August 23, 2022

Looking for the latest data?

Check out our 2024 Large Employer Health Care Strategy Survey, released in August 2023.

Key Takeaways

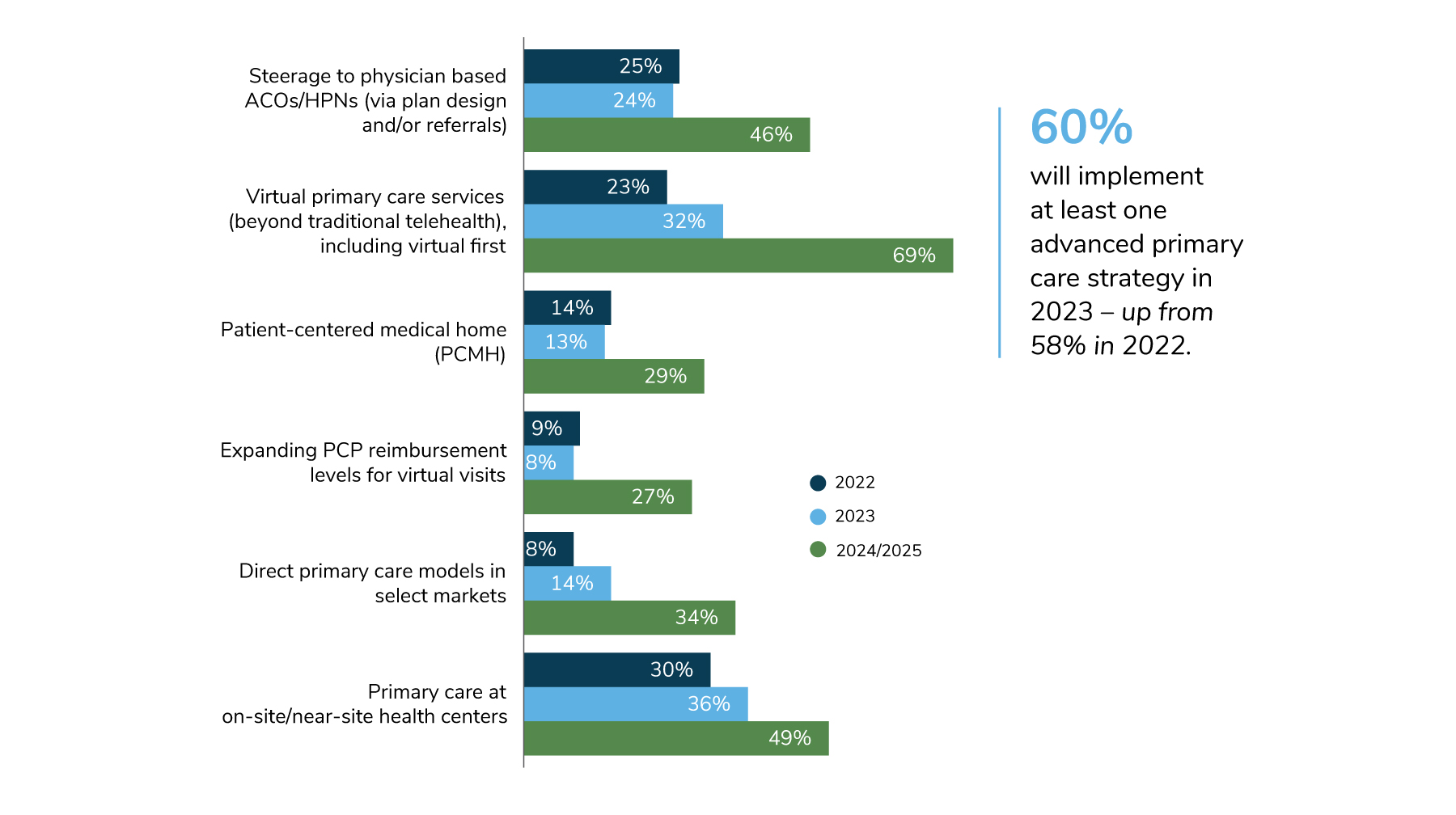

- Sixty percent of large employers will deploy an advanced primary care model in 2023. Virtual primary care is garnering the most interest.

- Access is the top mental health priority for employers, followed by stigma.

- Virtual health for specific conditions (e.g., musculoskeletal, reproductive health) continues to see growth in 2023 and further into the future.

- In 2023, on-site clinics are rebounding as more employees return to the worksite. Clinics will maintain some of the changes made during the pandemic.

Advanced Primary Care Goes Virtual

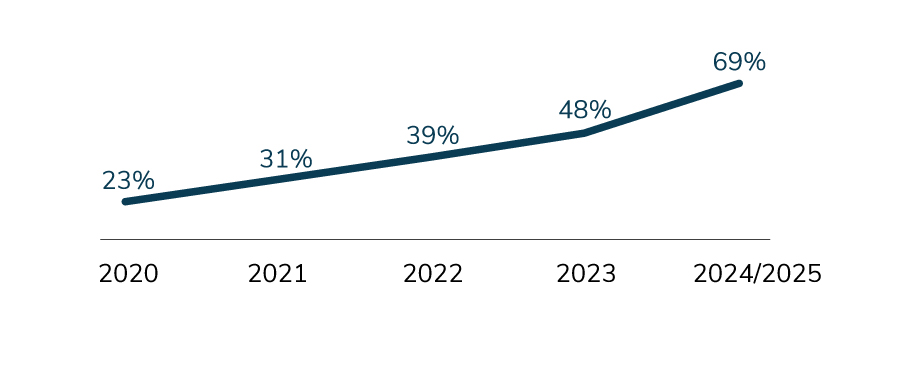

Employers continue to look to new ways to deliver primary care in recognition of its importance in improving and maintaining employee health. Virtual primary care services, including a “virtual first” model, are slated to experience the most potential growth between 2022 (23%) and 2025 (69%) – an upward swing of 46 percentage points. In addition, employers will continue to leverage their on-site clinics as primary care sites; in fact, as many as half of employers could offer primary care at the worksite in the coming years (Figure 3.1).

Cancer Screenings Gain Traction

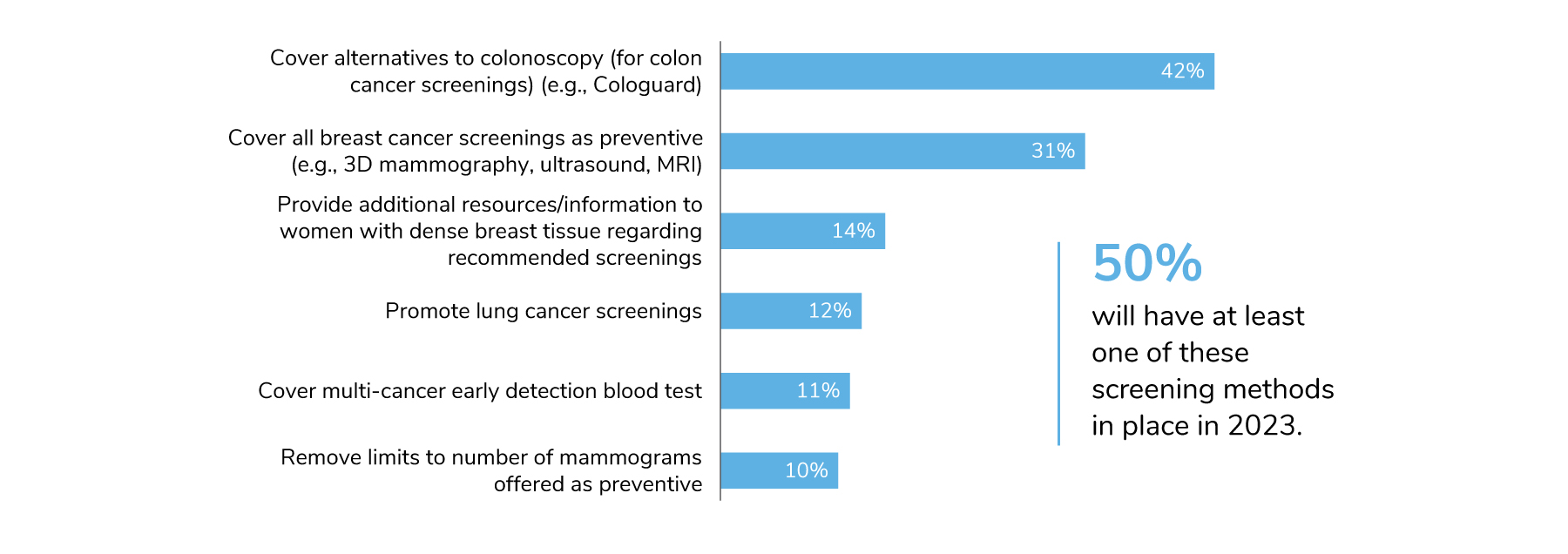

Given the concern and potential impacts of delayed care on cancer risk, the survey included a new question this year on cancer screening measures. Specifically, employers were asked which screenings they were promoting or covering beyond those recommended by the U.S. Preventive Services Taskforce. The two that stood out were alternatives to colonoscopies and a more expansive definition of preventive care for breast cancer screenings; 42% and 31% of employers, respectively, will put those in place for 2023.

Colonoscopies are a time-consuming and often inconvenient procedure that require outpatient care. At-home screenings have come to the market as an alternative. The advantage of these screenings is that not only do they save time and money but also widen accessibility to those who may have avoided traditional colonoscopies in the past. Relative to breast cancer, not all screening methods are deemed as preventive, which may lead to some women paying out-of-pocket should they need a 3D mammogram, ultrasound or MRI.

While not as common, multi-cancer early detection blood tests will be covered by 11% of employers. These blood tests are less invasive and offer the promise of detecting more cancers at earlier stages, potentially reducing the number of late-stage cancers, improving outcomes and reducing cost of treatment. (Figure 3.2).

Mental Health Remains Front and Center

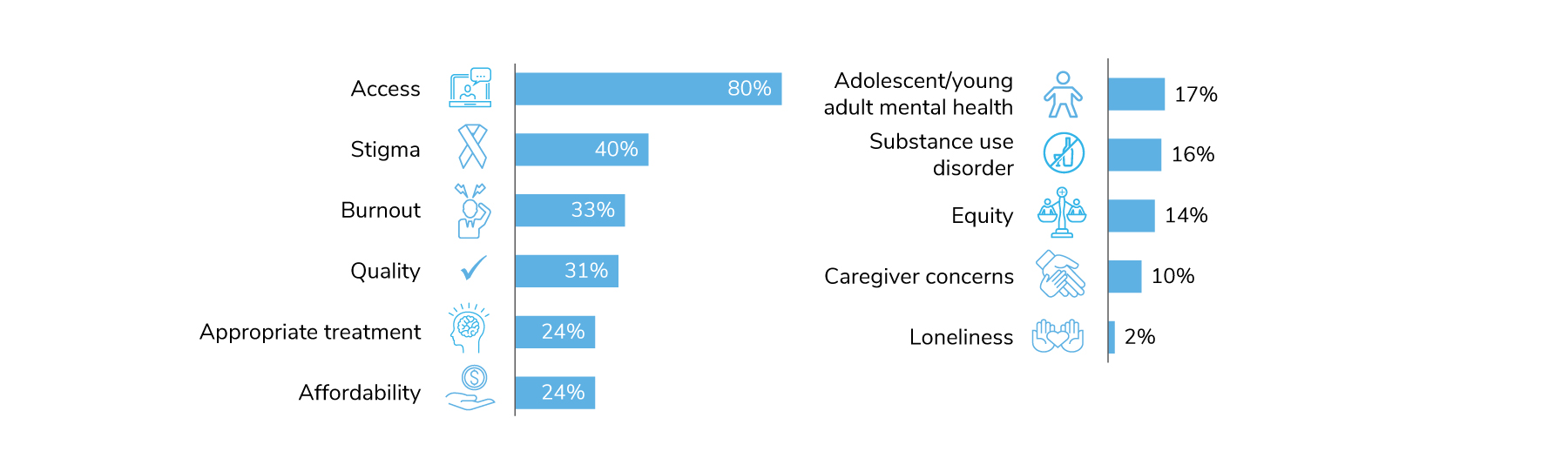

Employers continue to focus on meeting the mental health care needs of employees for 2023. When asked to select their top three mental health focus areas, eight in ten employers selected improving access to mental health services, making it the top mental health priority for employers in the coming year. Stigma continues to concern employers, and 40% will be concentrating on it in 2023.

Burnout comes in at number three for top priorities, as 33% of employers will actively address this well-being issue in 2023 (Figure 3.3). Employers can address burnout at the organizational and individual levels, including by offering flexibility in scheduling, creating a sense of community among employees and providing stress reduction and resiliency programs and tools.

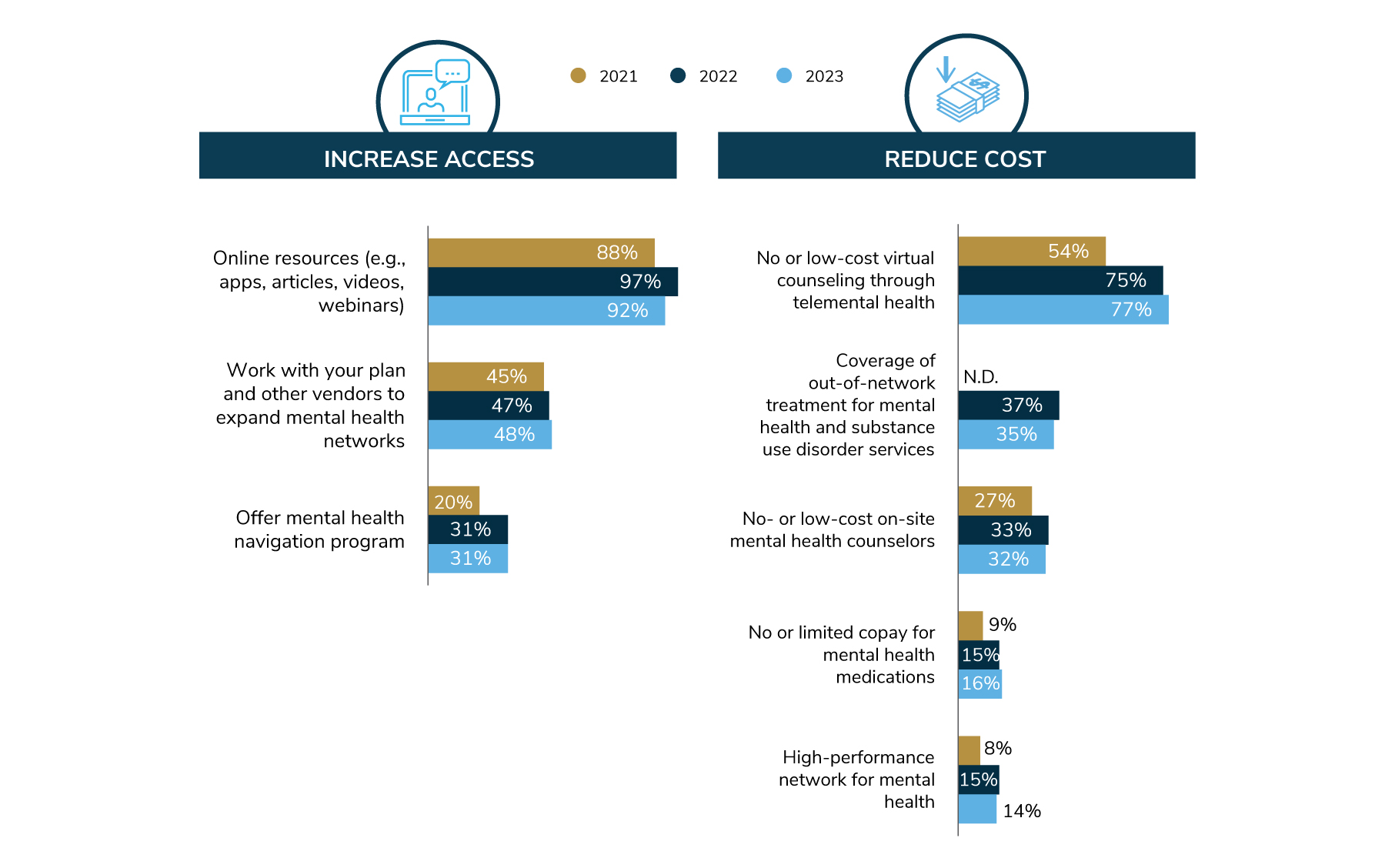

The most common approach to addressing access in the coming year is to provide online resources like apps, articles, videos and webinars, as 92% will do in 2023 (Figure 3.4). Expanding mental health networks is on the docket for 48% of employers, followed by a mental health navigation program at 31%.

A critical component of access is the ability to pay for services, and employers are working to make mental health more affordable. As seen in Figure 3.4, 77% of employers will offer no- or low-cost virtual counseling. Interestingly, this approach came into prominence in 2022 and appears to be maintained even as the impacts of the pandemic dissipate. Other strategies, although less common, include covering out-of-network providers and bringing providers on-site, which will be adopted by about one third of employers.

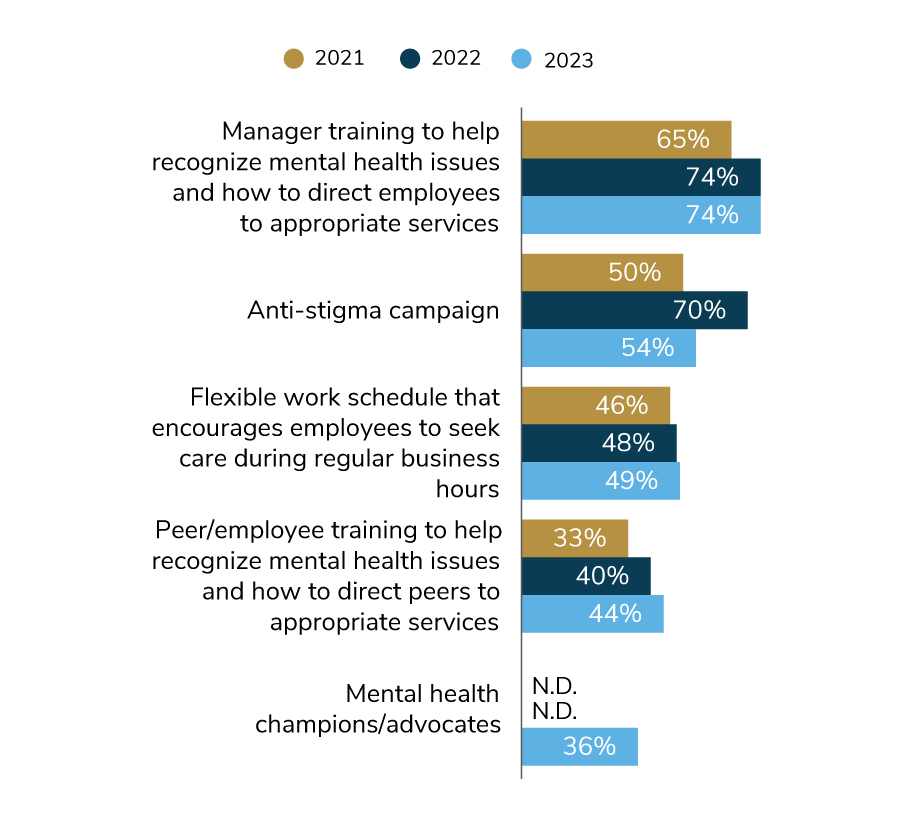

When it comes to addressing topics like stigma and burnout, employers are deploying a number of campaigns and trainings, as detailed in Figure 3.5. In recent years, conducting manager trainings has become the preeminent approach in this area. By helping managers recognize a mental health risk (like suicide ideation) and learn how to direct employees to help, companies can raise awareness and expand their network of individuals who can support employee mental health. Similar trainings directed to peers were also offered by employers, but much less frequently; 44% of companies are doing so. Additionally, 36% of employers have a mental health champion/advocate network to spread the word about the benefits available and be the voice of employees’ mental health needs.

The number of employers that will run an anti-stigma campaign declined, down to 54% in 2023 from 70% in 2022. There are many possible reasons behind this change, including the timing of other priorities like return-to-worksite or even employers noting progress on combatting negative associations with mental health. Lastly, about the same number of employers will allow employees to flex their schedule to seek mental health care during regular business hours (49% in 2023).

Widespread Virtual Health Programs Call for Coordination

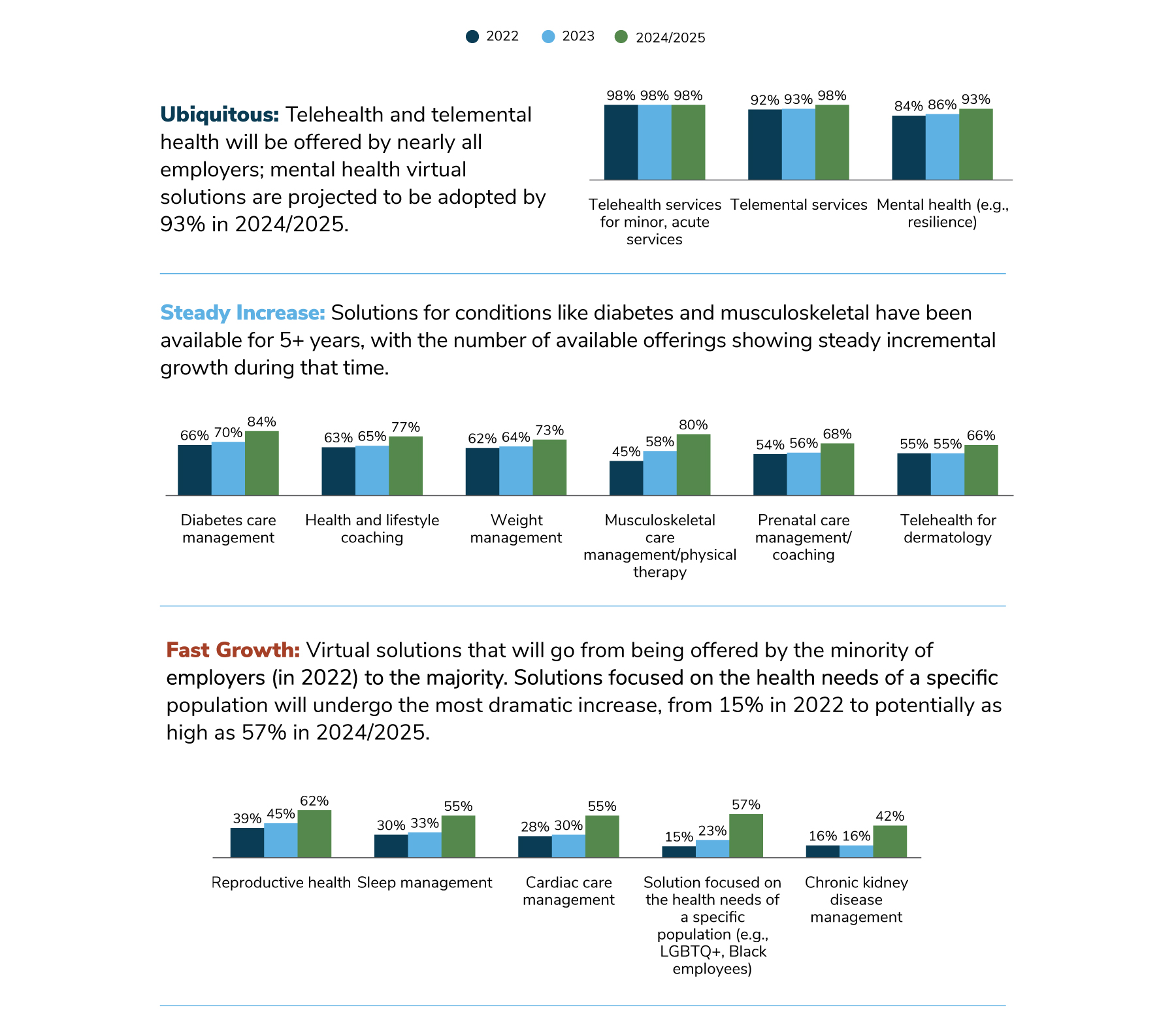

Virtual health is here to stay, undermining claims that its popularity was a pandemic driven blip. In actuality, the momentum behind telehealth and digital solutions has been building for a long time. As detailed in Part 1, nearly all (94%) employers will maintain their telehealth and virtual health offerings put in place during the pandemic.

The time is right for taking a closer look at virtual health to understand how employers are contracting and implementing these solutions. The employee experience is a critical component of success, an important reason why many employers are leveraging engagement platforms.

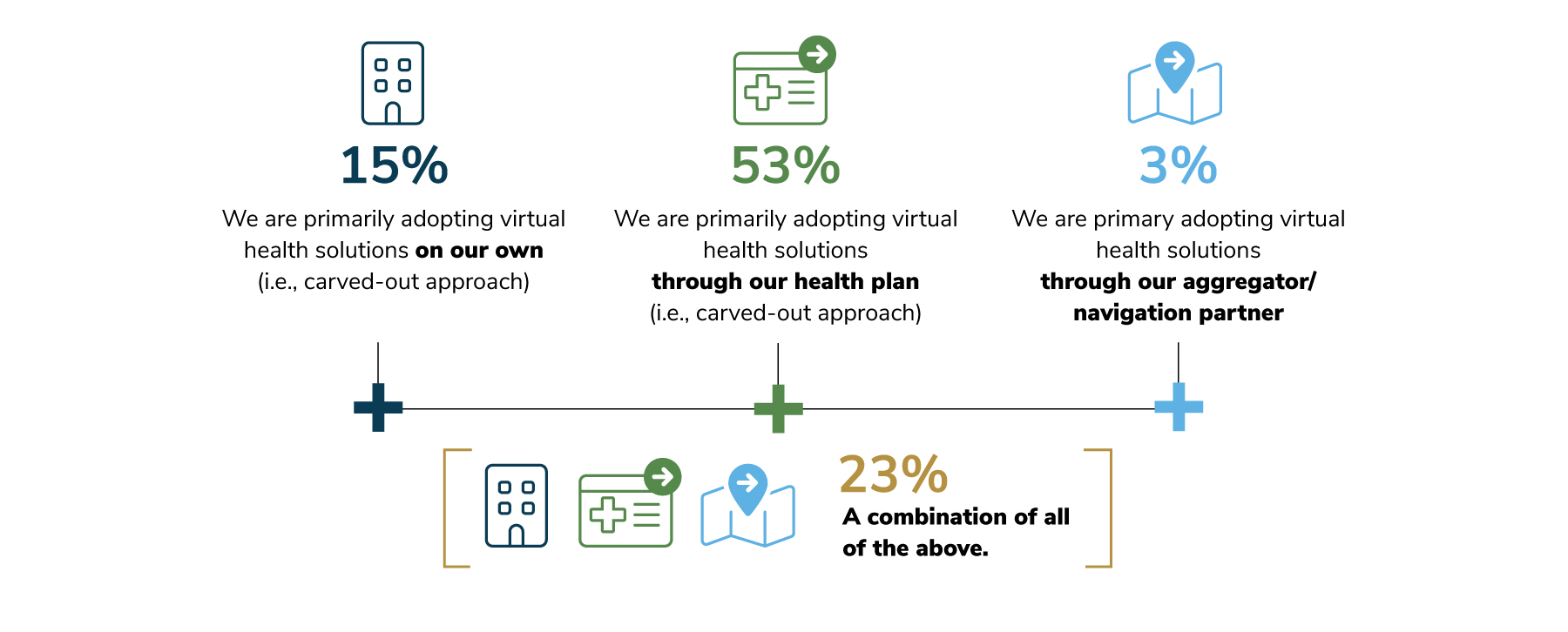

The capability to procure a virtual solution through an existing partner, like a health plan or aggregator/navigator, has opened a door for many employers that wouldn’t normally directly contract via a carved-out approach. It has also fostered an opportunity to better integrate multiple offerings, leading to a more cohesive experience for employees. Figure 3.6 shows that most commonly, virtual solutions are adopted through an employer’s health plan (53%), although 23% of employers mix it up by sourcing health plans or aggregators, as well as by adopting them on their own.

The above figure also demonstrates that virtual health programs can be specific and condition driven, determined by the needs of each unique workforce.

Another virtually-delivered tool (augmented by human interaction)—engagement platforms and navigators—can also serve as an aggregator of all these solutions. In fact, Figure 3.8 illustrates the paced growth of engagement platforms between 2022 and 2023. Over the next 3 years, however, a 21-percentage point leap is anticipated, signaling employers’ desire to improve the employee experience and navigation.

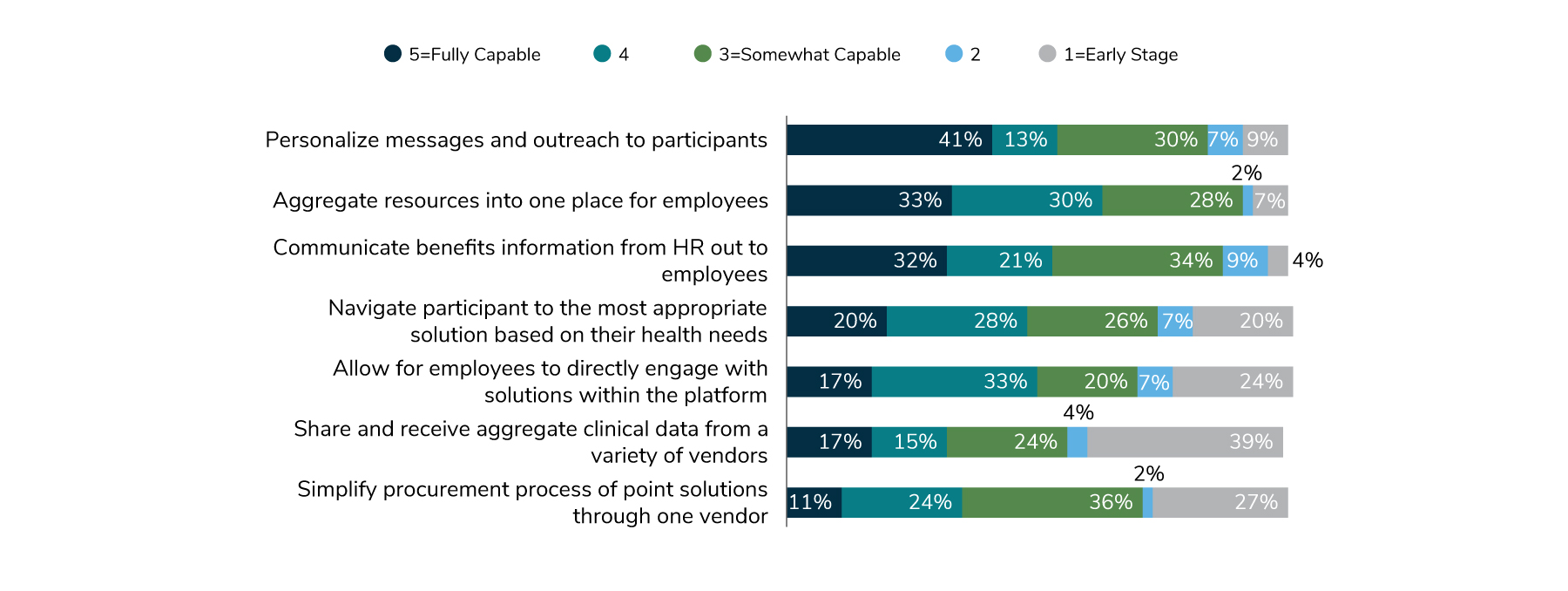

While growth is anticipated, there remain opportunities to fully optimize engagement platforms and navigator offerings. Figure 3.9 shows employers’ confidence levels in platforms’ capabilities. In general, employers believe platforms have the capability to personalize messages, aggregate resources into one place for employees and serve as a communication vehicle for HR. The areas of opportunities for improvement include integrating clinical information across vendors and simplifying the procurement process.

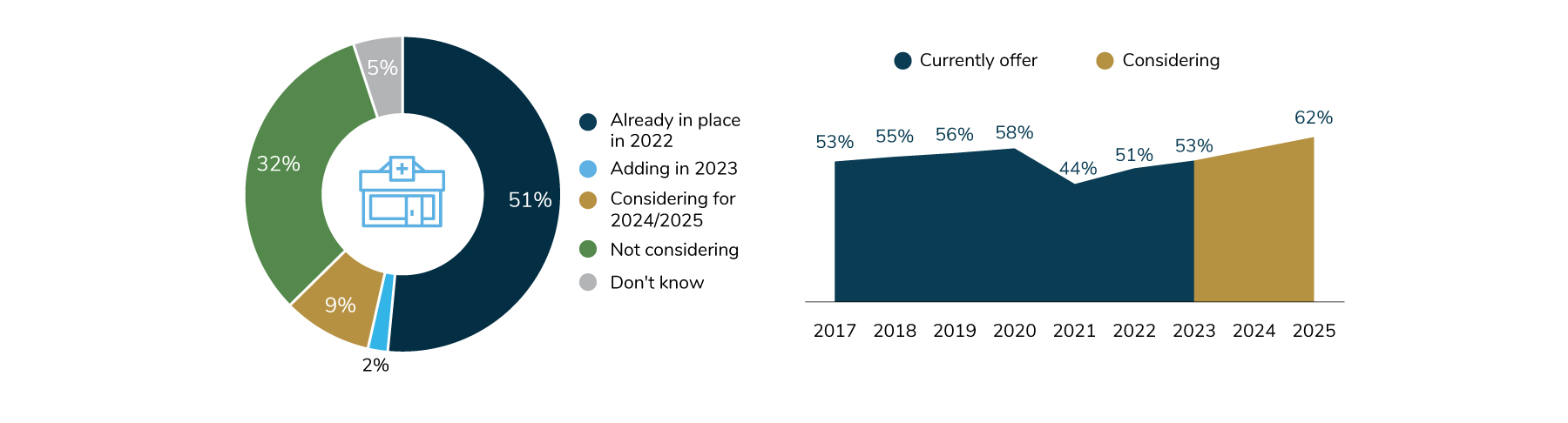

On-site Services Bounce Back

For on-site clinics, a notable change of course took place between 2021 and 2022. Last year, it was projected that the prevalence of employers with on- or near-site clinics would remain at pandemic levels (44%) through 2022. In reality, employers started to reopen clinics in 2022 and will continue doing so through 2023. What’s more, 2025 could bring the greatest number of on-site clinics in recent years, with upwards of 62% of employers making them available (Figure 3.10).

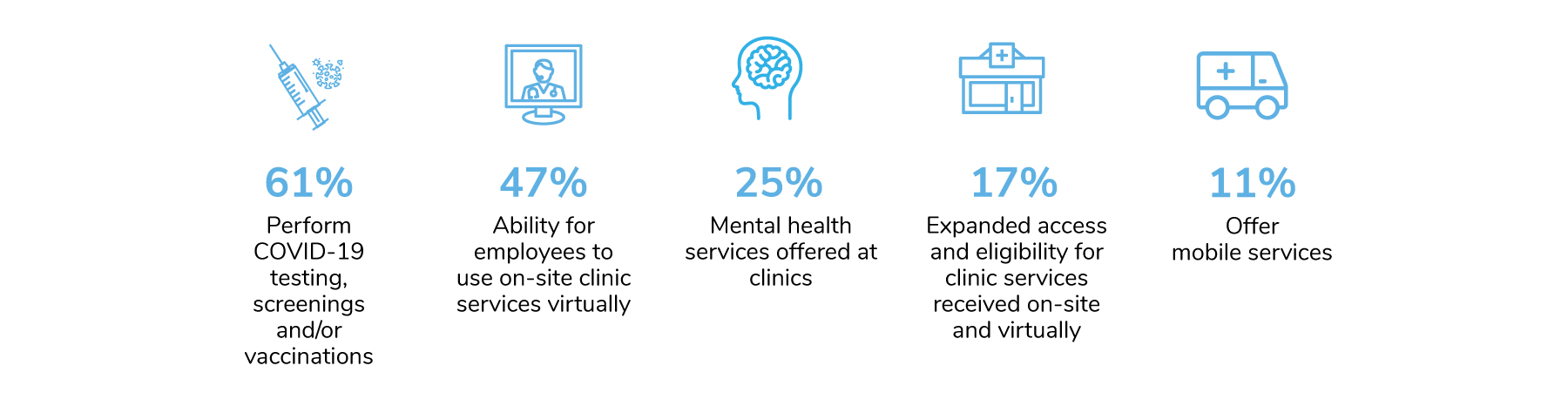

Employers added a variety of services to their on-site clinic lineup during the pandemic, some of which will remain for the long term. The most common (61%) are COVID-19- related services like testing, screenings and vaccinations to support employers’ ongoing efforts to keep employees safe at the worksite. Nearly half of employers will continue virtual capabilities of their on-site clinics. One-quarter will maintain mental health offerings (Figure 3.11).

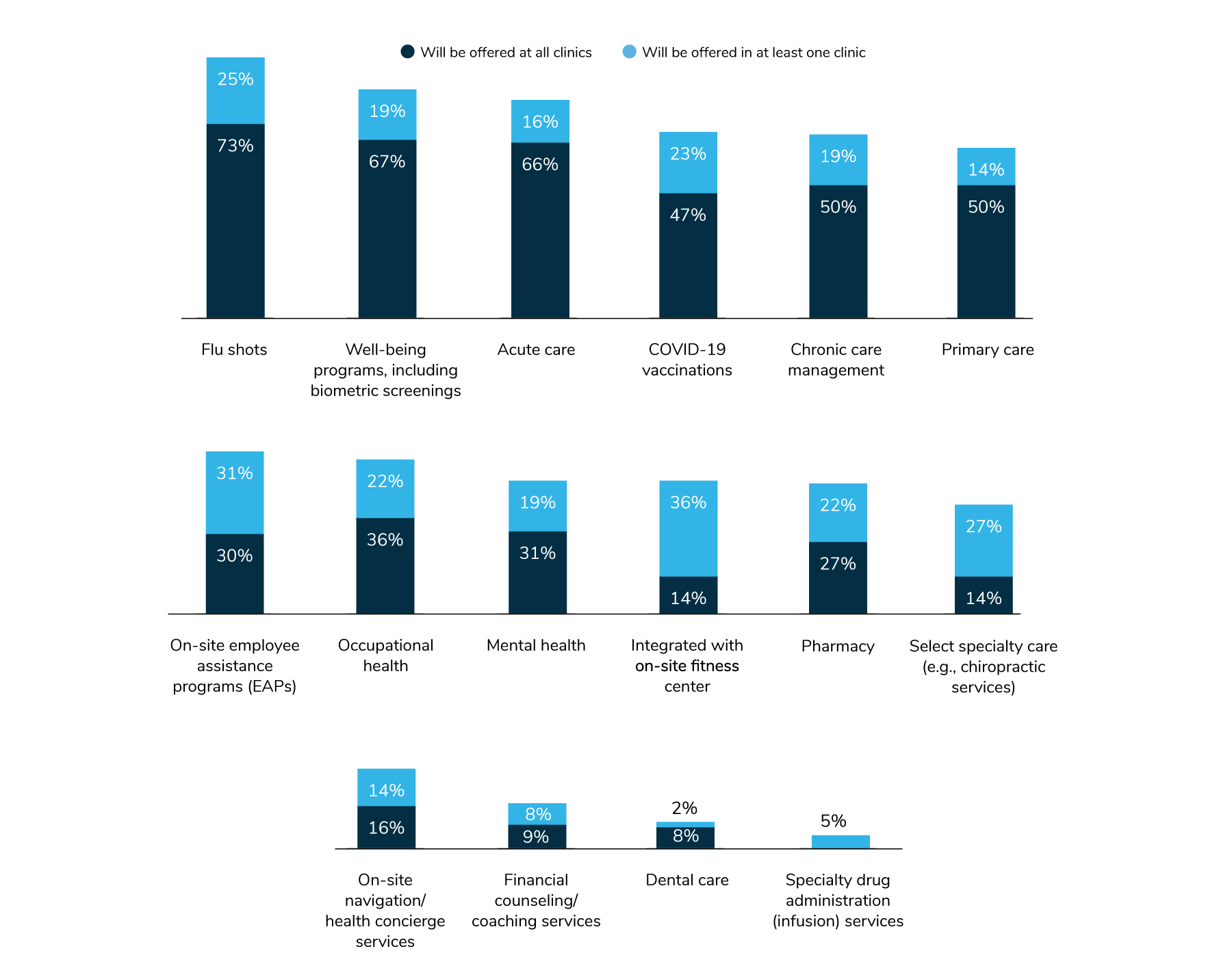

Aside from these pandemic-driven changes, employers are layering on more services right at the worksite. The most common services offered are flu shots, well-being programs, acute care and COVID-19 vaccinations. While there hasn’t been a huge fluctuation in offerings, a few minor changes are worth noting. More employers will fold in well-being programs to their on-site services. On the other hand, fewer employers will provide acute care, mental health services and specialty care, including infusions and dental services. As more employees are working a hybrid or fully remote schedule, it appears that employers are investing in the foundational services and may be scaling back those targeted approaches (Figure 3.12).

Value-based Payment Growth Driven by COEs

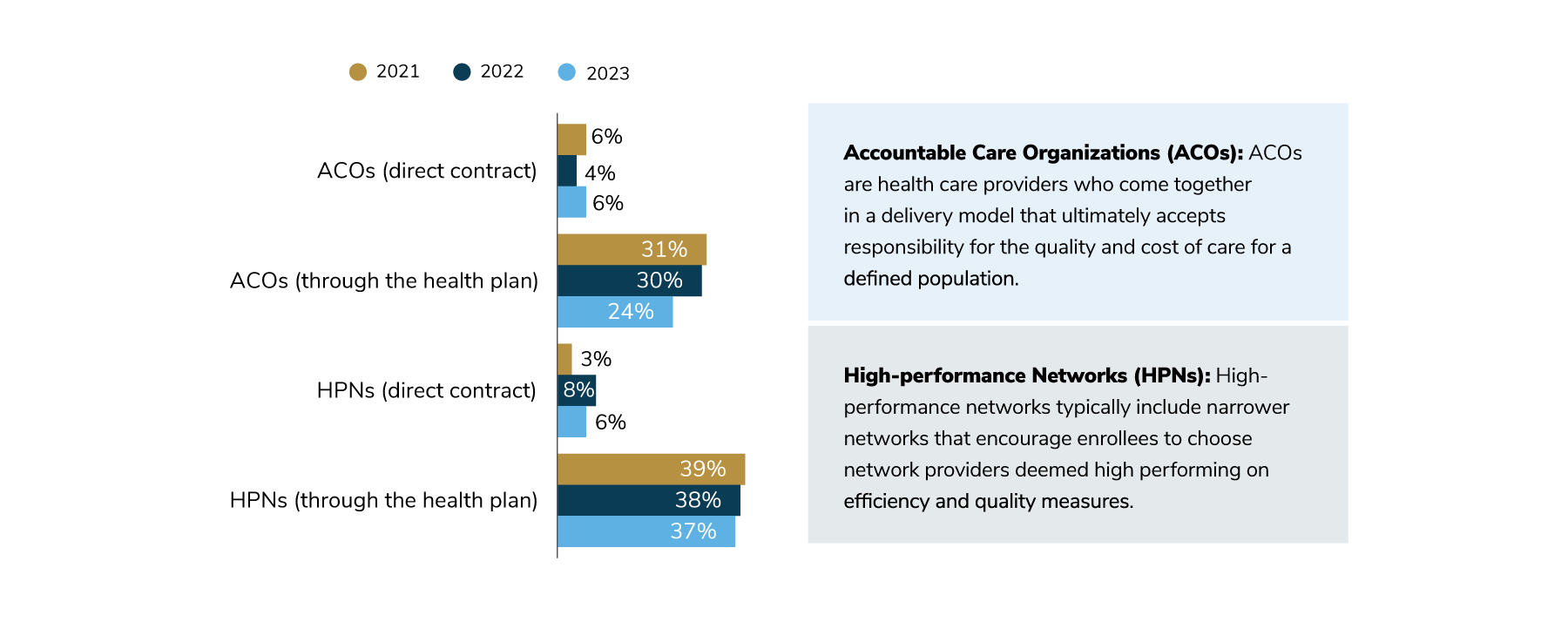

Accountable care organizations (ACOs), high-performance networks (HPNs) and centers of excellence (COEs) all provide a means to move away from fee-for-service to a more innovative payment method based on quality of care and outcomes. Directly contracting with an ACO or HPN has become less common as health plans increased their efforts to curate these networks on employers’ behalf (Figure 3.13).

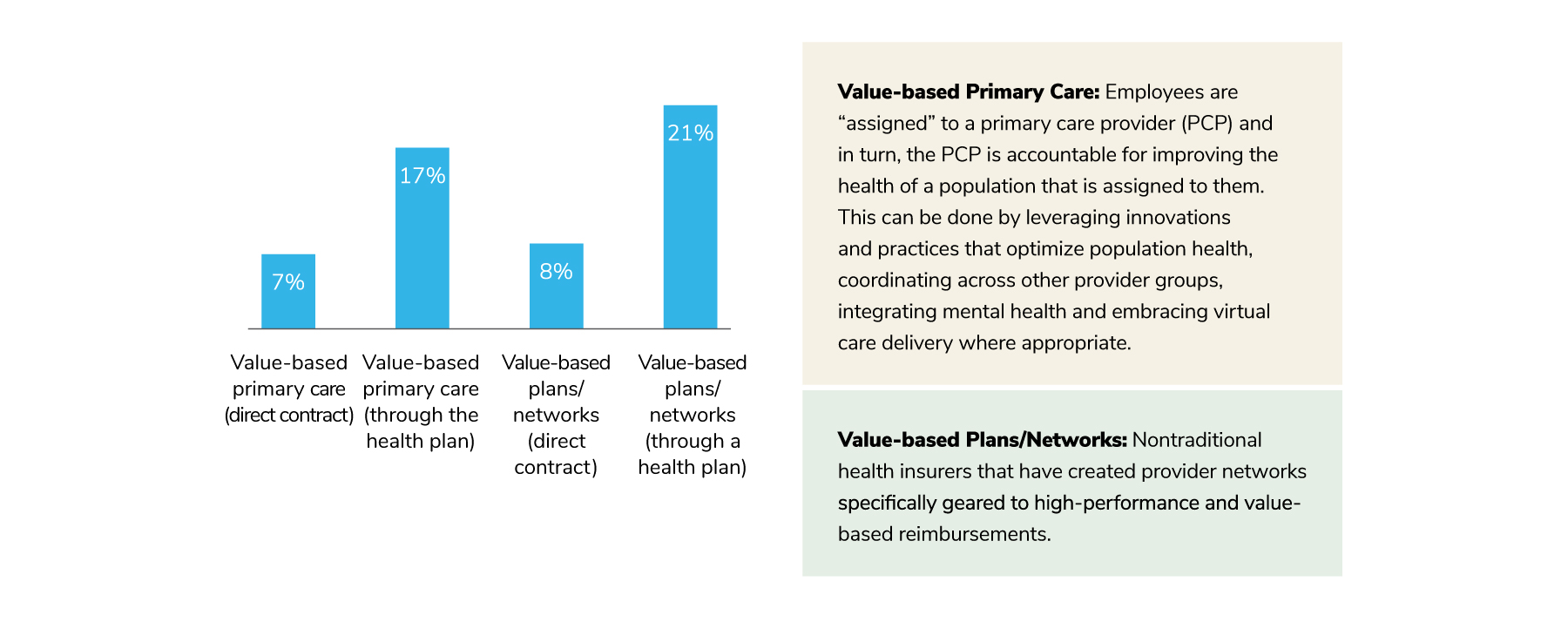

A new set of datapoints this year focused on value-based care broadly. Similarly, direct contracting for these approaches is less common, but a fair share of employers will pursue value-based primary care (17%) and value-based plans (21%) in 2023 (Figure 3.14). These findings underscore the reliance employers have on their health plan partners, as well as their expectations that these partners will ensure that employees are aligned with providers incentivized to perform high-quality care.

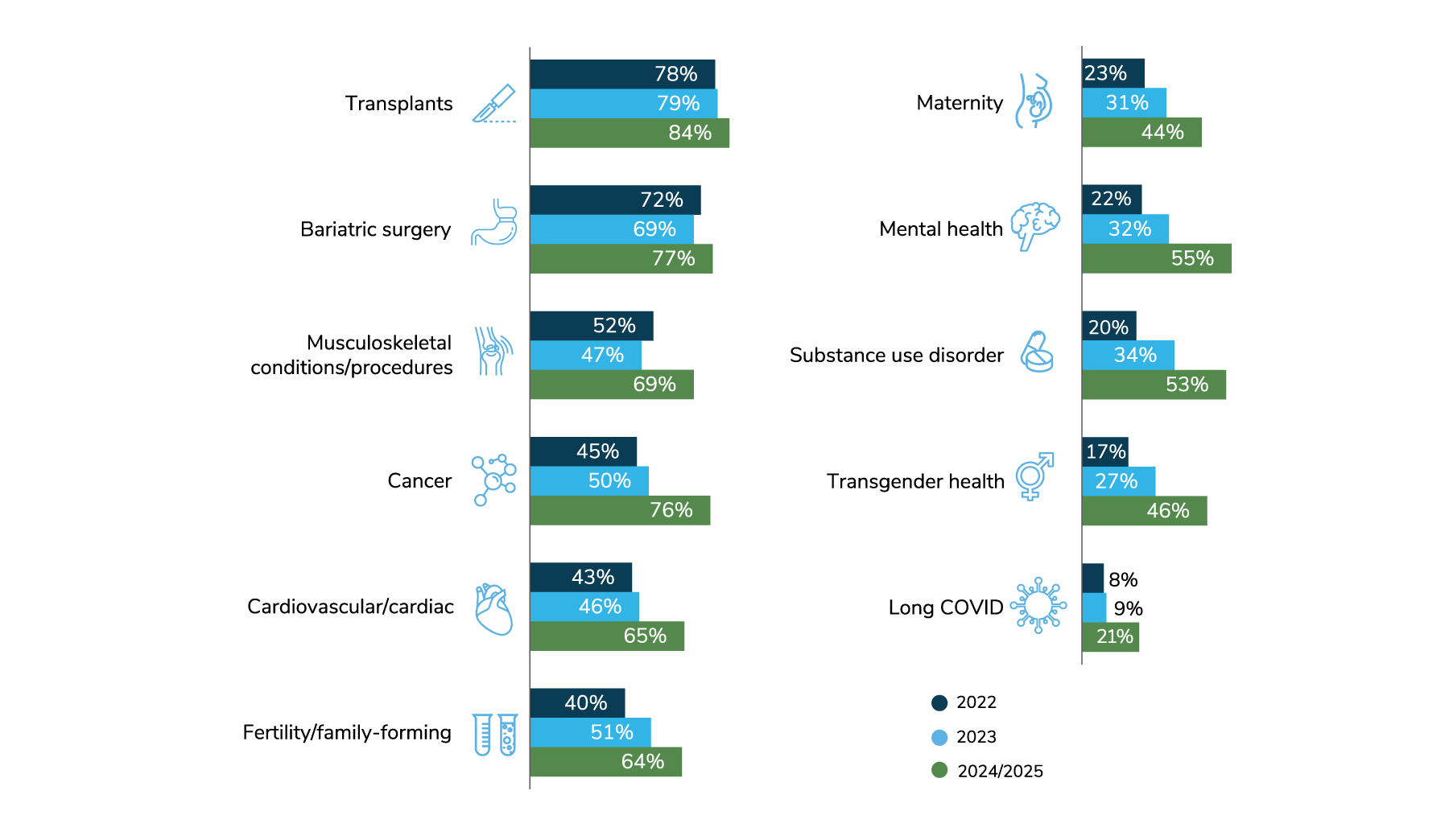

According to the survey data, employers are dedicating most of their quality efforts to COEs. By directing employees to a provider selected to perform certain specialized services because of their expertise, outcomes and favorable financial arrangements, employers are increasing the odds that their plan members will have better outcomes, which will in turn reduce health care costs.

Figure 3.15 shows the level of growth among several types of COEs. By 2025, a majority of employers expect to have COEs for transplants, bariatric surgery, musculoskeletal procedures, cancer, cardiac care, fertility, mental health and substance use disorders. Interest in long COVID COEs has jumped to 21% of employers potentially driving employees to a COE in 2024-2025.

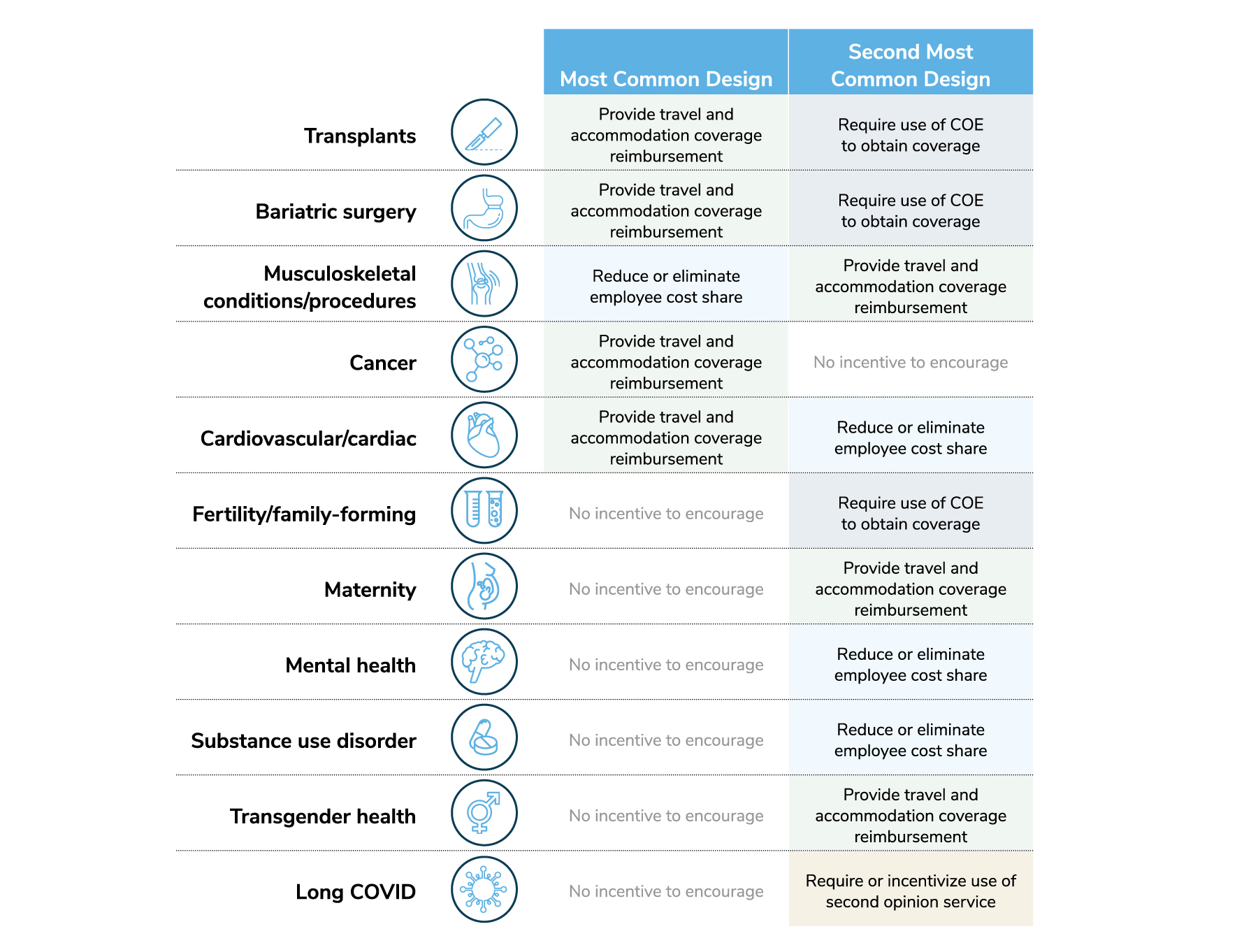

For some conditions, employees will select a COE by choice; most employers will not require or incentivize their use for conditions like maternity, mental health/substance use disorders, transgender procedures and long COVID. For other conditions, however, such as fertility and bariatric surgery, some employers will require a COE for coverage and/or have incentives in place to steer employees to COEs for these services. For musculoskeletal conditions, there will be a lower cost sharing arrangement for using a COE, and for cardiac care, employers will commonly provide travel and accommodation support (Figure 3.16). In the end, employers will take a variety of approaches to encourage employees to seek care at a COE – perhaps representative of the varying impacts certain conditions have on a workforce’s health.

Part 3: The Health Care Delivery System

-

Introduction2023 Large Employers’ Health Care Strategy and Plan Design Survey

-

Full Report2023 Large Employers’ Health Care Strategy Survey: Full Report

-

Executive Summary2023 Large Employers’ Health Care Strategy Survey: Executive Summary

-

Chart Pack2023 Large Employers’ Health Care Strategy Survey: Chart Pack

-

InfographicInfographic: Managing Rising Health Care Costs in 2023

-

Part 12023 Large Employers’ Health Care Strategy Survey: Perspectives on the Evolving Health Care Landscape

-

Part 22023 Large Employers’ Health Care Strategy Survey: Health Equity

-

Part 32023 Large Employers’ Health Care Strategy Survey: The Health Care Delivery System

-

Part 42023 Large Employers’ Health Care Strategy Survey: Health and Pharmacy Plan Design

-

Part 52023 Large Employers’ Health Care Strategy Survey: Health Care Costs and 2023 Priorities

-

InfographicInfographic: Prescription Costs and Pharmacy Benefits

-

InfographicInfographic: Cancer - Improve Quality, Reduce Costs

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()