, Fei K et al. Views of primary care providers on testing patients for genetic risks for common chronic diseases. Health Affairs. 2018 May;37(5):793-800. https://www.healthaffairs.org/doi/10.1377/hlthaff.2017.1548. Accessed December 5, 2020.

- 8 | Brodwin E. After you spit into a tube for a DNA test like 23andMe, experts say you shouldn’t assume your data will stay private forever. Business Insider. February 16, 2019. https://www.businessinsider.com/privacy-security-risks-genetic-testing-23andme-ancestry-dna-2019-2. Accessed December 5, 2020.

- 9 | Hendricks-Sturrup R, Prince AER, Lu CY. Direct-to-consumer genetic testing and potential loopholes in protecting patient privacy and nondiscrimination. JAMA. 2019, 32(19): 1869-1870.https://jamanetwork.com/journals/jama/fullarticle/2731672?widget=personalizedcontent&previousarticle=2706179. Accessed December 5, 2020.

- 10 | Medline Plus. Genetic Testing. September 10, 2020. https://medlineplus.gov/genetics/understanding/testing/. Accessed December 5, 2020.

- 11 | National Society of Genetic Counselors. 2023 Professional Status Survey. 2023. https://www.nsgc.org/Portals/0/2023%20PSS%20Executive%20Summary.pdf. Accessed September 20, 2023.

- 12 | Phillips KA, Deverka PA. The emerging use by commercial payers of third-party lab benefit managers for genetic testing. Health Affairs Blog. October 23, 2019. https://www.healthaffairs.org/do/10.1377/hblog20191021.563154/full/. Accessed December 5, 2020.

- 13 | American Clinical Laboratory Association. Economic Impact of Clinical Labs. https://www.acla.com/economic-impact-of-clinical-labs/. Accessed December 5, 2020.

- 14 | Swetlitz I. Genetic tests ordered by doctors race to market, while ‘direct-to-consumer’ tests hinge on FDA approval. STAT. March 16, 2018. https://www.statnews.com/2018/03/16/genetic-tests-fda-regulation/. Accessed December 5, 2020.

- 15 | Phillips KA, Deverka PA, Hooker GW et al. Genetic testing availability and spending: Where are we now? Where are we going? Health Affairs. 2018 May; 37(5): 710-716. https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2017.1427. Accessed December 5, 2020.

- 16 | Healthcare Fraud Prevention Partnership. White Paper: Genetic Testing: Fraud, Waste & Abuse. July 2020. https://www.cms.gov/files/document/hfpp-genetic-testing-fwa-white-paper.pdf. Accessed December 5, 2020.

- 17 | National Cancer Institute at the National Institutes of Health. Multiple-gene panel test. https://www.cancer.gov/publications/dictionaries/genetics-dictionary/def/multiple-gene-panel-test. Accessed December 5, 2020.

- 18 | American College of Obstetricians and Gynecologists (ACOG). Carrier Screening in the Age of Genomic Science. March 2017. https://www.acog.org/clinical/clinical-guidance/committee-opinion/articles/2017/03/carrier-screening-in-the-age-of-genomic-medicine. Accessed December 5, 2020.

- 19 | United States Preventive Services Task Force (USPSTF). Final Recommendation Statement: BRCA-Related Cancer: Risk Assessment, Genetic Counseling, and Genetic Testing. August 20, 2019. https://www.uspreventiveservicestaskforce.org/Page/Document/RecommendationStatementFinal/brca-related-cancer-risk-assessment-genetic-counseling-and-genetic-testing. Accessed July 8, 2020.

- 20 | Nelson HD, Huffman LH, Fu R, Harris EL, Walker M, Bougatsos C. Genetic risk assessment and BRCA mutation testing for breast and ovarian cancer susceptibility. Agency for Healthcare Research and Quality (US); September 2005. https://pubmed.ncbi.nlm.nih.gov/20722133/. Accessed December 5, 2020.

- 21 | American College of Obstetricians and Gynecologists (ACOG). Carrier Screening FAQs. October 2020. https://www.acog.org/patient-resources/faqs/pregnancy/carrier-screening. Accessed December 5, 2020.

- 22 | Molteni M. 23andMe’s new diabetes test has experts asking who it’s for. Wired. March 10, 2019. https://www.wired.com/story/23andmes-new-diabetes-test-has-experts-asking-who-its-for/. Accessed December 5, 2020.

- 23 | Catalyst for Payment Reform. How-to Guide: Unraveling Genetic Testing Benefits. December 2018. https://www.catalyze.org/product/value-genetic-testing-benefits/. Accessed December 5, 2020.

- 24 | Mayo Clinic. Pharmacogenomics Finding the Right Medication for You. 2013. https://mcforms.mayo.edu/mc1200-mc1299/mc1205-70.pdf. Accessed on December 5, 2020.

- 25 | Aon. Evidence-based Benefit Design Committee Presentation: Introduction to Human Genomics. February 13, 2019.

- 26 | Centers for Disease Control and Prevention (CDC). Mental Health Conditions: Depression and Anxiety. August 6, 2020. https://www.cdc.gov/tobacco/campaign/tips/diseases/depression-anxiety.html. Accessed December 5, 2020.

- 27 | Grohol JM. Gene testing for antidepressants & psychotropics: Not there yet. PsychCentral Blog. December 6, 2019. https://psychcentral.com/blog/gene-testing-for-antidepressants-psychotropics-not-there-yet/. Accessed December 5, 2020.

- 28 | Jørgensen JT, Hersom M. Companion diagnostics—a tool to improve pharmacotherapy. Ann Transl Med. 2016 Dec; 4(24): 482. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5233535/. Accessed December 5, 2020.

- 29 | U.S. Food & Drug Administration (FDA). Companion Diagnostics. December 7, 2018. https://www.fda.gov/medical-devices/vitro-diagnostics/companion-diagnostics. Accessed December 5, 2020.

- 30 | FDA. List of Cleared or Approved Companion Diagnostic Devices (In Vitro and Imaging Tools). November 16, 2020. https://www.fda.gov/medical-devices/vitro-diagnostics/list-cleared-or-approved-companion-diagnostic-devices-vitro-and-imaging-tools. Accessed December 5, 2020.

- 31 | Jørgensen JT. Companion & Complementary Diagnostics: Clinical and Regulatory Perspectives. Dx-Rx Institute Presentation at Workshop on Companion Diagnostics. January 31, 2017. https://biomarkers.dk/fileadmin/user_upload/Editor/Files/Niels/Biomarkers/events/Jan_2017/Jan_170127_-_Companion_and_Complemnetary_Diagnostics.pdf. Accessed December 5, 2020.

- 32 | Levy B. . Clinical Progress and Coverage Policies in Immuno-Oncology. Episode 1: Existing Treatment Landscape of Immunotherapies. July 28, 2016. https://www.ajmc.com/insights/clinical-progress-and-coverage-policies-in-immuno-oncology/distinguishing-between-companion-and-complementary-diagnostic-tests. Accessed December 5, 2020.

- 33 | Vassy JL, Bates D, Murray M. Appropriateness: A key to enabling the use of genomics in clinical practice? The American Journal of Medicine. 2016 Jun; 129(6): 551-553. https://www.amjmed.com/article/S0002-9343(16)30198-X/pdf. Accessed December 5, 2020.

- 34 | CDC. Genomics & Precision Health: Evaluating Genomic Tests. September 20, 2019. https://www.cdc.gov/genomics/gtesting/index.htm. Accessed December 5, 2020.

- 35 | Genomics Education Programme (NHS). What is NIPT? December 18, 2017. https://www.genomicseducation.hee.nhs.uk/blog/what-is-nipt/. Accessed December 5, 2020.

- 36 | National Human Genome Research Institute (NHGRI). Noninvasive Prenatal Genetic Testing. April 17, 2018. https://www.genome.gov/dna-day/15-ways/noninvasive-prenatal-genetic-testing. Accessed December 5, 2020.

- 37 | ACOG. Prenatal Genetic Screening Tests FAQs. October 2020. https://www.acog.org/patient-resources/faqs/pregnancy/prenatal-genetic-screening-tests. Accessed December 5, 2020.

- 38 | Medline Plus. Genetics. August 31, 2020. https://ghr.nlm.nih.gov/primer/newbornscreening/nbscost . Accessed December 8, 2020.

- 39 | Mayo Clinic. Genetic Testing. https://www.mayoclinic.org/tests-procedures/genetic-testing/about/pac-20384827. Accessed December 5, 2020.

- 40 | American Association for the Advancement of Science (AAAS). Research supports expanding insurance coverage of non-invasive prenatal testing. Press Release. October 8, 2019. https://www.eurekalert.org/pub_releases/2019-10/uoca-rse100819.php. Accessed December 5, 2020.

- 41 | United Healthcare. Carrier Testing for Genetic Diseases – Commercial Medical Policy. Effective Date: July 1, 2020. https://www.uhcprovider.com/content/dam/provider/docs/public/policies/comm-medical-drug/carrier-testing-for-genetic-diseases.pdf. Accessed December 5, 2020.

- 42 | Cigna. Genetic Testing for Reproductive Carrier Screening and prenatal Diagnosis – Medical Coverage Policy. Effective Date: December 15, 2019. https://static.cigna.com/assets/chcp/pdf/coveragePolicies/medical/mm_0514_coveragepositioncriteria_genetic_testing_repro_carrier_prenatal.pdf. Accessed December 5, 2020.

- 43 | Rose S, Chun C. The test that saved my sister’s life and my own. Healthline Blog. July 27, 2020. https://www.healthline.com/health/breast-cancer/brca-gene-test-saved-my-life. Accessed December 5, 2020.

- 44 | Filipski KK, Mechanic LE, LongR et al. Pharmacogenomics in oncology care. Front Genet. 2014; 5:73. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3986526/. Accessed December 5, 2020.

- 45 | U.S. National Library of Medicine. ClinicalTrials.gov. 2020. https://clinicaltrials.gov/ct2/results?term=%22gene+therapy%22+OR+%22gene+transfer%22+OR+%22virus+delivery%22&Search=Apply&recrs=b&recrs=a&age_v=&gndr=&type=&rslt=. Accessed December 5, 2020.

- 46 | Blue Cross Blue Shield Association (BCBSA). Evidence-based Benefit Design Committee Presentation: Genetic Testing in Precision Medicine Presentation. February 13, 2019.

- 47 | McCray PB Jr. Difficulties of gene therapy. The Lancet Supplement. 2001 https://www.thelancet.com/pdfs/journals/lancet/PIIS0140673601070325.pdf. Accessed December 5, 2020.

- 48 | Rockoff JD. The million-dollar cancer treatment. Who will pay? The Wall Street Journal. April 26, 2018. https://www.wsj.com/articles/the-million-dollar-cancer-treatment-no-one-knows-how-to-pay-for-1524740401. Accessed December 5, 2020.

- 49 | LifeSciencesIntelligence. The Top 5 Most Expensive FDA-Approved Gene Therapies. May 24, 2023. https://lifesciencesintelligence.com/features/the-top-5-most-expensive-fda-approved-gene-therapies#:~:text=Zolgensma%2C%20and%20Luxturna.-,Hemgenix,as%20congenital%20factor%20IX%20deficiency. Accessed September 20, 2023.

- 50 | FDA. Statement from FDA Commissioner Scott Gottlieb, M.D. and Peter Marks, M.D., Ph.D., Director of the Center for Biologics and Evaluation and Research on new policies to advance development of safe and effective cell and gene therapies. January 15, 2019.https://www.fda.gov/news-events/press-announcements/statement-fda-commissioner-scott-gottlieb-md-and-peter-marks-md-phd-director-center-biologics. Accessed December 5, 2020.

- 51 | American Society of Gene & Cell Therapy. Annual meeting.ASGCT - American Society of Gene & Cell Therapy | ASGCT - American Society of Gene & Cell Therapy. Accessed December 8, 2020.

- 52 | Buckles S. Gene therapy: Potential and pitfalls. Mayo Clinic blog. November 19, 2018. https://individualizedmedicineblog.mayoclinic.org/2018/11/19/gene-therapy-potential-and-pitfalls/. Accessed on December 5, 2020.

- 53 | Business Group on Health. Quick Survey: Genetic Testing Benefit Offering. February 21, 2020. https://www.businessgrouphealth.org/resources/genetic-testing-benefit-offerings-quick-survey. Accessed December 5, 2020.

- 54 | Ugalmugle S, Swain R. Genetic Testing Market Size by Test Type (Predictive Testing, Carrier Testing, Prenatal and New-born Testing, Diagnostic Testing, Pharmacogenomic Testing, Nutrigenomic Testing), By Application (Cancer, Genetic Disease, Cardiovascular Disease), Industry Analysis Report, Regional Outlook, Application Potential, Competitive Market Share & Forecast, 2020 – 2026. Global Market Insights. February 2020. https://www.gminsights.com/industry-analysis/genetic-testing-market. Accessed December 5, 2020.

-

IntroEmployers’ Guide to Precision Medicine: Genetic Testing, Treatments and Implications for Coverage

-

Section 1Genetic Testing and Treatments: Key Challenges and Recommendations for Employers

-

Section 2Genetic Counseling and Benefit Management: New Partnerships Emerge

-

Section 3Genetic Testing Landscape

-

Section 4Key Applications of Genetic Testing in Reproductive Health and Oncology

-

Section 5Gene Therapy: Key Considerations for Employers

-

Section 6Deep Dive into Pharmacogenomics: Deploying Precision Medicine in Drug Prescribing

This content is for members only. Already a member?

Login

![]()